Op-Ed: Litecoin, the Best Crypto For Storage Of Value

Litecoin, known to some as the digital silver and for being the first altcoin, is different due to its ASIC-resistant algorithm, the increased money supply, and shorter block times. However, it may also be the best cryptocurrency to utilize as a storage of value.

While many cryptocurrency holders would love to use bitcoin as a storage of value, it is simply too volatile for most investors to allocate a significant amount of their savings into. While bitcoin is currently trading at prices we last saw in June; there are no certainties exchange rates will stay at this level. While prices have doubled since this time last year, the price of bitcoin could move that same amount, but in the negative direction.

Why Cryptocurrencies Tied to an Asset is not Worth Your Time

Before discussing the merits of litecoin as a store of value, we need to explain why asset-pegged cryptocurrencies are not ideal. Asset-pegged cryptocurrencies try to mitigate some of the volatility that typically comes with cryptocurrencies by tying each coin or token to a corresponding asset, usually at a one-to-one ratio for simplicity sake.

While this would work in theory, they are harder to acquire as it typically requires users to go onto specific asset exchanges to purchase the tokens, as is the case for bitUSD, CoinoUsd, as well as DGX, just to name a few.

The tokens mentioned above first require a user to purchase a “base” currency such as Bitshares, NXT, or Etherum and then to exchange them for tokens, adding a layer of hassle and complication to the end user.

On top of this, market capitalizations, as well as daily trading volumes, are low, only two of the asset-pegged cryptocurrencies being in the top 100 on Coinmarketcap; Nubits and Tether. While Tether has a healthy trading volume that exceeds six digits regularly, it is a centralized currency which brings me to my next point.

For an asset-pegged cryptocurrency to be successful, users must trust that assets are bought to back the cryptocurrency equivalent. In Tether’s case, user ID and personal verification are required, due to AMC/KYL laws which further forfeits one’s privacy.

This reliance on trusting a centralized service defeats the whole purpose of using cryptocurrency, especially one that is fundamentally based on a fiat currency. The whole concept does not align with the ethos of cryptocurrency as a whole; users use cryptocurrency as a way to securely transact money with a monetary policy that is not controlled at the whim of a government.

Merits of Litecoin

First of all, Litecoin is a cryptocurrency, through and through. No personal information is required to send or receive Litecoin, and just like Bitcoin, Litecoin relies on a decentralized, peer to peer network.

Litecoin also has a robust community, with many services and exchanges supporting the currency. In fact, Coinmarketcap lists 100 trading pairs that trade Litecoin. For ultimate convenience, ShapeShift also lists Litecoin, so users could trade many cryptocurrencies and be receiving Litecoin as soon as the transaction confirms.

Not only are there many services and exchanges that will accept and use Litecoin, but there is also a multitude of wallets, both mobile, and desktop, to choose the one that best suits your needs. Moreover, if ever a technical problem arises, the Litecoin community is happy to help via Reddit, Twitter, and https://litecointalk.io, the official Litecoin Forum.

If you prefer to exchange in a private sale with an individual, the community allows that to be conducted quickly; Litecoin has a massive backing, only second to Bitcoin.

Litecoin also enjoys trading volumes that exceed $1 million daily, with $2 million achieved on a typical day and exceeding $10 million when the market is especially active. With a market capitalization of around $184 million, this makes Litecoin the fourth largest cryptocurrency by market capitalization.

So while Litecoin does not share any of the negatives that make asset-pegged cryptocurrencies less than ideal for users interested in using them as a store of wealth. What sets Litecoin apart is on top of the all the positive characteristics it has, Litecoin also maintains relatively stable market prices, one of the most desirable and important aspect when looking for a store of value in not only cryptocurrency but also assets as a whole.

Litecoin’s Surprising Market Stability

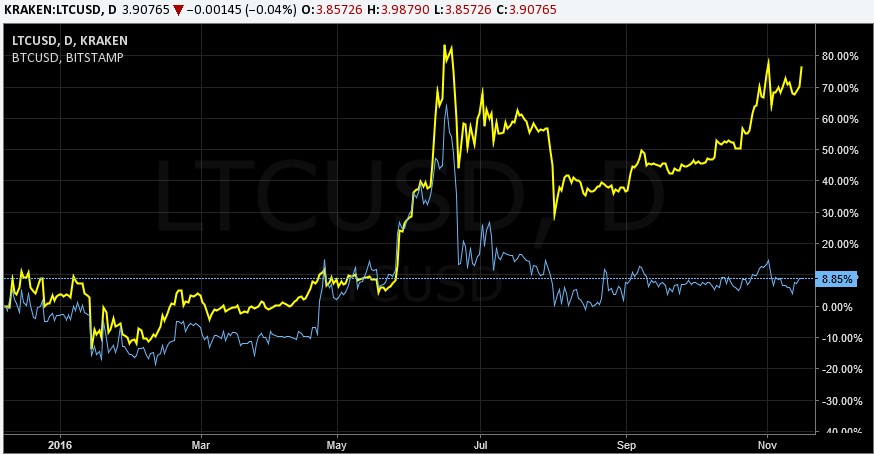

In the last year, the lowest litecoin has traded at was around $3, at a time where Bitcoin traded at around $320. On the other side of the spectrum, the highest litecoin has sold in the last year was around $6. This equates to only a total change of 74 percent, compared to bitcoin’s 139 percent total change for this year, a minimum of $320 to a high of around $765.

With cryptocurrencies swinging in value at a much higher rate than 74 percent in as little as a week, litecoin is one of the more relatively stable cryptocurrencies.

While one may argue that while litecoin decreased in value, Bitcoin increased. Volatility works both ways, however, which is seen by the drastic corrections and sharp bull runs of Bitcoin price charts. While Bitcoin has enjoyed recent growth shooting it from the low $630’s to flirting with the $700s, Bitcoin also saw a drop from the $760’s to around $620, a 20 percent drop in 3 days back in July.

While Bitcoin’s massive drop had an impact on litecoin as well as most other altcoins due to the network effect, litecoin only lost 15.8 percent of its value, not feeling as hard as of a drop as Bitcoin.

Moreover, as a bonus to this market steadiness, there’s the unquantifiable factor of peace of mind. Humans are emotionally wired creatures so while most investors know the familiar adage “buy low, sell high”, during times of excited market activity investors tend to do the exact opposite.

Investors will typically “buy high, sell low,” buying high after a bull run in hopes that it will continue, and sell low in fear that prices will continue to fall.

Conclusion: Litecoin is the ideal cryptocurrency for most investors

While there is a greater reward in holding bitcoin, there is just as much risk associated with it. Investors looking to park savings into an asset with the store of value intention prefer price stability to volatility; volatility can lead to potential gains but also sleepless nights when the market drops.

As litecoin is not entirely correlated to bitcoin, as shown below, but it provides a happy medium between volatility and price stability. Of course, investors should always diversify, so purchasing bitcoin and other cryptocurrencies as well as equities, precious metals, and commodities would provide the best portfolio.

If you are the type of investor that can handle the peaks and valleys bitcoin is known for, it will be in the long run the most rewarding investment vehicle. There is even a Bitcoin IRA that you can now open, shielding any capital gains on bitcoin from taxation. However, the standard IRA rules apply, meaning you cannot withdraw the funds until you approach the age of 60.

To protect digital assets, utilize a hardware wallet such as a Trezor or Ledger and hold bitcoin and other cryptocurrencies in a secure environment for cold storage. KeepKey is a multi-currency hardware wallet that supports Bitcoin and Litecoin, but also Namecoin, Dogecoin, and Dash, with support for more cryptocurrencies to be expected.

Usage of a hardware wallet provides security, knowledge of keeping your cryptocurrency offline under your discretion provides the most freedom, allowing more savvy investors to ride the swings of the market or have access to their funds if the situation ever arises.

All in all, if you are looking to make a cryptocurrency portfolio, a major percentage should be allocated toward Litecoin. The relatively docile market trends compared to other cryptocurrencies will provide some stability while still sharing some typical characteristics of cryptocurrency. The high market capitalization is a promising indicator for long-term growth, and its daily trading volume will ensure investors entering or exiting Litecoin will not upset the market.

Note: This op-ed article reflects solely the opinion of the author. Personal research to understand the risks involved, and whether there is an alignment with your risk appetite, should always be explored prior to making any investment in Litecoin or any other cryptocurrencies.