Plaintiffs renewed the lawsuit against Tether and Bitfinex once again

Another lawsuit has been filed against the Tether stablecoin issuer and the Bitfinex crypto exchange.

Table of Contents

The plaintiffs changed and again filed a lawsuit against Tether and Bitfinex, accusing the company of manipulating the price of Bitcoin (BTC) and other digital assets.

According to the plaintiffs, the defendants artificially inflated the price of virtual currencies by purchasing large quantities of coins at a particular time, creating a false impression of the creation of high demand for cryptocurrencies. Traders fell for it and purchased coins, increasing their rate even more.

“In reality, Tether issued billions of USDT to itself with no US dollar backing — simply creating the USDT out of thin air,” according to the complaint, which goes on to allege that the deception “ultimately result[ed] in billions of dollars of damage to innocent crypto commodity purchasers.”

Court filing

The first statement of claim said that over the years, Tether issued $3 billion worth of unbacked USDT tokens, which Bitfinex subsequently used to purchase cryptocurrencies to support prices during market downturns. The result of such manipulations was a sharp increase in the cryptocurrency market’s capitalization to $795 billion by the end of 2017.

Proceedings against Tether and Bitfinex

The proceedings against Tether and Bitfinex began in 2019, but so far, they have not led to any results, and the case threatens to fall apart. The defendants explain this fact by the unfounded nature of the accusations.

According to the companies’ representatives, the plaintiffs did not provide evidence that Tether and Bitfinex manipulated the price of cryptocurrencies by purchasing digital assets for unsecured funds of stablecoins.

Five crypto traders were the plaintiffs in this class action lawsuit. They claimed that they bought the cryptocurrency at inflated prices and recorded heavy losses.

In the motion, the defendants’ lawyers noted that the charges were based on unsubstantiated allegations and not on direct knowledge of the matter. They added that the plaintiffs failed to demonstrate the artificial nature of the prices due to the alleged manipulation.

The overall list of charges includes violations of the U.S. Commodity Exchange Act and the RICO Act, money laundering, pump and dump schemes, market manipulation through the issuance of USDT, and intentional deception of investors.

Paolo Ardoino gets ready to annihilate

Bitfinex announced on its blog that a new “baseless” lawsuit had been filed against it and its associated stablecoin issuer, Tether.

The company emphasized that it will not deal with the plaintiffs and will fight in the courts. Additionally, Bitfinex noted that USDT stablecoins have never been used for market manipulation.

Paolo Ardoino, the exchange’s technical director, tweeted about the decision to “annihilate this.”

Attracting Bittrex and Poloniex

In June 2020, plaintiffs in a $1.4 trillion lawsuit against Tether and Bitfinex accused cryptocurrency exchanges Bittrex and Poloniex of helping the defendants during the Bitcoin rally in 2017.

“With the willing assistance of Bittrex, Inc. (“Bittrex”) and Poloniex LLC (“Poloniex”), two other crypto-exchanges, Bitfinex and Tether, used fraudulently issued USDT to make strategically timed, massive purchases of crypto commodities just when the price of those commodities were falling.”

Court filing

The plaintiffs insisted that Bittrex and Poloniex were directly involved in the scheme by creating the illusion of fresh liquidity flowing into the market through multiple buy orders for BTC.

Penalty for Tether and Bitfinex

In February 2021, the New York City Attorney’s Office (NYAG) settled a legal dispute with Bitfinex and Tether. The firms were ordered to pay $18.5 million in fines and provide quarterly reports on their activities.

As Bitfinex and Tether general counsel Stuart Hoegner said, these $18.5 million should be seen as a measure of the desire to put this matter behind them and focus on growing the business. He said Tether has voluntarily provided USDT collateral information to NYAG and will continue for two years.

The settlement was meant to resolve the issue of the validity of the reserves backing USDT, which has long been a concern for the cryptocurrency industry. Since Tether will now be required to report its reserves, depending on the level of reporting detail, investors could have better tools to evaluate the claim that the company is issuing fiat tokens to inflate the price of Bitcoin artificially.

Tether continues to lead despite lawsuits

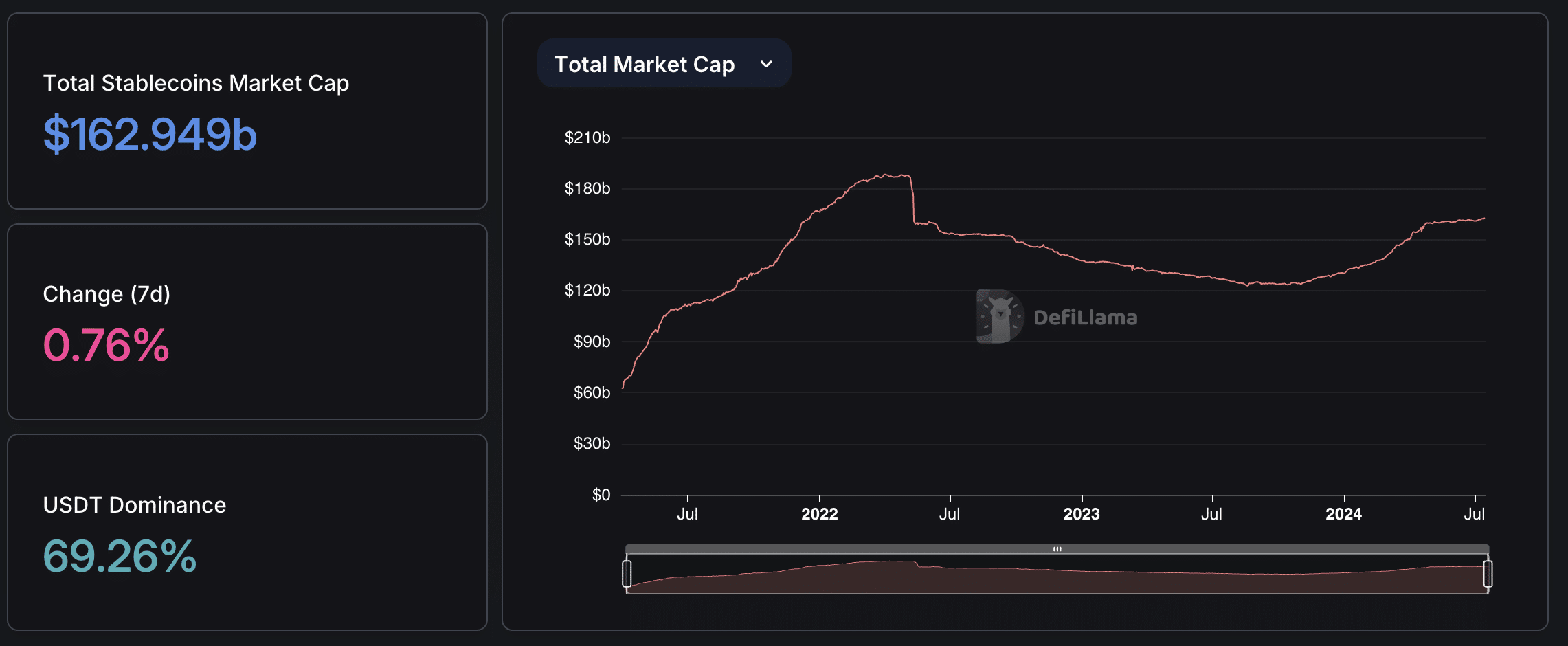

Despite many lawsuits, Tether remains the market leader in stablecoins by a wide margin.

According to the latest data, the market capitalization of USDT has reached a record $113 billion. Thus, the coin occupies 70% of the stablecoin market.

The increase in supply indicates that the digital currency market is beginning to accumulate more and more capital, barely strengthening the company’s position.