Polygon whale activity declines amid high open interest

Polygon has registered significant gains over the past month as the bullish trend rose with Bitcoin’s ETF anticipations.

MATIC increased by 22% over the past 30 days but slipped by 0.3% in the past 24 hours. Polygon is trading at $0.64 with a total market cap of around $5.95 billion at the time of writing.

The asset’s 24-hour trading volume registered a 38% hike, surpassing the $275 million mark.

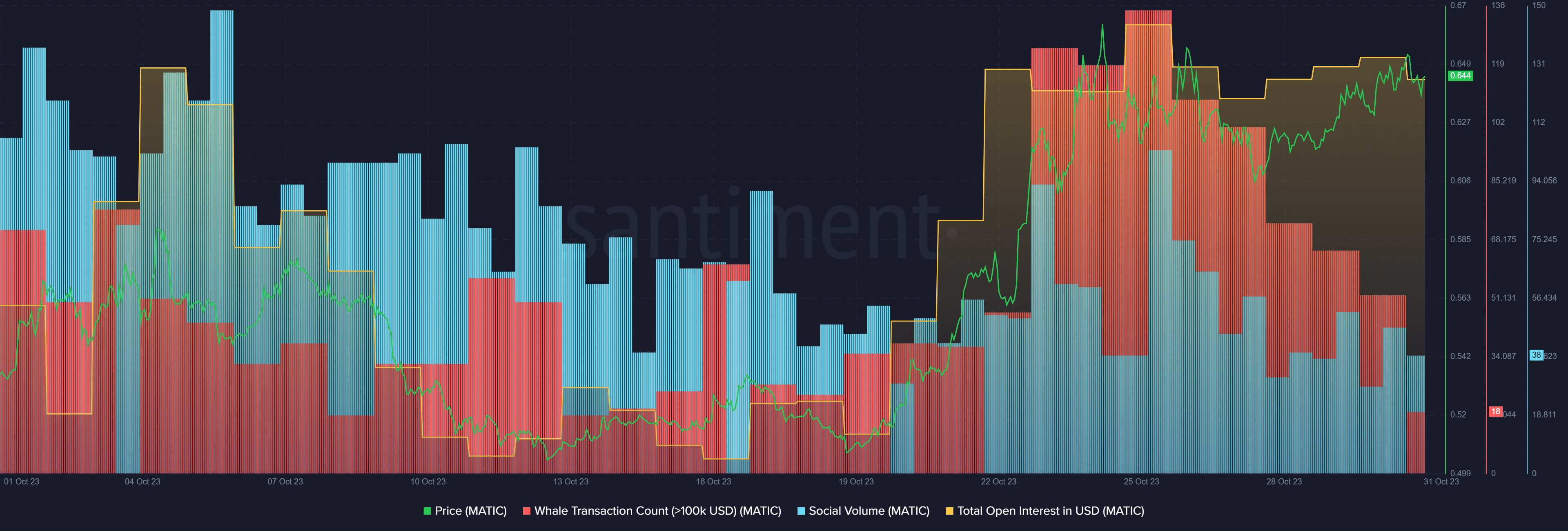

According to Santiment, MATIC’s whale activity has constantly declined over the past week. Per the market intelligence platform, whale transactions of at least $100,000 worth of MATIC declined by 86.5% since Oct. 25, falling from 135 daily transactions to only 18 in the past 24 hours.

Moreover, the asset’s social activity witnessed a pretty similar movement. Per Santiment, Polygon’s social volume plunged by 63% over the past week, yet the asset stayed in the trend zone on CoinMarketCap.

On the other hand, Polygon’s total open interest (OI) has been consistently rising over the past two weeks. According to Santiment, MATIC’s total OI rose from around $135 million on Oct. 16 to $170 million at the time of writing.

The movements suggest that Polygon investors have opened more derivatives contracts while waiting for major moves to cancel their orders.

On Oct. 19, a Lido Finance community member proposed the removal of Polygon staking on the decentralized finance (defi) platform. The reason for the request was Polygon’s low defi TVL, and called it a “potential risk.”

Last week, the Polygon team unveiled the new POL token and said the upgrade went live on the Ethereum (ETH) network.