Polymarket: Ethena’s USDe stablecoin will not lose its peg in 2024

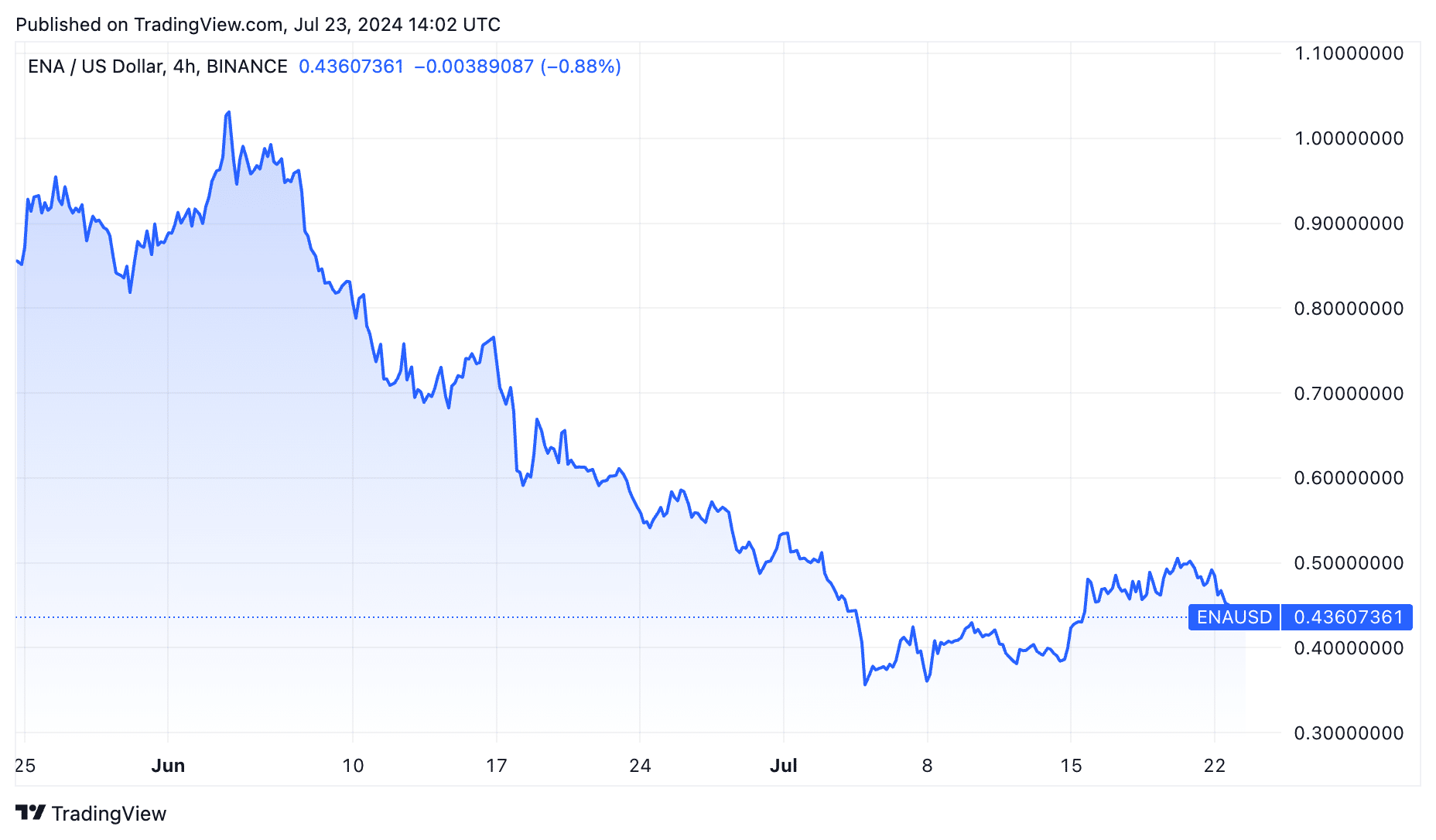

Ethena’s (ENA) price has crashed by 61% from its all-time high and is nearing its record low as concerns about its stablecoin rise.

ENA peaked at $1.13 in June and has dropped to $0.440, bringing its market cap from over $2 billion to $755 million.

Polymarket users expect Ethena USDe to maintain its peg

Meanwhile, Ethena’s USDe stablecoin has maintained its peg in the past few months as its assets jumped to over $3.39 billion. It has become the fourth-biggest stablecoin in the industry after Tether, USD Coin, and Dai.

Participants in Polymarket, the fast-growing betting platform, believe that the USDe token will not lose its peg this year. The probability of its collapse has dropped from 16% in June to just 5% this week.

This bet has attracted over $72,440 in predictions. If it crashes below 90 cents for 12 hours or more, it will resolve on December 31 this year or before that.

Polymarket has become a popular betting platform, and its users have made several accurate predictions. For example, users recently predicted that Joe Biden would avoid the general election. Polymarket’s base also predicted that spot Ethereum ETFs will start trading before July 26.

USDe offers an exciting 9.2% yield

The USDe stablecoin differs from Tether and USD Coin in that fiat currencies do not back it. Instead, it is an algorithmic stablecoin whose peg is maintained by spot crypto assets.

Holders love it because of its substantial yield, which is 9.4%, higher than U.S. government and corporate bonds.

It generates this yield by staking assets in Ethereum and by the funding and basis spread generated from derivative positions. Over 256,000 users hold the USDe token.

USDe’s mechanics have led to comparisons with Terra USD, which promised huge returns but collapsed in 2022, costing investors over $40 billion.

Many stablecoins have lost their pegs in the past. Terra USD, which was pegged at $1, has crashed to $0.019 while USDX lost its peg and was trading at $0.7953.

USDe has grown recently through integration with multiple platforms. It recently integrated with Skroll, a native zero-knowledge EVM platform for Ethereum. This partnership means that Skroll users will benefit from faster transactions, lower fees, and better security features.