Prominent Investor: Real Value of Crypto Is Only a Fraction of its Listed Price

Vinny Lingham, the CEO of Civic Key and well respected crypto investor, has said on the Venture Stories podcast that the actual value of most cryptocurrencies is likely lower than their listed prices.

Problem is Liquidity

Since early 2018, experts in the cryptocurrency sector have questioned the volume of major digital asset exchanges and the illegitimate practices used by many trading platforms to inflate their numbers. In March, cryptocurrency investor and researcher, Sylvain Ribes, discovered in a study that 90 percent of the volume of major digital asset exchanges are inflated or faked, and it is difficult to liquidate digital assets on these platforms.

Initially, Ribes initiated the study to gather data about the liquidity of crypto assets, to potentially find indicators that could be used in assessing the value of digital assets. However, as the study went on, Ribes found that exchanges like OKEx, which are said to process over a billion dollars worth of trades on a daily basis, have fabricated volumes.

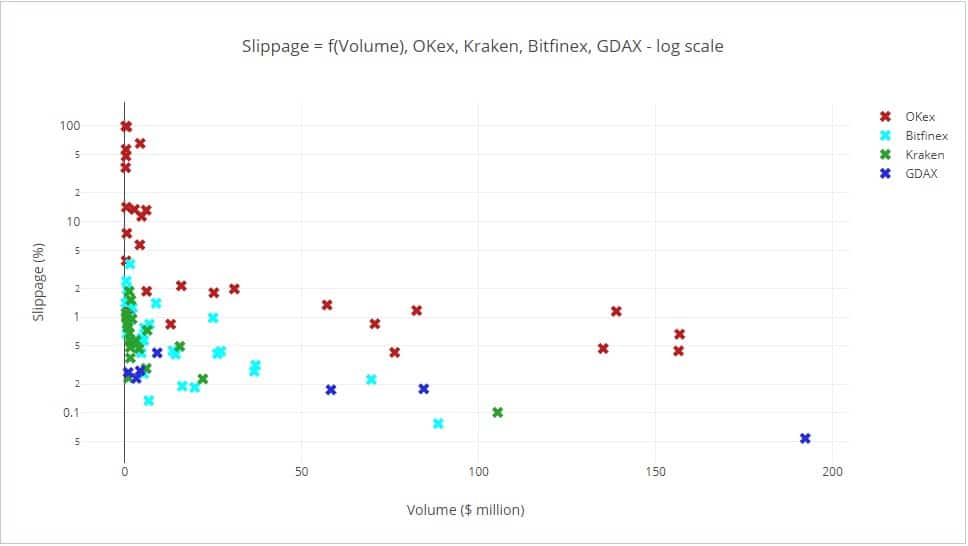

Average Slippage and Volume Chart

(Source: Medium.com)

Referring to the chart he provided above, Ribes described its contents as “striking” and noted that, “…although all first three exchanges seem to behave rather similarly, OKex pairs, in red, all have a massively higher slippage with regards to their volume.” Thus, he concludes that “most of the volume OKex claims is completely fabricated.” He goes on to state:

“Many pairs, albeit boasting up to $5 million volumes, would cost you more than 10% in slippage, should you want to liquidate a mere $50k in assets. Those pairs included, at the time of the data parsing (06/03/18): NEO/BTC, IOTA/USD, QTUM/USD. Hardly illiquid or low-profile assets.”

Slippage refers to the decline in the price of a digital asset upon the sell-off of a certain amount of the asset. In his study, Ribes measured the slippage of exchanges by selling $50,000 worth of a digital asset as a single order. Based on the the large slippages recorded by major exchanges throughout the study, Ribes concluded that it is difficult to liquidate millions of dollars worth of tokens and cryptocurrencies without experiencing a substantial drop in value.

As such, Lingham states that due to the lack of liquidity in the market, it’s not possible to sell all of the assets circulating in the market, and thus, the true value of the crypto market is really only a “tiny fraction” of their demonstrated price. Lingham added that valuing cryptocurrencies is more difficult than finding the base value of commercial companies, explaining:

“Commodities have industrial demand that set a baseline value for them. Companies can choose to forward purchase them if the price drops too much, to lock in future profits and lower costs of inventory. Where does the baseline industrial demand for crypto come from?”

Decentralized Exchanges

Coinbase co-founder and former Goldman Sachs executive, Fred Ehrsam, previously explained that decentralized exchanges can improve liquidity in the cryptocurrency exchange market, and more importantly, the quality of the liquidity of digital assets. Also, because decentralized exchanges are based on protocols like 0x that are compatible with relayers, it is possible to create a global pool of liquidity, which in concept, would be similar to Binance, Bitfinex, and Coinbase users being able to trade on one unified platform.