Ready for lift-off: The second leg of 5th crypto bull market begins

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto traders have seen the highs and lows of four crypto bull markets in the past. With Bitcoin (BTC) doubling from its recent lows, we have concluded the first part of this fifth bull market and have reached a critical juncture. Up until now, Bitcoin dominated, but as this bull market progresses, we will likely see altcoins outperforming as crypto traders are becoming more confident that this bull market has many months left.

What is changing?

After many quarters of declining revenues for the Ethereum (ETH) ecosystem, those revenues are bottoming out from depressed levels; this could signal a tradeable bottom for ETH. While revenues have only climbed back into the summer 2023 range of $30 million in weekly fees, the shocking number of just $12.1 million during the week of Oct. 9 might be behind us. A tactical bullish trade could have merit for as long as weekly Ethereum fees stay above $30 million.

Previously, we identified the 1,550 price as the critical support level for ETH, and a break lower could have targeted 1,200. While ETH briefly pierced this 1,550 on two occasions, it was the critical support level from which a new uptrend regained strength. The double breakout from the 1,700 level has provided a tradeable signal, and traders should remain long ETH if prices stay above 1,800.

For the last week, Bitcoin’s dominance appears to have peaked at 53.4%, and the decline to 51.8% signals that traders are adding more risk through ETH or other altcoins. Volume has also broadened out. While Bitcoin traded as much as 3x the ETH volume in mid-October, this ratio has also dropped to just 2x. Traders are trading more ETH than previously, supporting the view that altcoins could outperform.

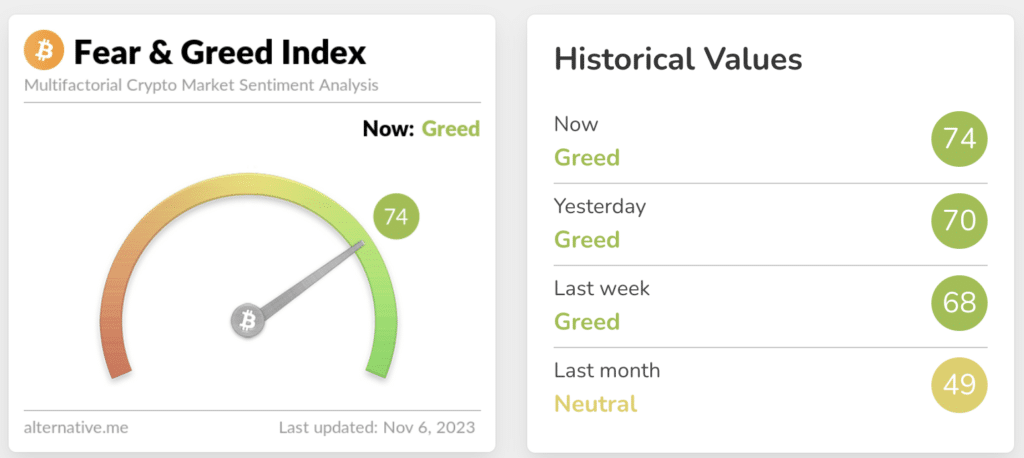

The Fear & Greed Index based on the ETH/BTC ratio signals that the crypto market is moving into the stage of an ‘alpha’ environment.

This contradicts the situation since the summer when ‘macro’ dominated crypto, and the only viable theme was the potential BlackRock Bitcoin ETF approval. As our indicator has climbed above the 50% hurdle, this would suggest traders should add more alpha (idiosyncratic trades) to their portfolios.

Options for Ethereum tend to trade 1.0x to 1.7x the realized volatility of Bitcoin, and buying Ethereum at 1.0x the volatility has historically been an excellent mean-reversion trade. The realized volatility spread has even declined to 0.8x while the implied volatility spread trades at 1.0x, with both ETH and Bitcoin at-the-money implied volatility trading at 58%.

The perpetual futures funding rate for Bitcoin and Ethereum is also trading at elevated levels. This signals FOMO – fear of missing out. While the funding rate was marginally positive all year and stayed within 5-10%, we noticed a shift higher into the 10-20% range during the last two weeks. This FOMO sentiment could easily spill over into the altcoin space and support a more aggressive view on beaten-down altcoins.

The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.