Retail and e-commerce lead crypto adoption, new study reveals

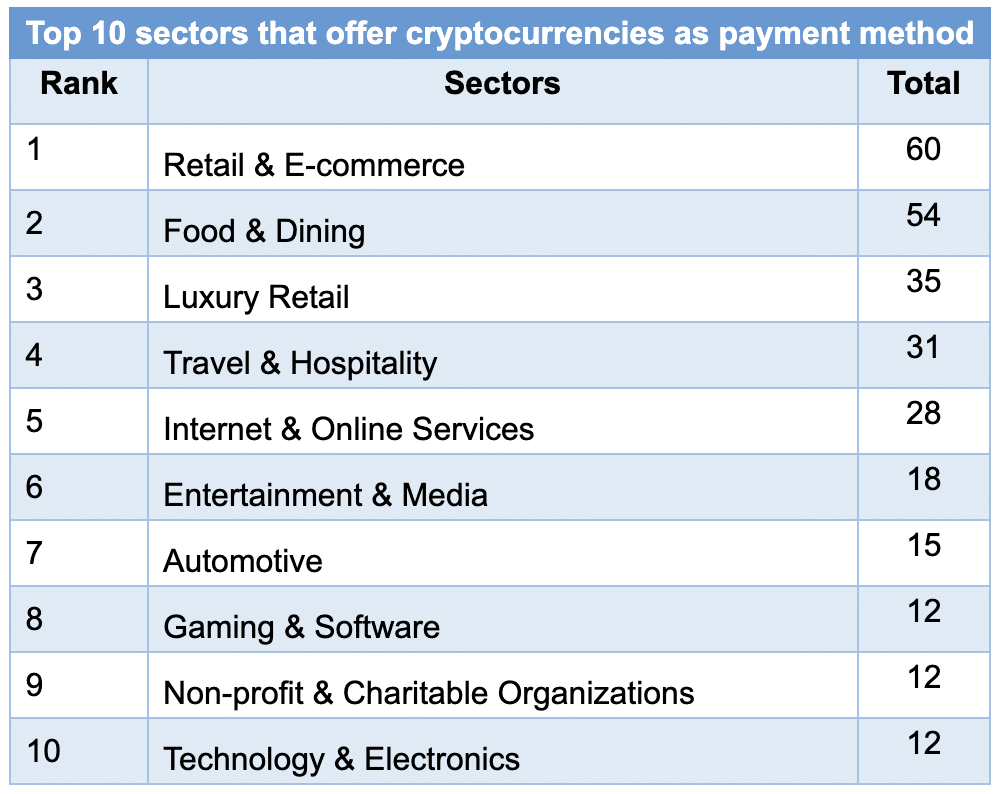

A study by crypto tax software CoinLedger found that the retail and e-commerce industries have the largest number of companies offering to purchase through cryptocurrency.

The study, received by crypto.news, compiled a list of more than 300 large companies. It turned out that in the ranking of cryptocurrency acceptance, retail, and e-commerce take first place.

60 companies accept cryptocurrency payments. These companies include Adidas, Yankee Candle, and H&M, as well as online shopping platforms such as Etsy.

Second on the list is the food and catering sector, with 54 companies represented. Examples include Chipotle, Chuck E Cheese’s, Domino’s, and Hard Rock Café, as well as delivery services such as DoorDash and Uber Eats.

In third place is luxury retail, with 35 companies offering the service, including high fashion brands Gucci and Ralph Lauren, luxury watch retailer Hublot, and jewelry companies such as Jewelry Relations and CRM Jewelers.

Next on the list, travel & hospitality ranks fourth, with 31 companies accepting cryptocurrency payments. The top five are completed by companies providing Internet and online services: 28 accept cryptocurrency as payment.

“The increasing number of companies accepting cryptocurrency payments reflects the growing acceptance and adoption of digital currencies in the mainstream economy. This trend not only aligns with the evolving preferences of tech-savvy consumers but also offers benefits such as reduced transaction fees and increased security.”

David Kemmerer, Co-Founder and CEO of CoinLedger

Previously, Chainalysis analysts found that the adoption of cryptocurrencies is declining worldwide, except in countries with lower middle incomes.

The most popular digital assets are among the population of countries such as India, Nigeria, and Ukraine. At the same time, in developed countries, there is a decline in the volume of transactions carried out by institutional investors.