Return of the ‘Bearwhale’: Around a Fifth of Mt. Gox’s “Missing” Bitcoin Dumped

On March 7, Tokyo attorney and bankruptcy trustee for the dead Mt. Gox exchange “spilled the beans” on his bitcoin and bitcoin cash sales since late September up until February 2018. Nobuaki Kobayashi presently revealed he sold about $400 million worth of bitcoin and bitcoin cash.

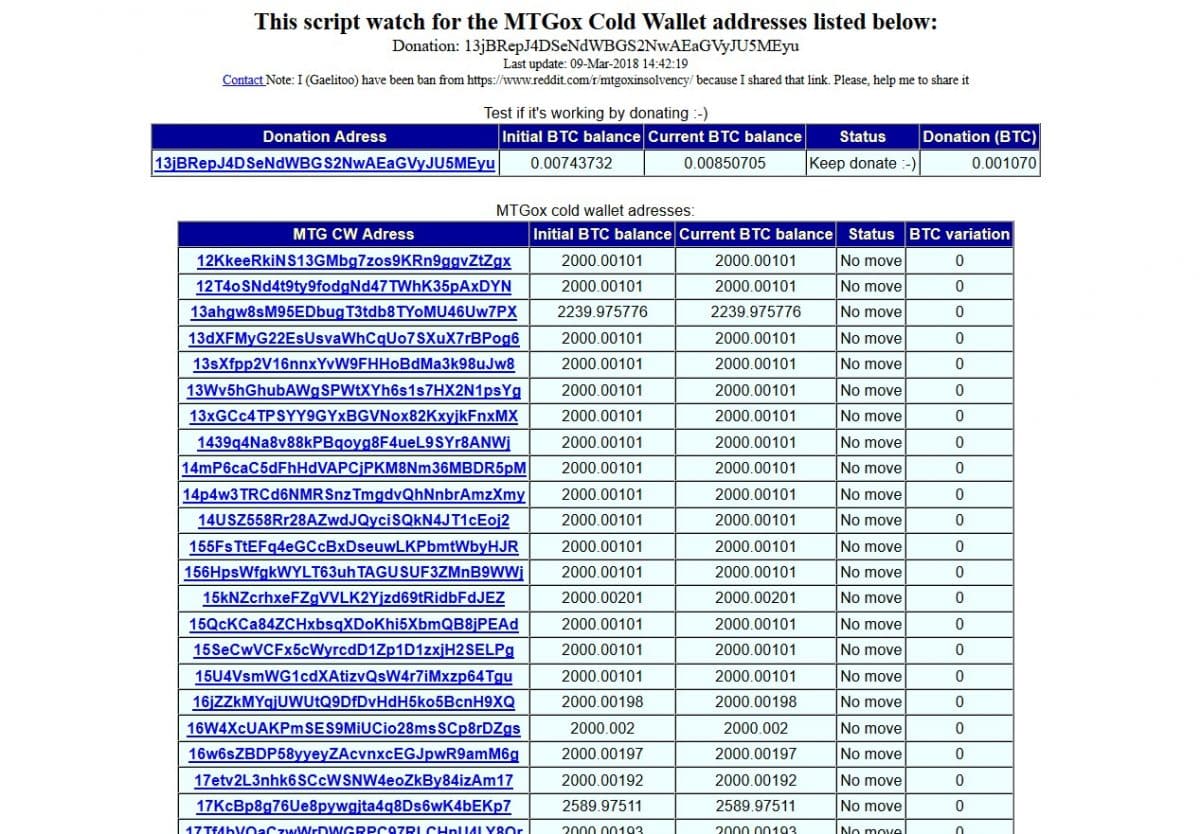

Kobayashi was in charge of the funds raised to distribute among the Mt. Gox’s creditors. On Wednesday, March 7, he came out saying that he has been dumping part of the funds into the market since late September (around 40,000 bitcoin). The trustee also revealed that he is still sitting on another $1.9 billion worth of the cryptocurrency (or approximately 160,000 bitcoin) and will consider offloading those as well as he raises cash to distribute to Mt. Gox’s creditors.

One website, created by Reddit user Gaelitoo, tracks the holdings of the trustee and gives information on the remaining bitcoin holdings:

Despite Kobayashi, being covertly selling the stash, he has inflicted the market with a lot of downward pressure, and many within the community are now calling him responsible for the huge retraction we are watching right now. It is a proven fact that he made the market crash by 75 percent. The event is reminiscent what occurred in October 2014, namely the Slaying of the Bearwhale, when a speculator who was shorting bitcoin heavily during a critical time failed and that marked the turning point in the price of bitcoin because the community stood strong and stood together while the ‘Bearwhale’ was killed.

The Slaying of the Bearwhale

Back in early October 2014, a disappointed bitcoin holder dumped 30,000 coins on the market when the price was on its support from its previous all-time high. Someone thought the party was over and decided to cash out and almost drove the prices to levels seen in 2010.

BTC-USD: Slaying of the ‘Bearwhale’

The market crashed as a result, but the community was there to fight the trader who was putting all that downward pressure, and the event became known as the ‘Slaying of the Bearwhale.’ This was a moment in bitcoin’s history that we could feel a real sense of community. Stories were told, and even a video of the fierce battle was put out. The ‘Bearwhale’ made the market tremble, but Kobayashi, on the other hand, is no ordinary bitcoin whale.

Reports have surfaced that the bitcoin exchange Kraken offered to work with the trustee to sell in a way that would not have had such an adverse impact on the markets. Jesse Powell of Kraken replied to a Reddit post:

“We advised the trustee that if they were to sell any coins (not advised), they should do it in an auction, which we would be happy to facilitate. This was months ago. We never heard anything again about the coin sale until the creditors meeting, along with the general public. It’s possible they’re getting guidance from someone else. Unfortunately, we don’t have any insight into how this went down.”

The Mt. Gox Bearwhale

Between 2012 and 2013, Mt. Gox was considered the world’s biggest bitcoin exchange. However, after a hacking attack and a few issues, the exchange declared bankruptcy. The company was already having problems in 2013 but only suspended its trading activity in February 2014. Mt. Gox filed for bankruptcy protection four years ago after disclosing that it lost 850,000 bitcoin, then worth about $500 million. The company, which later said it recovered about 200,000 bitcoin, blamed hackers for the loss.

Now, it is Nobuaki Kobayashi’s job to distribute the money amongst all the Mt. Gox creditors, which means, one way or another, sooner or later he will have to sell the creditor’s stash so that he can finally finish the distribution. However, from the sales already performed, it is possible that all claimants can be paid out in fiat, which means that no more large sell orders will be precipitated by the trustee.

Right now the price of bitcoin is going down on a rampage, and already dropped more than 15 percent after the SEC demands over cryptocurrency exchanges, so let’s hope that Kobayashi will hold the pot for a while. If not, the author does believe the community is still strong enough to defeat the Mt. Gox Bearwhale.