Ripple (XRP) price gets overbought as whale accumulation continues

Ripple’s price experienced a strong recovery this week, driven by increased whale activity.

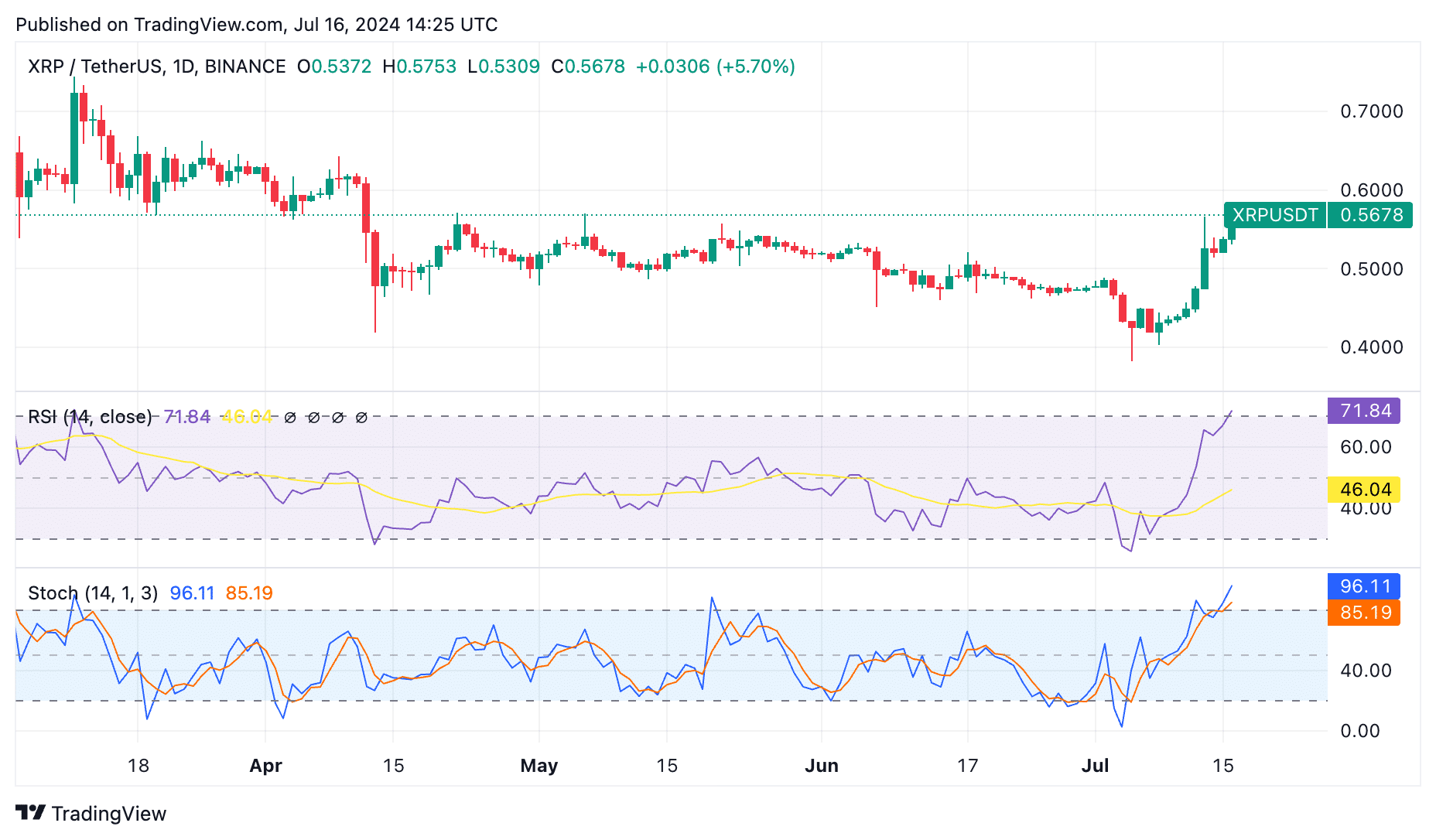

Ripple’s (XRP) price experienced a strong recovery this week, driven by increased whale activity. The XRP token surged to $0.5705 on Tuesday, its highest level since April 12th, marking a 50% increase from its lowest point this month.

Ripple’s performance coincides with significant whale accumulation. Data from Santiment reveals that large XRP wallets bought over $300 million worth of tokens between July 12th and 15th.

Large transactions like these often indicate that insiders are buying ahead of a major event.

This trend is also reflected in technical charts. The accumulation/distribution (A/D) indicator has reached a record high, showing strong accumulation. Additionally, XRP has surpassed key resistance at $0.4845, its lowest swing in January, and has moved above the 200-day and 50-day Exponential Moving Averages (EMA). The Average Directional Index (ADX) is at 34, suggesting strong momentum.

The ADX is a popular trend indicator that determines the strength of a trend. A figure of 25 and above is usually a sign that an asset has a strong momentum.

Ripple rises amid risk-on sentiment

Ripple’s rally occurred in a risk-on market environment. The US dollar index (DXY) has decreased to $104.40 from a year-to-date high of $106.30.

The VIX index has fallen to 13 while American stock indices are firing on all cylinders. The Dow Jones soared to an all-time high of $40,700 while the S&P 500 and Nasdaq 100 indices were trading at $5,640 and $18,500.

Meanwhile, most cryptocurrencies continued to rise. Bitcoin retested the crucial resistance point at $65,000 for the first time in weeks, and the crypto fear and greed index approached the greed zone.

Despite the recent rally, there is a risk that XRP’s price may pull back soon. The Relative Strength Index (RSI) has moved to 72, indicating overbought conditions, and the Stochastic oscillator lines have also reached the overbought level.

The other risk that Ripple faces is on its fundamentals. As I wrote recently, Ripple was created to facilitate cross-border transactions by companies in the banking and cross-border industry.

Some of these companies have found stablecoins or tokenized platforms as a better alternative to Ripple’s on-demand liquidity feature. For example, MoneyGram has a partnership with Stellar that lets users send and receive USDC stablecoins globally easily.