SEC complaint sparks questions on former Binance.US CEO’s sudden departure

The US SEC’s complaint against Binance has unveiled intriguing details surrounding the sudden departure of former Binance.US CEO Brian Brooks in August 2021, merely three months into his tenure.

The complaint references an undisclosed source who briefly oversaw Binance.US operations during the same period, coinciding with Brooks’ tenure.

Renowned cryptocurrency lawyer James Murphy, popularly known as MetaLawMan on Twitter, shared this revelation in a tweet on June 5. The dates outlined in the complaint align precisely with Brooks’ leadership at Binance.US following his appointment on May 1, 2021, succeeding former CEO Catherine Coley.

Allegedly, Brooks swiftly realized that he held no actual control over the company, prompting him to step down and publicly announce his resignation on August 7.

However, Binance’s Chief Communications Officer, Patrick Hillman, has cast doubt on Murphy’s speculations, suggesting that they may represent the subjective perspective of a single individual and may not withstand scrutiny over time.

Mounting legal troubles plague Binance

These revelations arrive amidst the SEC’s filing of 13 charges against Binance, accusing the exchange of operating as an unregistered securities exchange and engaging in illicit activities within the United States.

The SEC asserts that Binance unlawfully solicited US customers to trade assets on unregistered platforms. Moreover, the regulator alleges that Binance’s CEO, Changpeng Zhao, and the exchange itself were directly involved in the operations of Binance.US, contrary to prior claims made by the defendants.

In a parallel development, the Commodity Futures Trading Commission (CFTC) has also sued Binance for conducting business without proper registration, thereby violating the Commodity Exchange Act.

In the face of mounting regulatory issues, reports suggest that Binance might soon welcome a new CEO, Richard Teng, recently appointed to oversee the exchange’s regional markets outside the United States.

Binance’s response to SEC’s allegations

Binance has disappointedly responded to the SEC’s claims, expressing dissatisfaction with the agency’s decision to file an emergency complaint seeking relief against the exchange.

Binance emphasizes its proactive efforts to cooperate with the SEC and reach a settlement in previous investigations. However, the exchange accuses the SEC of abandoning the cooperative approach and opting for unilateral litigation.

Binance alleges that the SEC’s enforcement and litigation strategy fails to consider the intricate and dynamic nature of the underlying technology.

While firmly acknowledging the seriousness of the SEC’s allegations, Binance vows to vigorously defend its platform, contending that they should not form the basis of an enforcement action, especially on an emergency basis.

Binance CEO Changpeng Zhao characterized the SEC lawsuit as an attack on the entire cryptocurrency sector.

Binance vs. SEC showdown rocks crypto market

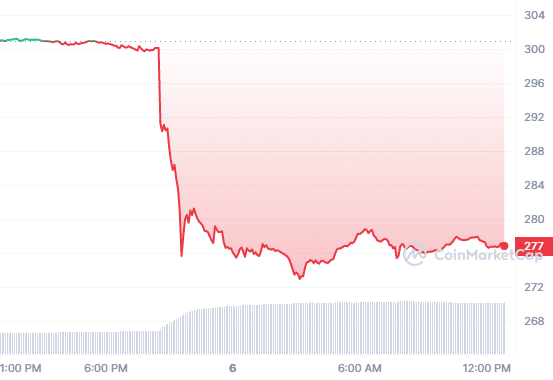

The impact of the latest developments surrounding Binance reverberated throughout the cryptocurrency market, resulting in significant downturns for major cryptocurrencies.

Binance’s native cryptocurrency, BNB, experienced an 8% setback, while other popular altcoins, including Dogecoin, XRP, and Solana, plummeted by over 7%.

Data from Nansen on June 5 revealed that during one hour, traders on Binance withdrew a staggering $125 million worth of digital assets, while the platform received only $56 million in deposits. These figures indicate a substantial net outflow of funds from the exchange within that hour.

As the legal battle between Binance and US regulators unfolds, the cryptocurrency industry anxiously awaits the outcome, aware of its potential implications for the broader ecosystem.