Short-term bitcoin holders dumping coins at a loss, report reveals

Glassnode, a blockchain analytics firm, has released a new on-chain report indicating short-term bitcoin holders are increasingly offloading their coins on exchanges at a loss, while long-term holders remain in profit.

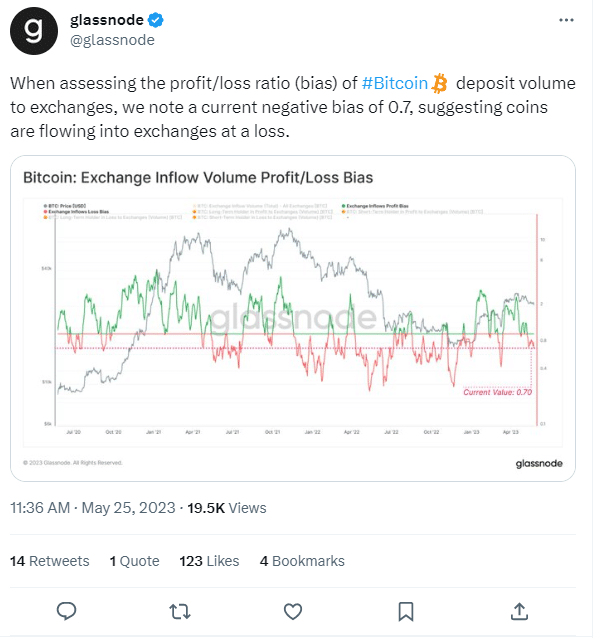

In the ever-evolving world of cryptocurrency, understanding market dynamics and investor behavior is key to making informed decisions. Glassnode’s latest report, which delves into the profit/loss ratio of bitcoin deposit volume to exchanges, offers interesting insights into the current state of the market.

The report highlights a negative bias of 0.7, suggesting that bitcoin (BTC) flows into exchanges at an overall loss. However, when examining the exchange inflow bias based on the duration of holdings, a fascinating divergence between short-term and long-term holders comes to light.

Long-term holders (diamond hands), often regarded as firm believers in bitcoin’s potential, enjoy a positive bias of 1.73. This indicates that their BTC deposits to exchanges are resulting in profits.

It suggests long-term holders may strategically capitalize on favorable market conditions or carefully time their trades to maximize gains. This group of investors exhibits confidence and patience, staying committed to bitcoin as a long-term investment.

In contrast, short-term holders are experiencing a negative bias of 0.69, closely resembling the market-wide bias of 0.7. This discovery implies that short-term holders currently dominate the inflow of bitcoin to exchanges but at the expense of their profitability.

The motivations driving their decisions to offload coins despite incurring losses raise intriguing questions.

An explanation for the reason for the numbers in the report lies in the influence of short-term market sentiment. Short-term holders, more prone to reacting to market fluctuations, may be swayed by recent negative price movements, leading them to panic sell or cut their losses.

It is important to note that the report does not make any definitive claims about the reasoning behind short-term holders’ behavior but presents the observed data for analysis and interpretation.

As the cryptocurrency market continues to mature, recognizing market participants’ diverse strategies and behaviors becomes crucial.

Understanding the motivations and actions of both short-term and long-term holders can provide valuable insights for individual investors and institutions alike. Researchers can monitor market trends and potentially identify emerging patterns by analyzing the profit/loss ratio and exchange inflows.

It remains to be seen whether the trend of short-term holders offloading their coins at a loss will persist or if market dynamics will shift in the near term.

It is essential for investors to stay informed, exercise patience, and make well-informed decisions to navigate the super-volatile world of cryptocurrencies successfully.