Solana breaks $20b market cap as ETF buzz fuels Bitcoin over $37k

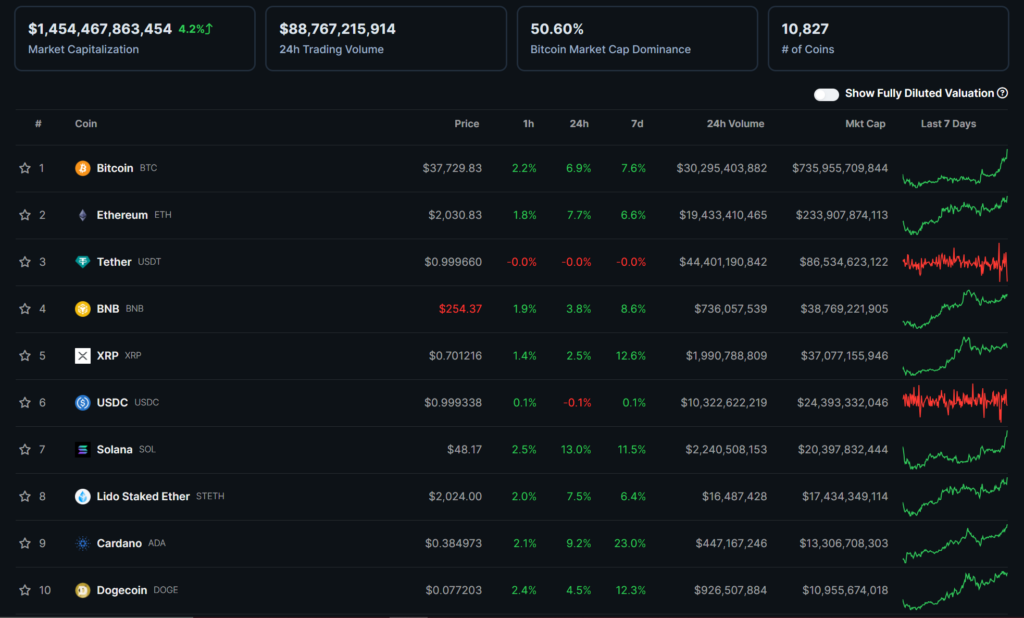

The coin was one of the top gainers on Nov. 9 amid a broad market upturn that propelled Bitcoin (BTC) to an 18-month high as crypto’s leading token headed toward $38,000.

Bitcoin’s leap above $37,000 for the first time since May 2022 coincided with Solana’s market cap breaking above the $20 billion mark as inflows poured into cryptocurrencies across the board.

The last time SOL boasted a market cap north of $20 billion was in summer of 2022, during Terra’s collapse and caused subsequent bankruptcies among some of the industry’s top firms, like Three Arrows Capital.

Solana (SOL) has seen double-digit gains in 24 hours and during a seven-day sprint as digital asset proponents surmised that crypto winter might be thawing in the run-up to a possible spot Bitcoin ETF approval from the U.S. Securities and Exchange Commission (SEC).

While BTC flirted with $38,000, rising as high as $37,900 on some trading venues, the SEC is reportedly in talks with Grayscale regarding the firm’s BTC ETF.

Grayscale CEO Michael Sonnenshein said that a possible timeline for a decision was not disclosed by America’s securities watchdog, however, an eight-day window opened where all 12 applications could be approved as reported by crypto.news.

Experts at Galaxy Digital predicted a 74% increase in BTC prices as ETFs could usher in $14.4 trillion of capital in their first year. This number could rise to $39 billion by year three, as the firm sees spot Bitcoin ETFs as a more efficient investment channel compared to existing options.