Swiss Bank UBS: Fintech is Opportunity, Not Threat

Swiss global financial services company and multi-billion dollar bank UBS recently carried out a multinational survey involving its customers and users. Based on their report, UBS believes fintech and online payment networks are opportunities for the bank to take advantage of.

The rapid emergence of fintech services and platforms since 2015 has forced banks to explore alternative technologies to ensure their customers and users are satisfied with the efficiency and security of their networks and payment applications.

In response to the changing trend, UBS has announced their plans to adopt fintech services and applications in the next 12 months, with a vision of integrating emerging innovative financial technologies in its core operations and infrastructure to optimize existing financial services and products. Evidence Lab recently evaluated demand for such services from its customers and users.

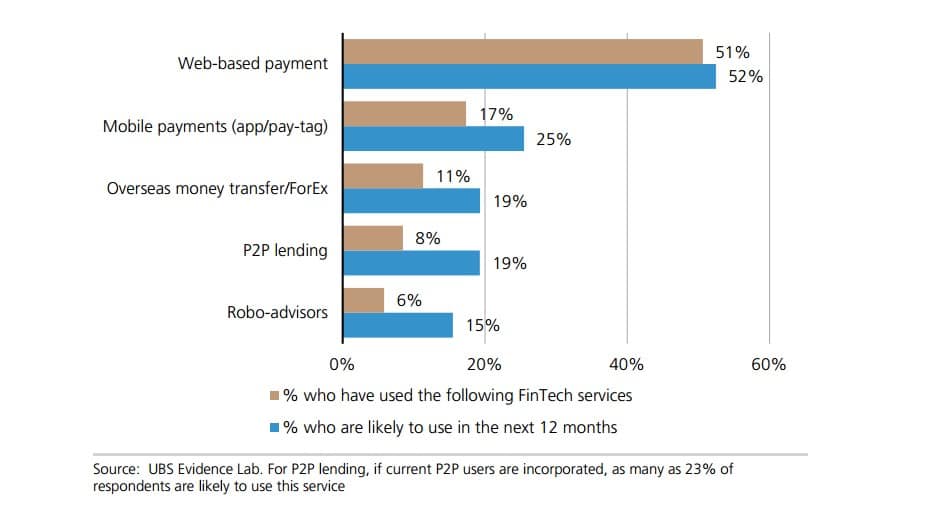

UBS inquired its customers to voice their opinions on fintech services and if they plan to use such services from the bank. Approximately 51 percent stated that they have been using fintech services and 52 percent of the users told the bank that they plan to use their fintech services if launched in the next 12 months.

The bank believes this optimism of their customers will allow the company to roll out innovative services and products without the possibility of market failure. The customers and users are ready for adoption and the bank is ready to embrace new technologies.

The UBS report further states that the payments and remittance categories under fintech are considered threats to the company, and UBS envisions to offer these payments, transforming them into opportunities to overhaul their outdated financial systems.

The UBS Evidence Lab projected a 3.8 percent revenue uplift if and when the partners and executives of UBS come to a consensus regarding adoption. The 3.8 percent revenue uplift is expected to substantially increase bank ROE internationally in the next three years, which is positive for commercial banks like UBS. The advantage of fintech as suggested by the UBS Evidence Lab is its applicability and flexibility to run parallel with bank’s existing financial services and IT systems.

For instance, if three of the largest sectors in the fintech market are considered, peer-to-peer lending, payment, and remittance-focused technologies can be offered to customers in correlation with the bank’s existing loan, bank payment, and remittance networks, which allows the banks to increase the efficiency of their existing operations and offer new services to its customers.

According to the infographic above provided by UBS, the bank will most likely focus on the development of web and mobile-based applications to allow customers to settle transactions with low costs in a secure manner.

UBS is currently looking to form partnerships and connections with emerging startups by setting up innovation labs and research institutions to better understand the technologies that they will soon offer.

Particularly, UBS established a blockchain research group led by Alex Batlin to study the blockchain technology and its applicability in the world of finance. At Level 39, Batlin was in charge of managing the UBS Innovation lab, which exploited the use of blockchain and cryptocurrencies in mainstream finance.

However, Alex Batlin left the UBS blockchain group recently to start his own ventures and projects. Still, UBS is expected to continue its development of blockchain-based technologies and cryptocurrency applications to potentially integrate them into their systems.

“Alex’s dedication to the innovation lab and Crypto 2.0 pathfinder program has left us with a well-organized project pipeline and in a strong position to approach the next phase of blockchain technology acceleration and business development,” said UBS Head of Innovation Veronica Lange.

With the bank’s progress in the development of blockchain-based platforms and financial technology-related services, it is highly likely that UBS will stick to its plan to offer innovative and reliable fintech services in the next year, to optimize and improve its services provided to millions of customers around the world.