The token that lived: how Solana project rose from the ashes

Solana (SOL) showed the best performance among the top 10 digital assets by capitalization. What caused this rapid growth following a significant decline?

In 2023, Solana showcased exceptional success, in stark contrast to Ethereum (ETH). While SOL surged over 1000%, ETH saw only a 90% increase.

To better understand Solana’s ecosystem scale and recovery pace, let’s examine crucial blockchain metrics from the time of the FTX crash on Nov. 11, 2022.

FTX bankruptcy

When the cryptocurrency exchange filed for bankruptcy on Nov. 11 last year, Solana’s metrics had already significantly declined from their peak values.

For instance, SOL’s price dropped from $62 to $17, and the daily trading volume decreased from $6.7 billion (108 million SOL) to $2.2 billion (130 million SOL).

The exit of a major investor and the risk of coin sales triggered Solana’s fall, leading crypto community members to predict its imminent demise.

Solana’s co-founder and CEO, Anatoly Yakovenko, acknowledged that the significant decline in SOL resulting from the FTX collapse was a “bitter pill to swallow.” Still, these unpleasant moments paled compared to the damage caused to ecosystem projects.

About 20% of Solana-based projects received investment from the crypto exchange FTX or its subsidiary Alameda Research, and only 5% of startups in the ecosystem held funds on this trading platform. Yakovenko expressed sympathy for the project creators who worked to raise capital and trusted FTX as the custodian of funds.

Project rise

Despite the negative forecasts, Solana survived and began its recovery. Experts attributed the project’s “survivability” to the team’s use of stress testing to fix bugs.

Solana’s active growth occurred during the publication of the court decision in the FTX case. The founder of the crypto exchange, Sam Bankman-Fried, was found guilty of all charges.

Now freed from a powerful partner’s pressure, Solana’s fate seems clearer, enhancing its investment appeal. Crypto industry representatives have started discussing Solana’s potential to lead the next bull market, evident in the large volume of open long positions, showing investors’ confidence in its positive trajectory.

Development of Solana and its impact on the ecosystem

Despite pessimistic forecasts and a general decline in network activity following FTX’s bankruptcy, the Solana developers remained proactive. The blockchain has undergone several significant technical updates and innovations throughout the past year. Since the summer of 2023, Solana has introduced new defi services, including lending platforms, LSD protocols, and decentralized exchanges (DEX). The developers aim to create a new generation of platforms with “healthy” tokenomics and high-quality UI/UX.

The validators’ migration to client version 1.16 at the end of September 2023 optimized memory usage, expanded support for zero-knowledge proofs (ZKP), and integrated confidential transfers with the new token standard. The update also increased the stability of the network and reduced the hardware requirements for validators. Version 1.17 is expected to add even more ZKP integration capabilities.

Another major improvement was the introduction of State Compression in April 2023. The solution makes storing data outside the main network cheaper by using on-chain hashes to prove its authenticity.

Meme coins powered by Solana

The end of the year witnessed notable excitement surrounding Solana-based memecoins, with one of the standout tokens being Bonk. Bonk, a meme coin operating on the Solana blockchain and depicting a Shiba Inu dog, resembles the largest meme cryptocurrencies such as Dogecoin (DOGE) and Shiba Inu (SHIB).

Introduced early in January of the same year, Bonk initially sparked short-term excitement, followed by a systematic price decrease until the end of October, after which it began to experience rapid growth. The surge in the coin’s price might have been triggered by the increase in the Solana blockchain token’s value, generating interest in assets within this network, including BONK.

The escalating demand for the rising token value resulted in a tenfold surge in Saga smartphone sales by Solana developers. Individuals owning the device are eligible for a complimentary distribution of BONK tokens, whose quantity, at the current rate, covers the smartphone’s cost. The company restricted sales to one device per person.

What lies ahead for Solana

VanEck analysts published a report presenting several forecasts for the price of SOL by 2030. The pessimistic scenario projects a coin price of $9.81, while the most optimistic scenario reaches $3211.28.

Experts suggest Solana could potentially be the first blockchain capable of accommodating applications with over 100 million users. However, VanEck believes Solana’s monetization will only reach about 20% of Ethereum’s due to “fundamental differences in the philosophies of the communities of the two projects.” This may result in less than half of Ethereum’s market share.

Experts also anticipate decentralized exchanges’ market share will reach an all-time high as high-performance networks like Solana enhance user trading experiences. They predict the Solana blockchain will rank among the top three in market capitalization, TVL, and active users.

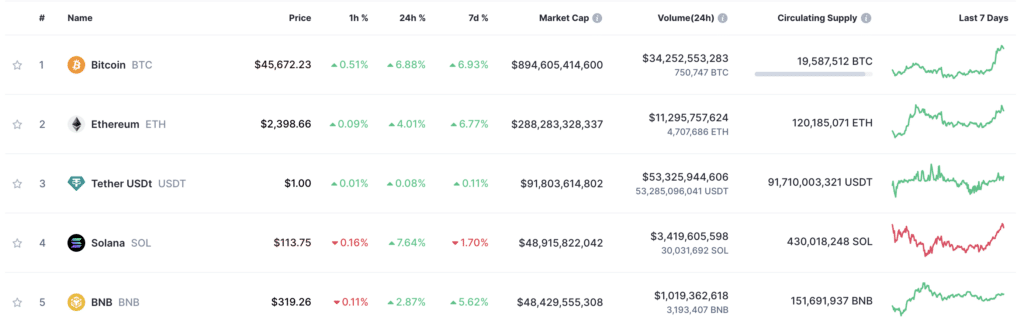

While the initial forecast regarding the token price may appear challenging to achieve given current token values, the second forecast seems reasonably realistic. In January, SOL secured its place in the top five cryptocurrencies by market capitalization, surpassing Ripple (XRP) and BNB.