Two firms announce new layoffs: What’s happening and what does the SEC have to do with it

Two crypto companies, dYdX and ConsenSys, have announced a new round of layoffs. What’s happening, and why are American regulators being blamed for this?

Antonio Juliano, the CEO of the decentralized derivatives exchange dYdX, announced a 35% layoff. He thanked the former employees for their work and explained the layoffs as the need to “revitalize” the exchange since, in its current form, it is “different from the company dYdX must be.”

“I have seen this over and again, and it will continue. What we are building is much larger than just a company, and this you will always be a part of.”

Notably, the layoffs at dYdX came shortly after ConsenSys cut its staff by 20%. ConsenSys CEO Joseph Lubin cited unfavorable macroeconomic conditions, uncertainty over crypto regulation in the U.S., and the cost of a legal battle with the Securities and Exchange Commission (SEC).

At the same time, Lubin called the company’s financial position stable.

According to him, ConsenSys will focus on its core revenue drivers, which aligns with its previously adopted strategy. The company’s flagship products, MetaMask and Linea, the second-layer Ethereum network, will serve as the basis for further development.

In addition, ConsenSys CEO said that the laid-off employees will receive support after leaving the company, namely, severance pay depending on the length of service, assistance with future employment, and expanded health benefits.

Lubin also told Fortune that the layoffs will affect about 162 of the 828 employees working from all divisions at Consensys. Now, ConsenSys has now become the leader in layoffs in 2024, according to layoffs.fyi.

Why the SEC is again the culprit of all the worst?

In the layoff statement, Lubin cited the SEC as one of the reasons why he will cut staff. In June, the regulator sued the developer of the MetaMask wallet, noting that the company violated the law through the MetaMask Staking service.

The lawsuit comes shortly after ConsenSys filed a lawsuit against the SEC and five of its unnamed employees over its “oversight of ETH,” asking the court to formally approve language that would not classify the asset as a security.

As a result, the SEC’s Division of Enforcement closed its investigation into Ethereum 2.0. The agency took this step after the organization sent a letter asking for clarification on the asset class when approving the spot Ethereum ETF. However, the lawsuit over the SEC’s allegations is ongoing, leaving ConsenSys facing legal costs.

The layoffs come at a time when the market is bucking trends

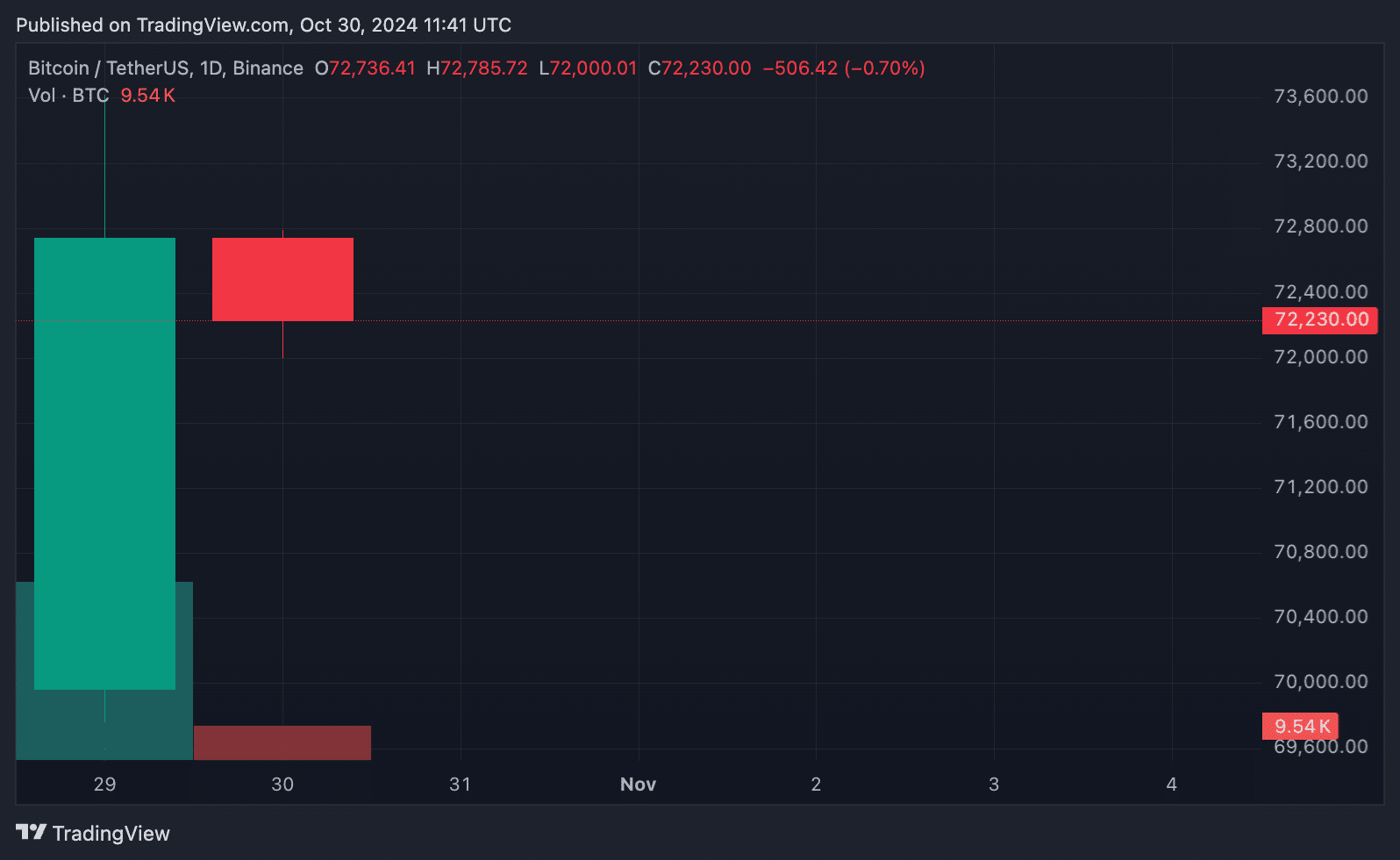

Notably, the crypto market was booming at the time of the layoff announcement, which is generally considered a good time for crypto companies. Thus, on Oct. 29, the Bitcoin (BTC) rate grew from $70,000 to just over $73,600, approaching the historical maximum of $73,777. Since the beginning of the month, the cryptocurrency’s value has grown by 12%. Analysts associate this trend with forecasts for the U.S. presidential election.

Interestingly, the growth of Bitcoin is also explained by the situation in the U.S., which the CEO of ConsenSys previously complained about, explaining the layoffs.

The growth in the price of Bitcoin is due to several factors. In particular, interest in Bitcoin ETFs from large companies such as BlackRock is increasing, which attracts significant investments. Recently, the U.S. saw an influx of $2.7 billion into Bitcoin ETFs, which helped attract new investors and raise the price.

In addition, the desire to protect against inflation significantly impacts the market. Against a weakening dollar and rising inflation, many investors are turning to limited assets such as Bitcoin to preserve their savings.

dYdX cuts staff while competitors gain momentum

Since the beginning of the year, the crypto market has been recovering from a long crypto winter, with many exchanges ramping up their growth. According to Bloomberg, Crypto.com, Binance, Coinbase, Gemini, and Kraken are hiring as cryptocurrencies like Bitcoin rise—not dYdX, though.

When announcing the staff reduction, Juliano mentioned that in its current form, the exchange is different from what it should be, without specifying what exactly he meant. However, further development will require human capital capable of reviving the platform. Therefore, announcing a 35% staff reduction against the backdrop of crypto exchanges trying to get the most out of the current rally looks illogical, to say the least, but Juliano is hardly worried about FOMO.

How the dynamics of layoffs in the crypto industry have changed?

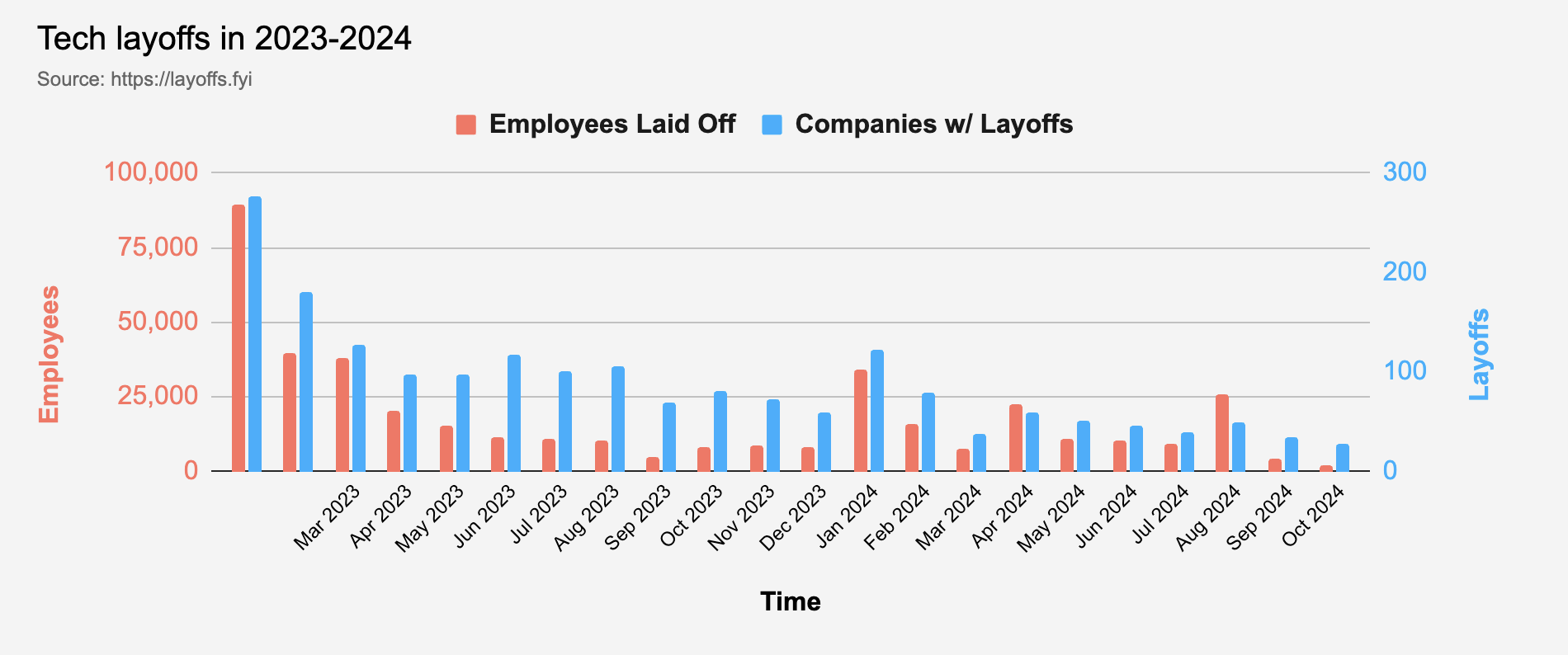

According to layoffs.fyi, Q1 2023 was the peak in layoffs since 2020, when more than 167,000 employees lost their jobs. However, in 2024, the situation looks much better: the peak of layoffs occurred in Q1, with 57,000 employees who lost their jobs. There were even fewer layoffs in the second and third quarters – 43,000 and 38,000, respectively.

Thus, the story of dYdX and ConsenSys has become more of an exception to the rule than a typical trend for 2024. After massive layoffs in 2022 and 2023, the blockchain job market seems to be recovering.