Uniswap Protocol Has Deeper Liquidity than Centralized Exchanges, Research Shows

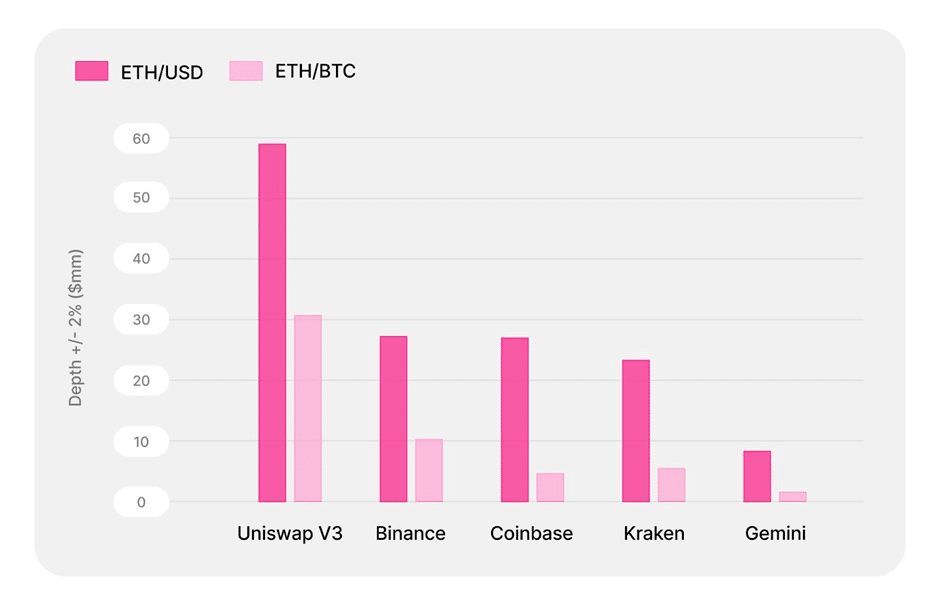

The latest data provided by Paradigm Research confirm that Uniswap has several times deeper liquidity in the major ETH pairs as compared with the leading centralized exchanges.

Transformation of Traditional Financial Market

The industry findings indicate that decentralized exchanges tend to strengthen their advantages in the industry as compared with traditional exchanges due to higher liquidity, stability, and security. Uniswap has at least 2 times higher liquidity resources as compared with the leading centralized exchanges.

In addition, Uniswap has much higher liquidity in regards to the main stablecoins, such as USDC, USDT, and their pairs with ETH and BTC. For instance, Uniswap has 5.5 times higher liquidity than Binance in regards to the USDC/USDT pair.

Uniswap also has a considerable advantage as compared with centralized exchanges in all major price categories, implying that its market offerings are much more appealing to users in regard to both small and large transactions. The average price impact on Uniswap is just 0.5% as compared with 1% on Coinbase. Therefore, users have considerable incentives to use decentralized exchanges not only due to the higher privacy they provide but also for financial benefits.

Potential Market Implications

While the traditional financial market and centralized exchanges are dominated by several large companies, easy liquidity creation allows reducing the existing barriers to this market niche. As a result, more flexible decentralized exchanges can introduce additional innovations that contribute to more cost-effective offerings for all major stakeholders. Centralized exchanges appear to be unable to maintain the same rates of innovations as their decentralized competitors, thus increasing the likelihood of the market structure is further transformed in the direction of higher decentralization and flexibility.

Uniswap can further strengthen its position as the optimal choice for exchanging ERC-20 tokens. However, other decentralized exchanges may also significantly benefit from the current market trends. Thus, PancakeSwap can continue its dominance among users of the Binance Smart Chain. 0x Protocol can generate additional financial and reputational gains as a multi-chain liquidity provider. Finally, IDEX and Loopring can enjoy broader adoption as the major layer-2 decentralized solutions. Therefore, the structure of the exchange segment will continue to rapidly change with the growing dominance of decentralized exchanges. Moreover, no single DEX will be able to achieve absolute dominance with different sub-segments being controlled by different exchanges.

Price Implications

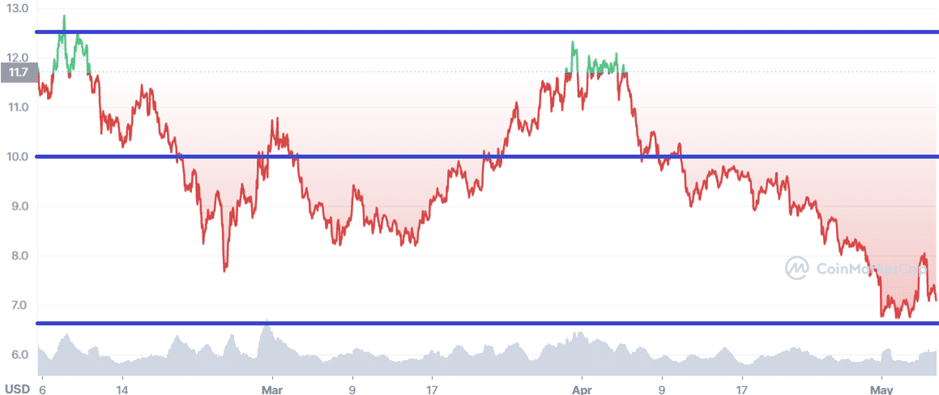

Uniswap as one of the DEX leaders experiences the controversial impact of the market forces. On the one hand, the adoption of its services increases among members of the crypto community, thus creating additional opportunities for market expansion and capitalization growth. On the other hand, the growing severity of “crypto winter” prevents many investors from entering the market and investing in risky tokens such as UNI. Technical analysis allows for determining the major support and resistance levels that may inform the optimal investment decisions under the changing market conditions.

UNI’s price follows the horizontal correction within the past three months. At the moment, the token’s price is close to the lower border of the channel. The major support level corresponds to the price of $6.8 that refers to the minimal level reached during the past three months. The first major resistance level is at the price of $10 proven to be historically significant for Uniswap. In case the token reaches this level, it can reverse the current negative tendency observed in the short term. Another significant resistance level is at the price of $12.5 that may prevent UNI from approaching the historically maximum levels.

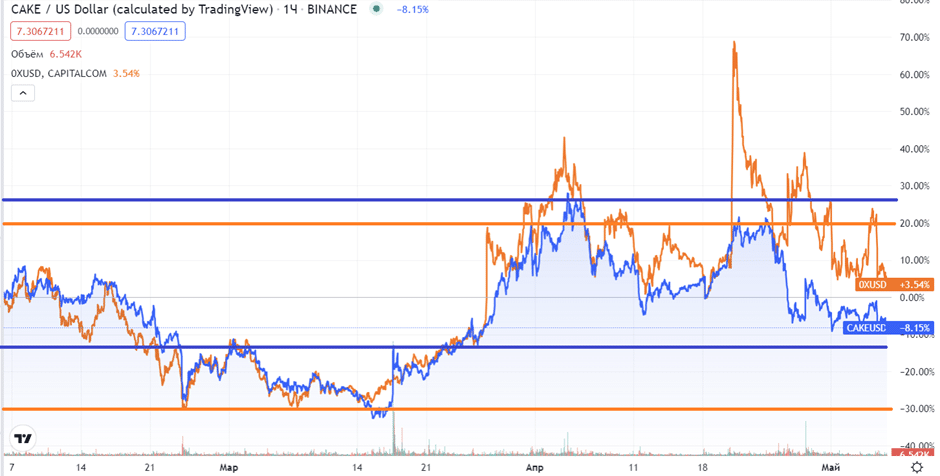

Other tokens, such as PancakeSwap and 0x Protocol face similar challenges as their price movements also follow the horizontal correction. The only major difference is that PancakeSwap suffers losses just as Uniswap, while 0x Protocol has added 3.5% to its market value during the past 3 months.

PancakeSwap faces the major support level at the price of $7.39 (12% below its start price 3 months ago) and the resistance level at $10.75 (about 28% about its initial price). Similarly, 0x Protocol has the major support level at the price of (30% below its initial price level) and the resistance level at (20% above its initial price). However, both tokens are still significantly dependent on the general situation in the crypto market and regulatory policy.