US elections to keep driving crypto volatility: report

QCP Capital analysts said U.S. election news will continue to induce crypto market volatility as the presidential result will shape the future of digital assets in America and, perhaps, globally.

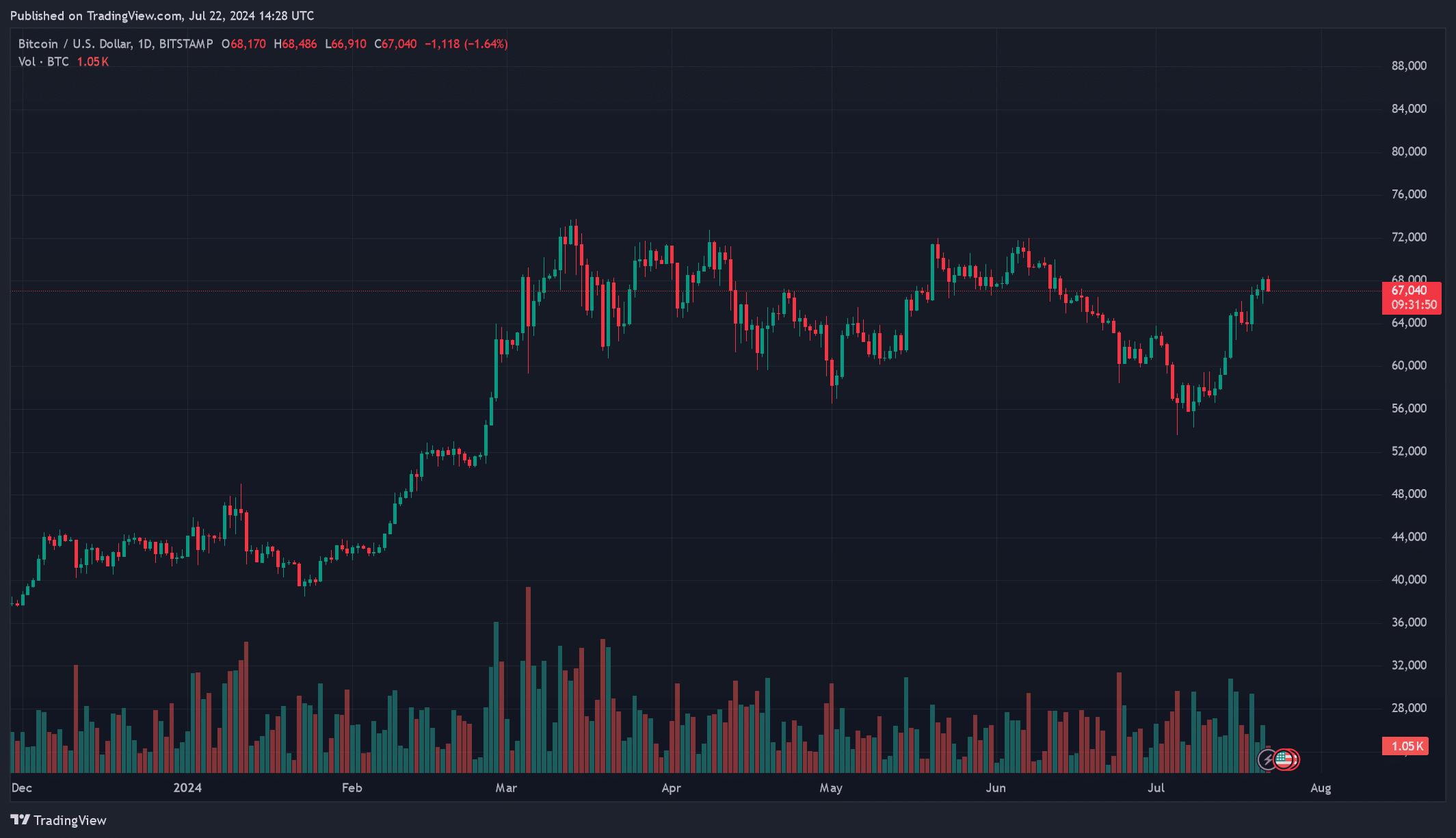

QCP Capital’s Monday report price movements following the failed assassination attempt on former U.S. President Donald Trump as an example of the election’s impact on digital assets. As crypto.news previously noted, Bitcoin (BTC) and the broader virtual currency market experienced an uptick in value after the event in Pennsylvania on July 13.

Data shows that the total crypto market gained over 10% the following week, and Bitcoin recently reclaimed $68,000. News of President Joe Biden’s exit from the race also rocked markets. Bitcoin dropped by nearly $1,000 over the weekend before regaining strength and climbing back above $67,500.

According to QCP Capital, the Nashville Bitcoin conference could be the next event to trigger price swings. Trump is expected to speak at the gathering, and there are rumors he might promise a strategic national Bitcoin reserve.

Crypto options market

QCP analysts added that volatility has also swept through digital asset options markets due to uncertainties surrounding the presidential election outcome.

“Prices for out-of-the-money options have increased significantly in the past 24 hours, indicating expectations for more extreme market movements,” analysts noted.

Volatility may be thick in the market, but the firm predicted that upside movements are likely. Anticipated Federal Reserve rate cuts and a pro-crypto U.S. election result were suggested as reasons for price increments.