XRP price flashes unusual $66 million signal: Can it stay above $0.50?

Ripple (XRP) price is hovering just above the $0.50 level at press time on Feb. 6, but vital derivatives market trends reveal more worrying signals.

SHORT traders are tightening their stronghold on the XRP derivatives markets. Can it avoid a bearish price reversal below the critical $0.50 support?

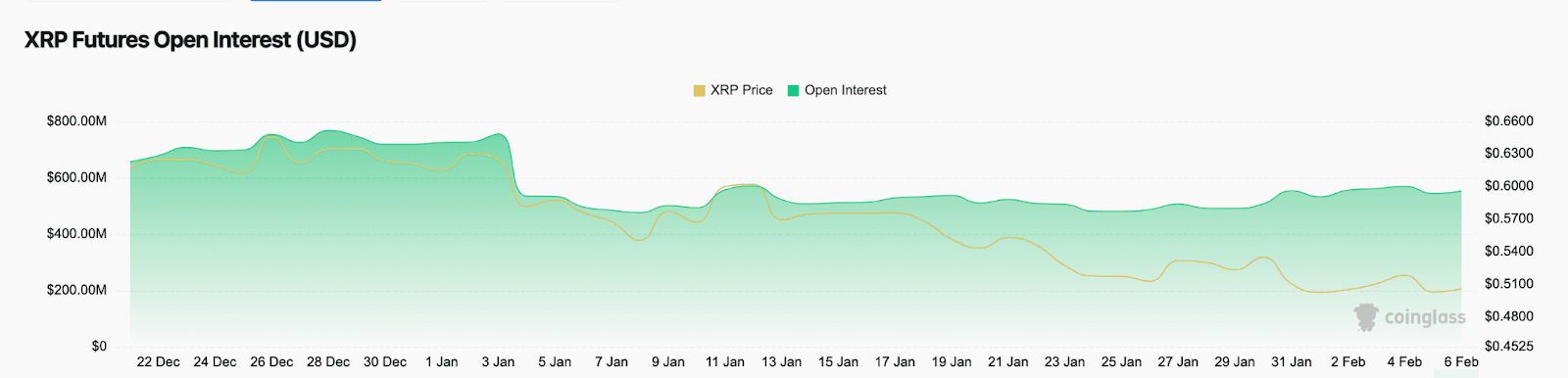

XRP open interest up $66 million amid price downtrend

Down 6% within the seven-day timeframe, XRP has battled a series of bearish news events in recent weeks. More recently, Ripple Labs’ co-founder Chris Larsen lost $120 million to a hack on Jan 31.

While exchanges and law enforcement agencies have since intervened, investors’ reaction to the event appears to have further tilted the market momentum in the bears’ favor. The price has declined 6% from $0.54 to $0.50 between Jan. 30 and Feb. 6.

Notably, recent trends in the derivatives markets further emphasize that more bearish action could follow.

CoinGlass’s open interest data tracks the nominal value of active futures contracts currently listed from a crypto asset.

The latest readings show that, while the price has shrunk 6%, open interest has increased by $66 million in the last 10 days, dating back to Jan. 26.

When open interest increases during a price downtrend, strategic investors typically interpret this as a signal that short traders are doubling down on their positions.

Hence, this $66 million uptick in XRP open interest suggests a reinforcement of bearish sentiment in the market as more traders anticipate and position themselves for continued downward price movement.

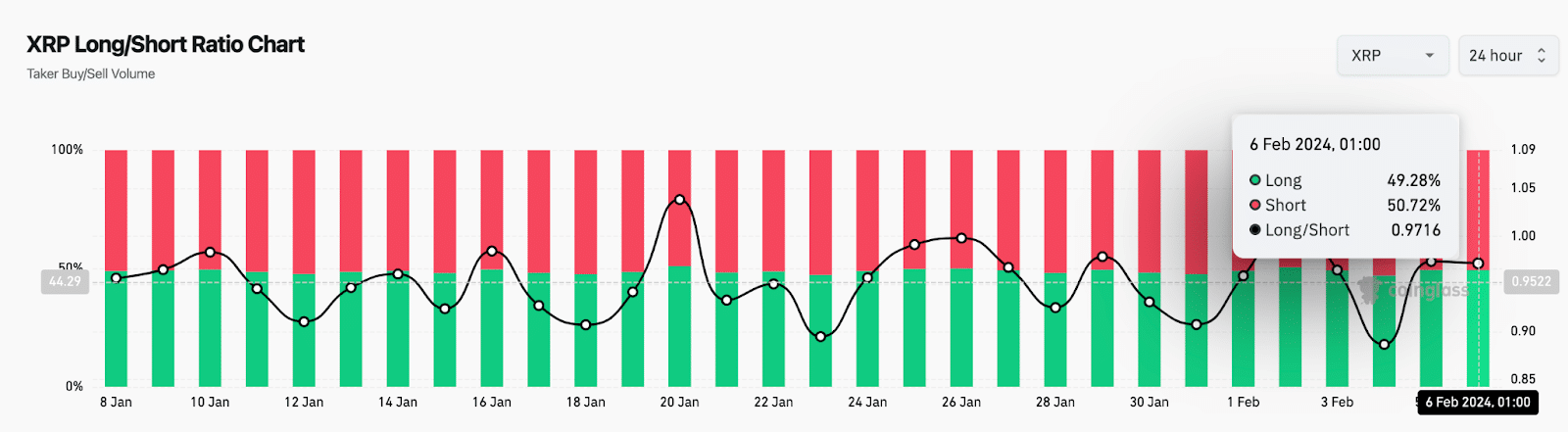

XRP short positions now outnumber bullish contracts

The long-to-short ratio is another vital derivative metric affirming the bearish outlook. Essentially, it tracks the ratio of long positions to short positions in the market, providing insight into the sentiment and positioning of traders.

XRP’s long-to-short ratio has trended below 0.99 in 27 of the last 30 trading days, indicating the bear’s prolonged dominance. At the time of writing on Feb. 6, the XRP long-to-short ratio is 0.97.

This implies that 50.7% of active XRP futures contracts are short positions, against 49.3% longs.

When the long-to-short ratio falls below 0.99 for an extended period, it indicates bearish sentiment, with more traders holding short positions in anticipation of further price decline.

In summary, the negative divergence between price and open Interest combined with the low long-to-short ratio could form a precursor to more downsizing.

If this scenario plays out as historically observed, investors can anticipate a downswing below $0.50 in the days ahead.

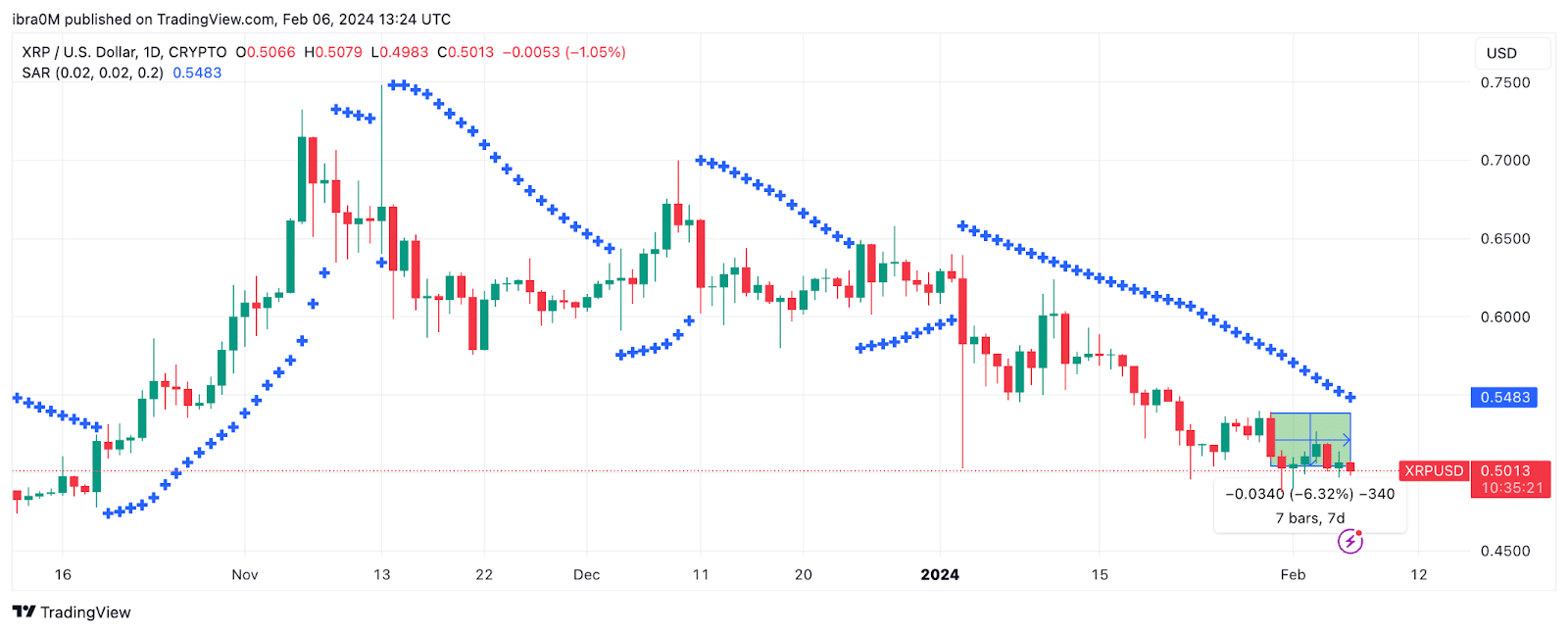

XRP price forecast: Imminent reversal to $0.45 ?

In addition to the bearish signals among speculative traders, current trends observed on the Parabolic SAR technical indicator also support the bearish price forecast.

When the Parabolic SAR points above an asset’s current price, it indicates a dominant bearish momentum.

In this case, after a 6% deficit in the last 7 days, XRP’s Parabolic SAR, as illustrated by the blue dots below, currently points to $0.55, while the current price is $0.50, confirming the negative outlook.

Traders often interpret this alignment as a signal to sell or enter more short positions, implying that the price trend might be on the verge of further decline.

If this scenario is as predicted, the bulls can mount significant support at the $0.45 psychological support to avoid widespread margin call triggers. Failure to hold the $0.45 support could trigger a further downswing toward $0.40.

Conversely, the bulls could negate this bearish forecast by staging a rebound toward $0.55. However, as the SAR dots above outlined, the resistance sell-wall at $0.54 could form a daunting challenge.