Report: XRP Sales Increase 17x Compared to Last Quarter

Ripple’s published its quarterly report for XRP on August 3, detailing important metrics around the tokens and other relevant information for investors.

Maintaining a “Healthy” XRP market

In Q2 2020, total XRP sales were $32.55 million vs. $1.75 million in the previous quarter. Ripple continued the pause of programmatic sales, focusing solely on its over-the-counter (OTC) sales as part of providing increased XRP liquidity to RippleNet’s On-Demand Liquidity (ODL) customers.

The Q2 2020 XRP Markets Report provides an in-depth analysis of the current #crypto markets, highlights a continued pause in programmatic #XRP sales and explores the latest crypto market moves. https://t.co/IYK8agJgCY

— Ripple (@Ripple) August 3, 2020

Ripple said the added liquidity is vital as ODL continues to evolve and expand into new corridors. It added a “healthy, orderly” XRP market that allows for minimized costs, and decreases risk for customers, play a responsible role in the liquidity process.

The post said financial institutions are increasingly leveraging RippleNet’s ODL service, resulting in more liquidity being added to the broader XRP market. However, Ripple remains a buyer in the secondary market and “may continue to undertake purchases in the future at market prices.”

Coming to the sales – only OTC figures as a programmatic pause is in place – the blog said Ripple ended the quarter at 18 bps of CryptoCompare TopTier volumes, compared to last quarter’s.

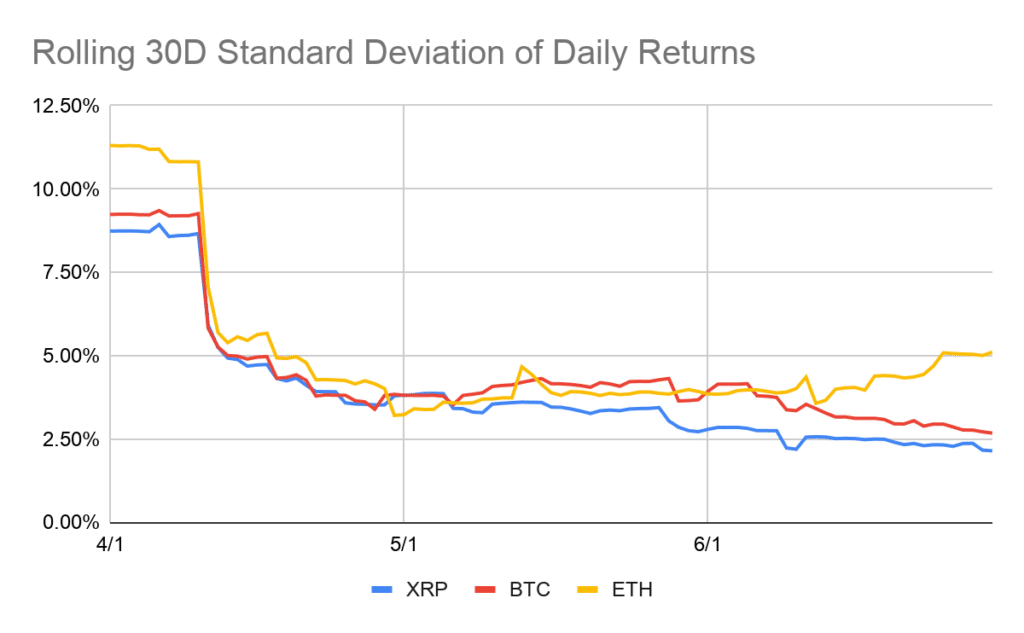

Meanwhile, XRP’s standard deviation of daily returns over Q2 was 3 percent, a drop from last quarter’s 6.2 percent. The figure was in line with the lack of volatility seen across other large-cap cryptocurrencies like Bitcoin and Ethereum. The below image illustrates:

However, XRP volatility lower than that of both the currencies, with Bitcoin at 3.4 percent and Ethereum at 4.2 percent.

Escrows, ODLs, and remittances

Three billion XRP was released out of the company’s escrow program, said the post. In all, across the last quarter, 2.6 billion XRP was returned and subsequently put into new escrow contracts.

On the other hand, On-Demand Liquidity (ODL) saw a pronounced increase in usage and demand. The post noted:

“More than ever, financial institutions are seeing the value of RippleNet’s ODL service to provide instant, global payments and meet market demand, especially during times of crisis due to the exposure risk and increased volatility.”

It added that in Q2 2020, ODL accounted for nearly 20 percent of RippleNet volume. However, compared to a similar period in 2019, RippleNet has experienced 11x year-over-year growth in ODL transaction volume, said the blog.

Ripple said – adding it identified this early on – that remittances were the company’s primary use case, and as such, it will continue to focus on supporting “low-value, high-frequency payments with ODL.”

It concluded that the emphasis has now shifted from large treasury payments to support individual, low-value transactions, “addressing the [latter’s] growing need in remittances and small- and medium-sized enterprise payments.”