XRP whale activity explodes, sell signal emerges

XRP’s recent price rally brought a significant increase in the asset’s whale activity. At this point, a key indicator shows a sell signal for the sixth-largest digital currency.

XRP is up by 14.2% in the past 24 hours and is trading at $0.69 at the time of writing. The asset’s market cap is currently standing at $37.8 billion with a daily trading volume of $7.2 billion.

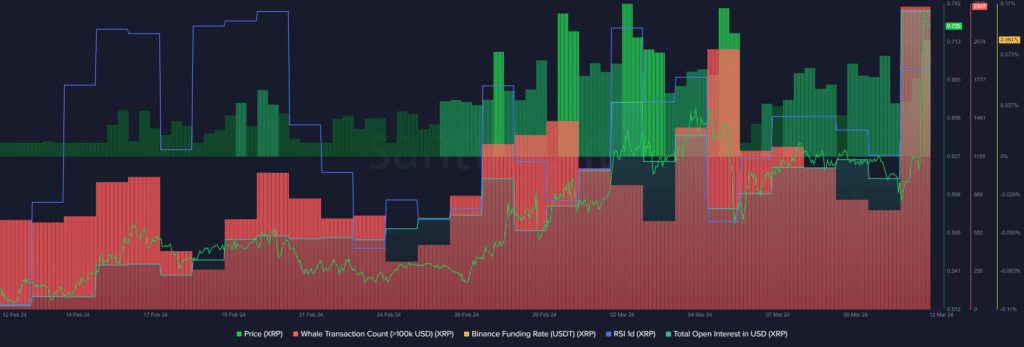

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of XRP increased by 205% over the past 24 hours — rising from 770 to 2,347 unique transactions per day.

Following the heightened whale activity, XRP’s Relative Strength Index (RSI) also hiked from 62 to 72 over the past day, per Santiment data. The indicator suggests that XRP is slightly overheated at this point and high price volatility would be expected.

For XRP to remain bullish, its RSI would need to cool down below the 60 mark.

Data from Santiment shows that the XRP price-daily active addresses (DAA) divergence dropped to negative 29% at the reporting time. When the number of active addresses declines while an asset’s price increases, the price DAA divergence indicator shows a sell signal.

On the other hand, XRP’s total open interest (OI) surged from $635 million to $845 million over the past 24 hours. Surprisingly, the XRP Binance funding rate also increased from 0.05% to 0.08% in the same timeframe.

This shows that the ratio of investors betting on a further price rally has increased despite the overheated market conditions. If the price of XRP falls, traders might witness a large amount of longs being liquidated.