2022 funding wrap: Epic Games, Citadel and LFG lead good year for crypto startups

Crypto had a difficult 2022 in general, but the startling string of major failures, including Three Arrows Capital (3AC), Voyager, Celsius, FTX, and BlockFi, did not slow down venture capital (VC) activity, as evidenced by data from blockchain fundraising tracker Crypto Rank.

VC funding exceeded the 2021 total

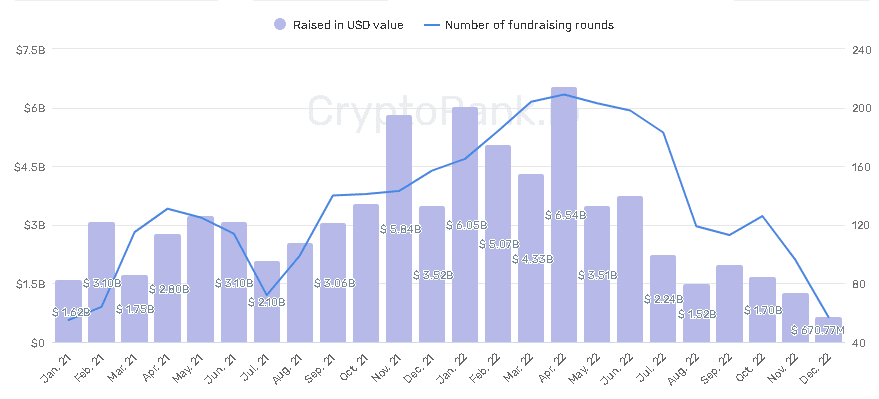

While venture capital financing for blockchain projects began to decline sharply in May 2022, total capital inflows for the year were nearly $8 billion higher than in 2021.

According to data from Crypto Rank, crypto startups received a total of $38.67 billion from an assortment of funds and investors in the past year. By contrast, blockchain companies raised only $30.3 billion in 2021.

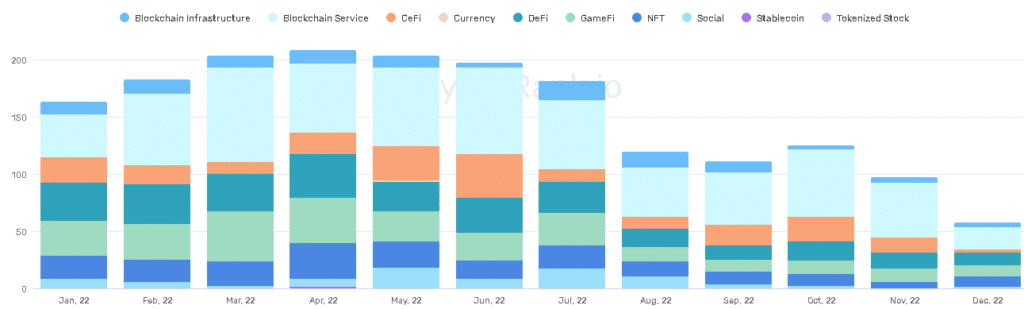

Numbers from the crypto venture database show that a significant amount of money was injected into blockchain projects and startups within the crypto industry, with centralized finance (CeFi) surpassing decentralized finance (DeFi) in the first half of 2022.

In the first six months of the year, DeFi projects raised nearly $2 billion, while Web3 and non-fungible token (NFT) projects and related companies raised about $8.6 billion.

Monthly fundraising

The Crypto Rank data showed that June was DeFi’s busiest month, with several companies raising almost $700 million. Conversely, the month with the highest amount raised for blockchain infrastructure was February, with organizations like Luna Foundation Guard (LFG), ALEO, Aptos, Helium, Polygon (MATIC), and Secret Network (SCRT) accounting for the bulk of the more than $2.5 billion raised.

In general, April saw the highest VC activity, with 207 funding rounds raising about $6.5 billion. Of the rounds in that month, 60 were blockchain service projects, while 40 were GameFi. Thirty-eight were DeFi startups, 31 were NFT projects, 19 were CeFi, and only seven were centered on Web3 social networks.

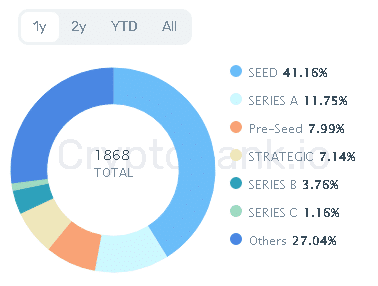

Seed rounds made up more than 40% of funding

Interestingly, as seen in the chart above, despite the turmoil facing crypto, VC firms still showed a lot of interest in fresh startups, as more than 41% of funds raised last year went to provide seed capital for new crypto projects. Nearly 12% of the 1,868 funding rounds documented by Crypto Rank were Series A, while less than 4% were Series B.

In total, more than 51% of the specialized rounds for crypto infrastructure funding came from Series A financing rounds or later, signifying a “maturing” sector.

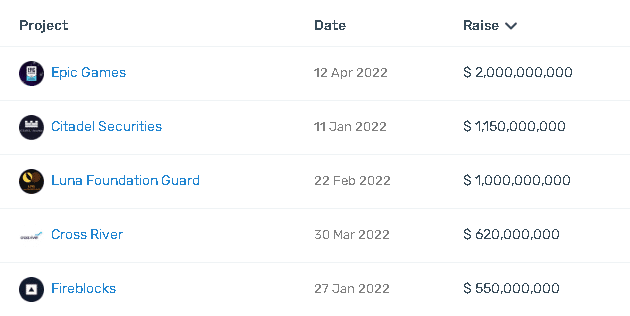

Top 5 funding rounds of 2022

GameFi project, Epic Games, led the most successful funding round of the year, raising $2 billion from Sony Financial Ventures and former LEGO Group CEO Kirk Kristiansen’s private holding and investment company, KIRKBI. Both Sony and KIRKBI invested $1 billion in the “Fortnite” creator, raising the company’s value to $31.5 billion.

The fundraising was to help advance Epic Games’ collaborative metaverse project with the LEGO Group, which is a KIRKBI subsidiary.

Leading global market maker Citadel Securities also benefited greatly from funding in 2022, managing to raise $1.15 billion from Sequoia and Paradigm. The funding round that saw the two VC firms acquire minority stakes in Citadel valued the company at approximately $22 billion.

The year also started with great pomp for the Singapore-based Luna Foundation Guard (LFG), the non-profit behind the infamous Terra ecosystem. Data from Crypto Rank shows that the organization raised $1 billion on Jan. 11 from several backers, including Tribe Capital, Jump Crypto, DeFiance Capital, GSR Ventures, and the now-defunct 3AC hedge fund.

The funding went towards building a bitcoin-denominated reserve for TerraUSD, an algorithmic stablecoin whose eventual de-pegging later in the year caused a catastrophic industry-wide chain reaction that led to the loss of billions and the collapse of several blue-chip crypto companies.

CeFi firm, Cross River, was another huge beneficiary of funding in 2022. The New Jersey-based technology infrastructure provider received $620 million in a financing round hemmed by Andreessen Horowitz, T. Rowe Price, Whale Rock, and Hanaco.

The new capital raised Cross River’s valuation to about $3 billion. It was earmarked for accelerating the company’s tech-focused growth strategy, including building out Cross River’s embedded payment cards and bolstering global strategic partnerships.

Rounding off the top five funding rounds was crypto custodian Fireblocks, which raised $550 million on Jan. 27. VC firms that participated in the funding round included D1 Capital, Spark Capital, Sequoia Capital, ParaFi, General Atlantic, Canapi Ventures, Capital IG, and Index Ventures. The round increased Fireblocks’ valuation from $1.9 billion, attained in July 2021, to $7.5 billion.

Other companies that raised more than $350 million included ConsenSys, Polygon, Yuga Labs, Circle, FTX US, Lithosphere (LITHO), Secret Network, Compute North, Animoca, Crusoe Energy, and Near Protocol (NEAR).

2022’s most active venture capital firms

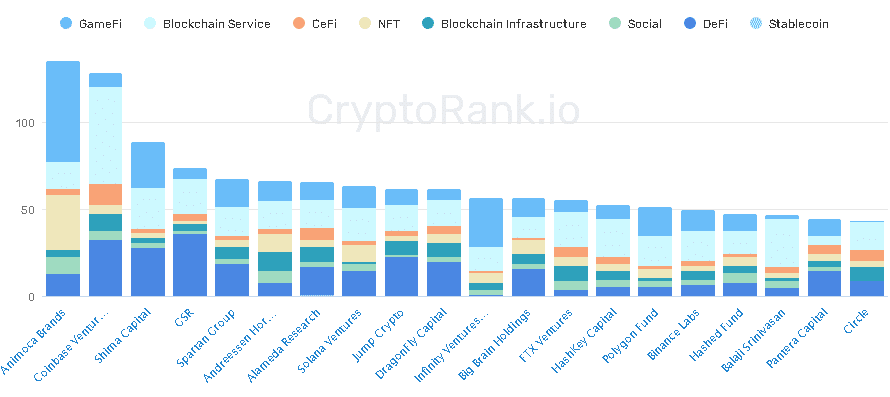

Among investors, Animoca Brands led the way in the number of funding rounds it participated in, in 2022. The Hong Kong-based gaming software and VC firm took part in 136 funding rounds, 58 of which were for GameFi projects and 32 for NFT-related startups.

Coinbase Ventures, the investment arm of popular crypto exchange Coinbase, was last year’s second most active VC company. The firm took part in 128 funding rounds, with the bulk being in the DeFi and blockchain service categories.

Other firms that took part in more than 50 funding rounds included Shima Capital, CSR, Spartan Group, Andreessen Horowitz, Solana Ventures, Jump Crypto, DragonFly, Polygon Fund, Binance Labs, and Sam Bankman-Fried’s FTX and Alameda Research, which participated in a combined 121 funding rounds.