MicroStrategy, Coinbase among the Major Crypto-Related Corporate Losers of the Past Days

A new wave of the “crypto winter” recession has proved to be especially devastating for the major crypto-related stocks, such as MicroStrategy and Coinbase that lost up to 25% at premarket.

Challenges Faced by MicroStrategy and Coinbase

As the total crypto market capitalization falls below $1 trillion for the first time in 18 months, investors tend to reconsider the valuations of the major companies that are heavily invested in cryptocurrency. Michael Saylor’s MicroStrategy is the primary victim of the current market correction because the company owns more than 129,000 BTC.

Independent experts suggested that the BTC price decline to $21,000 could constitute a serious challenge for the company and even result in a margin call. Despite Michael Saylor refuting such claims, they may still affect investors’ demand for stocks in the following days.

According to Saylor, MicroStrategy would be able to avoid margin calls and serious financial problems as long as the BTC price remains above the $3,500 level. However, analysts are concerned that some further BTC price decline to $23,900 would imply losses of about $1 billion for the company.

Coinbase experiences similar challenges with its stock being down by 17.6% according to Yahoo Finance. As the stock price declined to $48, Coinbase has lost about 87% of its market capitalization as compared with its all-time high level reached in November of 2021.

Moreover, the capitalization dynamics of these stocks may remain highly volatile in the following weeks, considering the panic that prevails in the market.

Causes of Problems

There are several major causes of the current collapse in the stock market for the major crypto-related companies beyond the BTC price action. First, the Federal Reserve continues its contractionary monetary policy that implies rising interest rates.

Under such conditions, investors have to reconsider their risk acceptance strategies. In particular, they may prefer to avoid risky investments due to the rapidly growing scarcity of financial resources. The increased volatility of cryptocurrencies has contributed to the decision to avoid such risky stocks for most traders and investors.

Second, the major miners, such as Marathon Digital (MARA), Riot Blockchain (RIOT), and Hut 8 (HUT) also faced considerable double-digit losses in the past several days.

As a result, short-term investors may tend to avoid all key crypto-related stocks due to the concerns that the crypto market may continue to decline even further. Under such conditions, they may try to reallocate their funds to bonds, gold, or other assets expected to provide guaranteed returns with minimal risks. The absence of the drivers of crypto growth contributes to the spread of such sentiments.

Third, the serious problems experienced by the crypto lending company Celsius cause similar concerns in terms of MicroStrategy’s and Coinbase’s sustainability under the present market conditions.

Celsius has declared its inability to meet its financial obligations by appealing to “extraordinary market conditions”. Thus, many investors may believe that other crypto-related companies may also appear to be unable to

MicroStrategy’s and Coinbase’s Market Perspectives

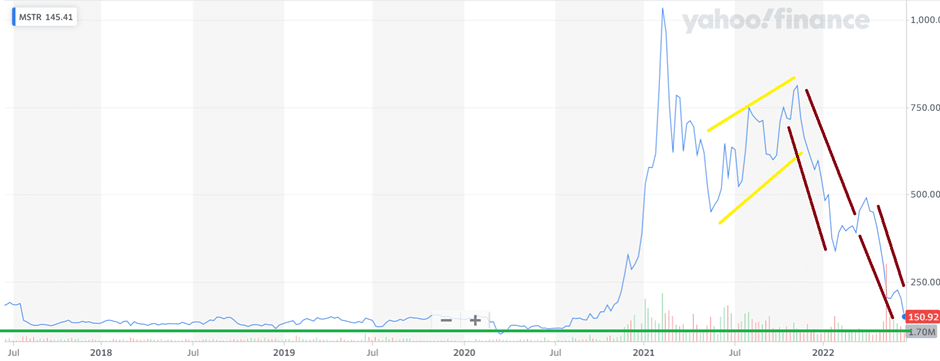

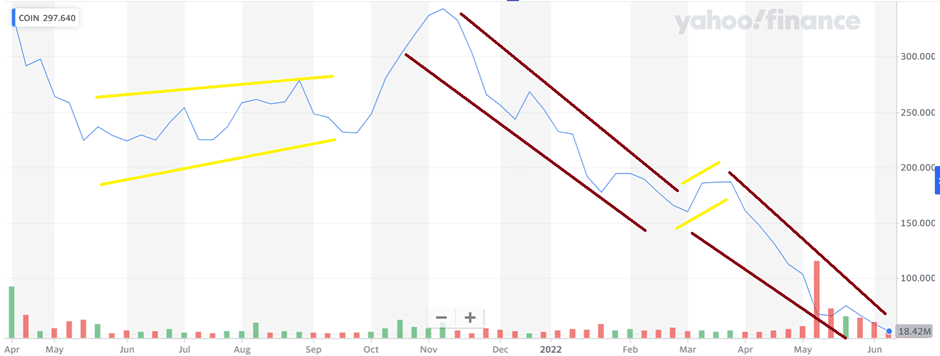

The current market collapse poses additional threats to the sustainable development of the analyzed companies. They need to reallocate the available funds to reorganize their operations in a manner that will enable sustainable development in the long term. Technical analysis may be helpful for identifying the key support levels and price development channels.

MicroStrategy has a strong support level at the price of about $100 which corresponds to its local minimum within the past several years. Therefore, it needs to preserve its level in order to avoid traders’ capitulation and serious valuation problems. Overall, the company possesses the required reserves to reverse the negative trend in the following weeks. However, the complete stock price restoration may become possible only after the normalization of the crypto market dynamics.

Coinbase experiences much more serious problems because its stock does not have a strong support level, and the price declines within the downward-sloping price channel. The company’s stock needs to break this channel upwards in order to achieve price consolidation and gradually achieve its capitalization restoration in the future. Thus, MicroStrategy has a much stronger market potential than Coinbase at the moment.