Alameda-backed Ren protocol shuts down, alerts users to unwrap tokens

The Alameda-backed protocol, Ren, warned users that its version 1.0 is winding down, and there is a potential risk of losing assets.

The Alameda-backed protocol, Ren, announced in a Twitter thread that their version 1.0 is winding down, and there is a potential risk of loss of assets. The team stated that after version 1.0 is retired, its holders may not be able to recover assets.

Ren tweeted that Ren 1.0 is not the end of the Ren protocol. After Ren’s version 1.0 shuts down, it will be replaced by a new community-run Ren 2.0.

The developers told users to immediately burn the circulating tokens on Ethereum and claim them back to the original chain as soon as possible to protect themselves from potential risk. According to some reports, there are currently 1130 renBTC ($19.2 million) on Ethereum.

The Ren team claims Ren 2.0 will be much stronger and more resilient than Ren 1.0. It will also enable novel multichain application development with EVM support.

The Ren Protocol is an issuer of a wrapped Bitcoin asset called renBTC funded by the infamous Alameda. Ren allows Bitcoin holders to lock their assets and mint a wrapped version that can be used on Ethereum (ETH). However, this mechanism has been put on hold for some time.

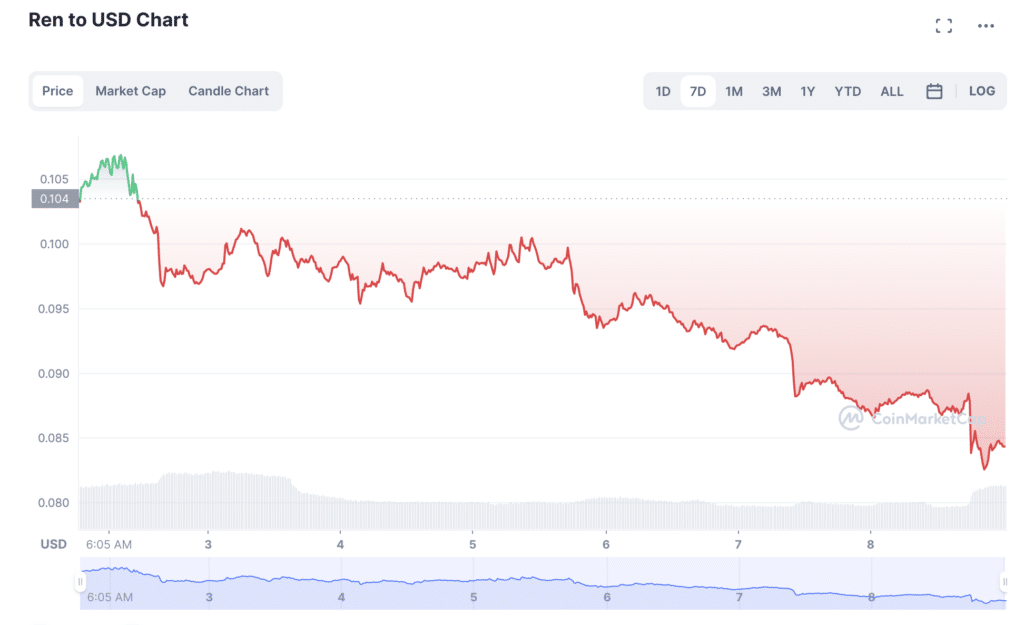

The team announcement resulted in a misunderstanding, as some users panicked and started selling out their REN tokens instead of unwrapping renBTC. As a result, REN dropped from $0.93 before the announcement to $0.82 at the lowest.

An open protocol created to enable value movement between blockchains could soon be sunken into the ice of failed projects. The primary reason for it is the lack of funding after the financial collapse of its mothership, Alameda Research, which acquired the Ren project earlier this year.

Alameda and the FTX exchange filed for Chapter 11 bankruptcy protection in the early days of November. Ren said its main funding source would be removed, forcing it to wind down. Ren’s team previously said it was left with a runway that would finish at the end of the year.