Ark Invest buys $3m worth of Coinbase stock despite bear market

Cathie Wood’s investment company, Ark Invest, which has long been a supporter of bitcoin (BTC), bought 78,982 shares of Coinbase (COIN). With this acquisition, 5.7 million shares of COIN are now held by the ARK Innovation ETF (ARKK).

Cathie wood’s organization buys the dip

In an email, Cathie Wood’s Ark Invest announced that it purchased 78,982 shares of digital currency exchange Coinbase (COIN). This was the firm’s first investment in the exchange in a month.

Wood said:

“The Bitcoin blockchain didn’t skip a beat during the crisis caused by opaque centralized players. No wonder Sam Bankman Fried didn’t like Bitcoin: it’s transparent and decentralized. He couldn’t control it.”

Cathie Wood, Ark Investment

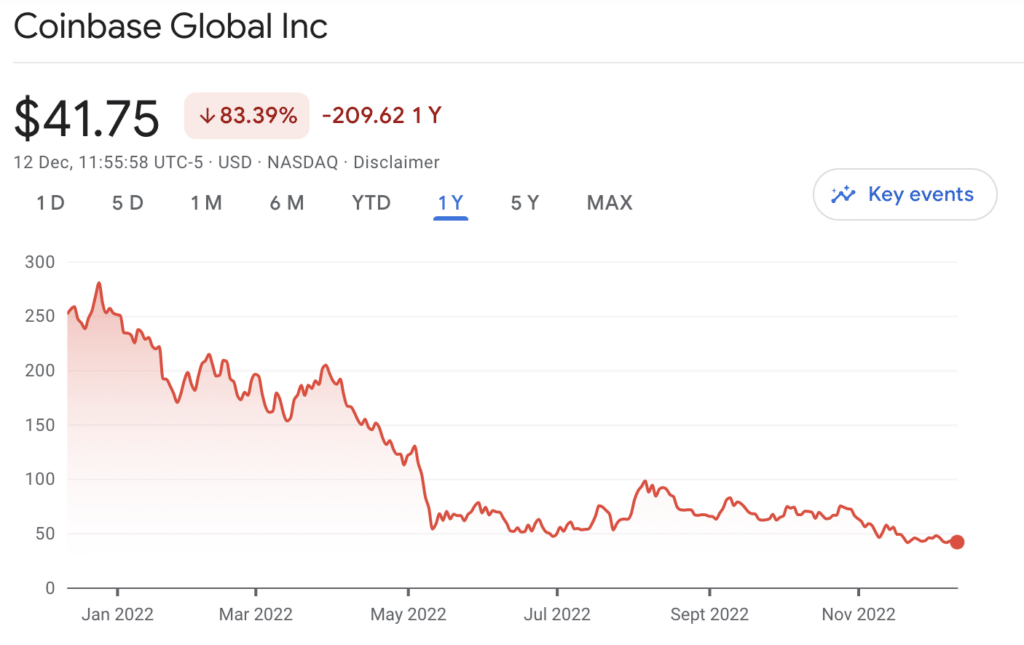

The price of Coinbase stock on Friday, when trading ended, was $40.24, a decline of about 20% over the previous month. The shares had nearly $430 when the exchange first went public in April 2021, which is a significant decline. In addition, it could have cost approximately $3 million to make the purchase. The stock has been in a slump lately and has dropped almost 60% from its early August high of $98.

Coinbase stated that it had only $15 million on deposit in FTX to enhance company operations and customer trades. Furthermore, the organization did not maintain interaction with FTX’s token FTT, which fell roughly 80% and had no awareness of FTX’s sister company, Alameda Research.

Coinbase’s latest activities

By completing the purchase, 5.7 million COIN shares are now held by the ARK Innovation ETF (ARKK). With a 1.4% increase in exposure, the purchase is on the small side. It implies that the investment company continues to see positive trends in the crypto market but may be choosing to exercise caution due to the current turbulent market conditions.

Brian Armstrong, the CEO of Coinbase, predicted the prior week that the sales revenue would be at least 50% lower this year than last year due to the sharp declines in price volatility and sector-wide repercussions of numerous large companies going bankrupt, including rival exchange FTX.

In its press statement, Coinbase disclosed a third-quarter net income of $576 million, a 28% decrease from Q2 2022’s $803 million quarter, and a drop in trading volume from $217 billion to $159 billion.

The startup’s CEO Armstrong recently shared his opinion on FTX’s Sam Bankman-Fried, saying he is receiving “kid treatment” after allegedly committing crypto fraud.