Binance partially rejects Monero withdrawals, users claim

Multiple investors face problems making withdrawals in their Monero (XMR) wallet in Binance, prompting a public outcry on Reddit.

XMR issues on Binance worry users

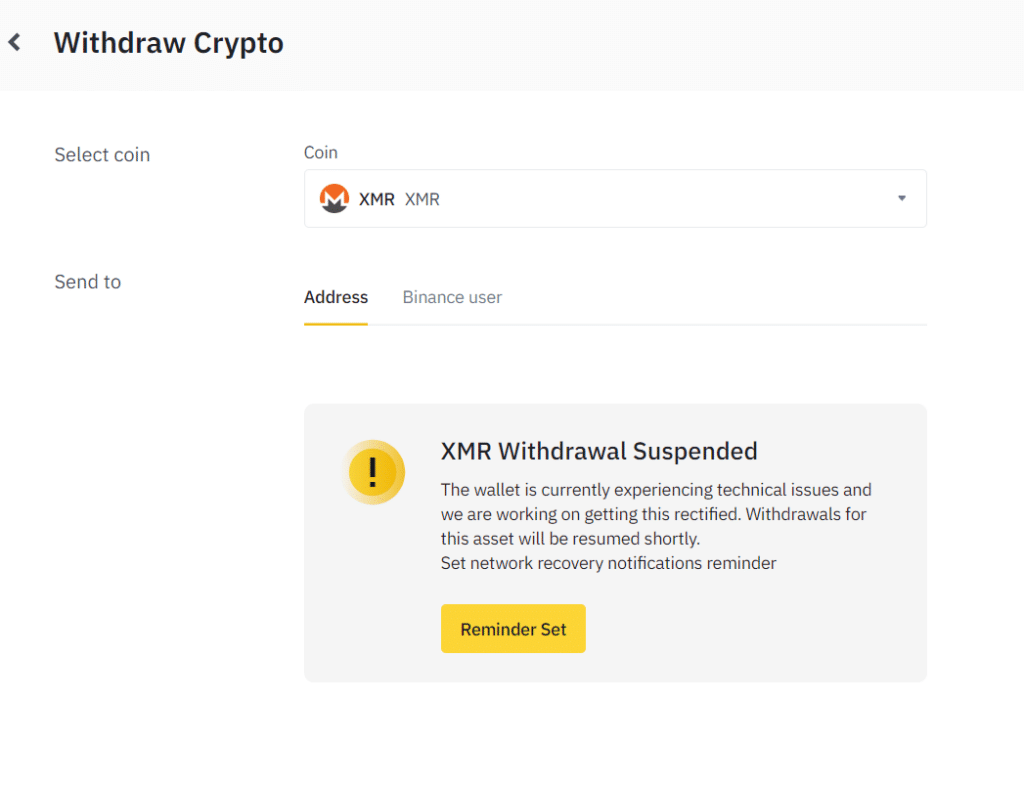

An agitated customer, identified as WhatJay, posted a screenshot showing XMR withdrawal suspension. The post comes just a few hours after multiple customers complained of XMR withdrawal problems in Binance. Clients using Monero wallets have been receiving a message requiring them to wait for replenishment of the wallet.

The image displayed on Reddit shows that Binance acknowledges facing technical difficulties in effecting withdrawals through Monero.

Another customer questioned the motive of withdrawal suspension, attributing it to liquidity issues or a deliberate move by the exchange to wait until the market was in their favor. Another user speculated that Binance could have run out of XMR and was waiting for deposits to authorize pending withdrawals. Most customers continue to speculate on the reasons for the suspension, while others said they had a successful withdrawal.

The deposit option in Binance, however, is working well. Amid customer complaints, the company has not yet issued a statement to alert its users on the suspension of withdrawals in Monero.

On August 13, Binance suspended withdrawals and deposits through Monero (XMR) when the development team upgraded their system. Binance informed its users of the suspension and gave the timeline for the solution.

Is Binance facing liquidity problems?

Last week Binance was in the spotlight after Mazars, the auditing firm that conducted a proof-of-reserve assessment, halted its services to crypto-related clients. The clients suspended by Mazars’ proof of reserves services included Binance, Crypto.com, and KuCoin. The main concern for suspension was in relation to public perception of the reports.

According to the Mazars, the reports generated were not an audit opinion nor assurance but were limited to results from historically agreed procedures. The report released earlier in December indicated the over-collateralization of bitcoin reserves.

The company continues to face challenges. Last week’s article indicated a withdrawal pause of USDC that the Binance CEO attributed to the closure of banks.