Binance POR: Ethereum holdings declined while Bitcoin and USDT steadied

In Binance’s 10th proof-of-Reserves (POR), Ethereum (ETH) holdings decreased, while Bitcoin (BTC) and Tether (USDT) remained stable or slightly increased.

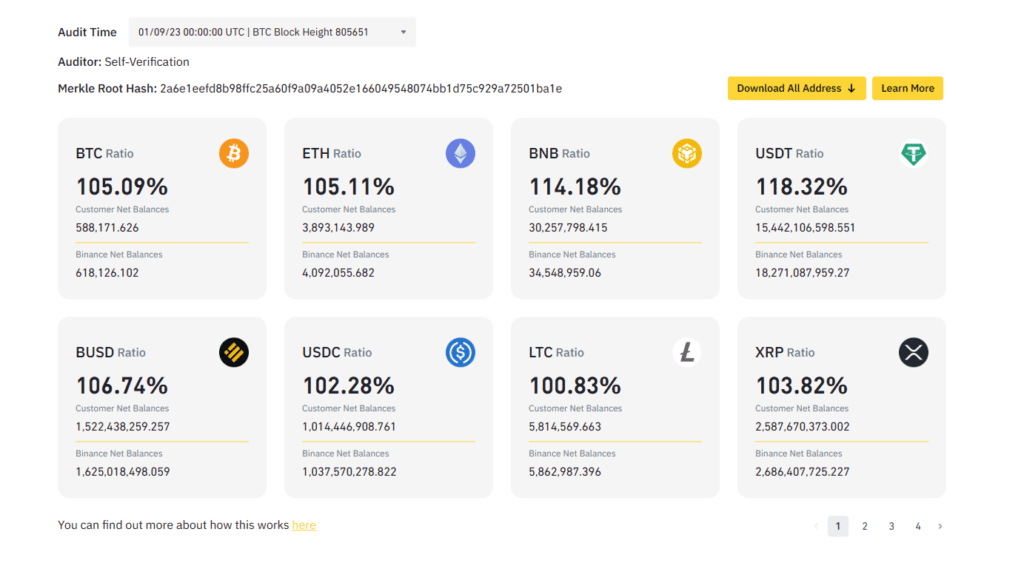

Binance published its 10th POR amid liquidity concerns, offering the public a look into the state of customer assets and holdings.

The disclosure reveals mixed trends: Bitcoin and Tether deposits have stayed steady or slightly grown, but Ethereum holdings have dropped by 4.3%.

Key figures from Binance’s reserves showed that Bitcoin deposits stood at around 588,000 BTC while there was approximately 3.89 million ETH, down 4.3%. Meanwhile, the exchange held $15.44 billion of USDT, up 1%.

The latest POR revealed that Binance held 4.71 million ETH and 276,215 BTC in cold storage.

These figures complement the user deposits, which stood at 1.18 million ETH and 311,821 BTC on the BNB Chain.

Meanwhile, Binance held $13.6 billion of USDT, juxtaposed with users’ $1.86 billion on BNB Chain.

While Bitcoin deposits remained relatively stable, there was a 4.3% decrease in Ethereum assets and a 1% increase in USDT holdings. This suggests changing user sentiment, possibly influenced by market conditions or perceptions of asset stability.

For the past month, there have been growing concerns about Binance’s market position.

Sudden exits of several high-profile executives, regulatory pressure, the discontinuation of BUSD, and partnership termination from VISA and Mastercard, caused jitters.

Binance’s POR not only ensures its financial strength but also provides insights into asset allocation trends among its large user base.

This release highlights Binance’s dedication to asset security and transparency, serving as a means to confirm that it has enough reserves to safeguard customer holdings, enhancing its credibility in a competitive and frequently unstable market.