Binance Report: Crypto Markets Beginning to Resemble Traditional Finance

Binance’s Q2 report celebrates the outstanding results of the second quarter of the year and investigates correlations patterns among cryptoassets. Evidence highlights a decreasing correlation between Bitcoin and altcoins, while positive associations remain between cryptocurrencies that share similar features.

Rising Tides Lift All Boats

Popular crypto exchange Binance has released its Q2 Report of the cryptoassets market, which features an investigation into the correlation among digital assets.

Despite a pullback in the final days of the second quarter, the overall performance of the crypto market was extremely positive in the first six months of 2019. The market rose as much as +139 percent only in the past quarter, making it the third-best quarter since 2014. In dollar terms, Q2 has witnessed an increase of almost $200 billion, making it the second-best performing quarter of all time, ranked only behind the bull run of Q4 2017.

The Binance report focuses on recent changes in correlations within the industry and further analysis of some reoccurring patterns in the crypto market. In traditional finance, correlations have always been widely investigated as a tool to diversify and efficiently allocate assets.

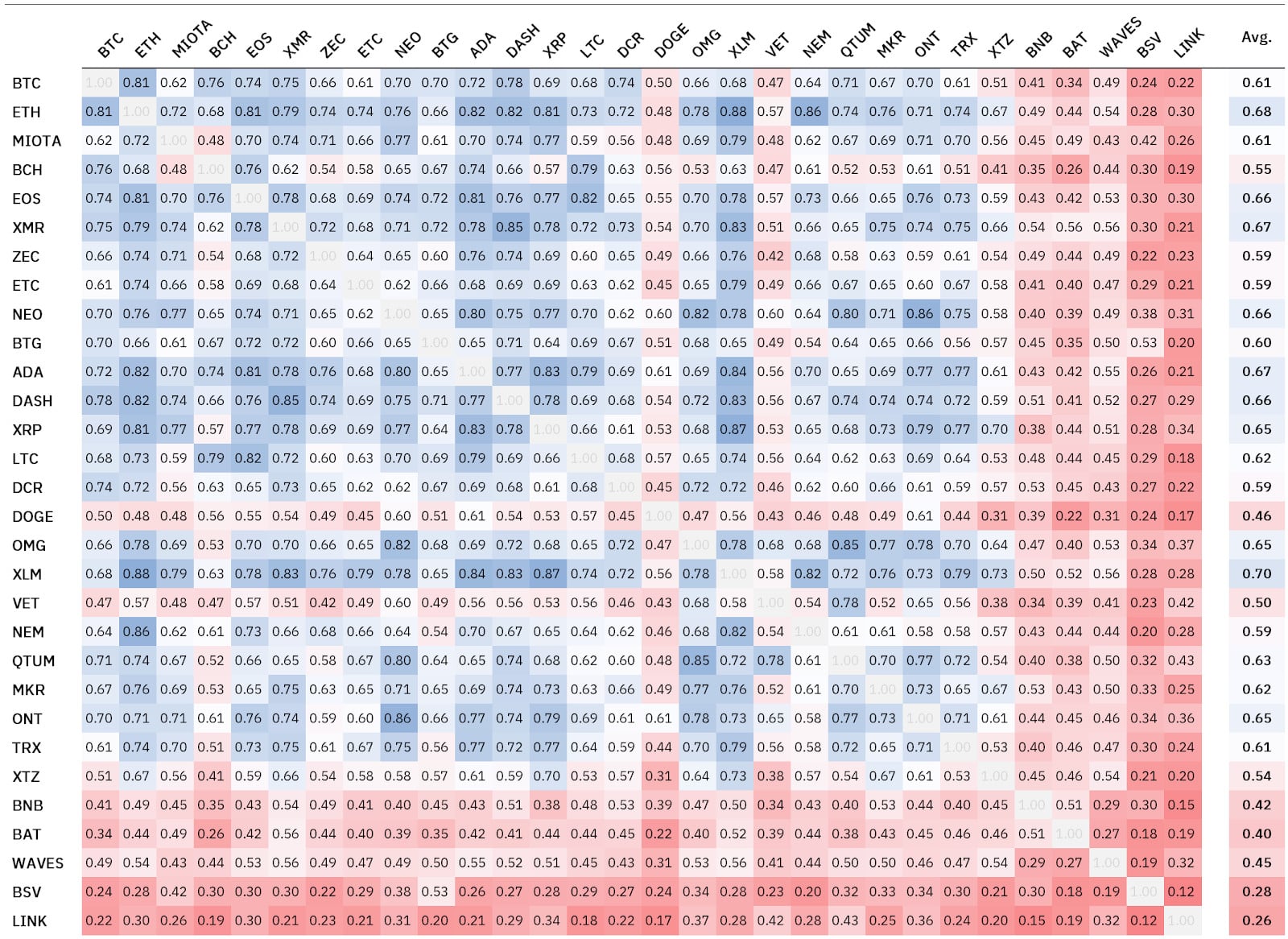

Correlation values above 0.5 or below -0.5 are considered to have either strongly positive or strongly negative correlations. Similarly, a close-to-zero correlation indicates the lack of a linear relationship between the returns of two assets.

While Bitcoin exhibited a high average correlation with other cryptoassets in Q1 2019, it fell significantly in Q2. During this time, Bitcoin’s price increased by 300 percent, pushing its market dominance to above 60 percent and marking new highs for the year.

(Source: Binance)

Despite the decreasing correlation, no single pair of cryptoassets exhibited a negative value. This means that the influence on the performance of individual coins is still heavily influenced by overall market changes.

Moreover, cryptocurrencies with more idiosyncratic factors (e.g., major news and events) such as BNB, LINK, or BSV exhibited relatively low average correlations compared to other cryptoassets.

We can also find a low correlations value for cryptos that followed to the so-called “Binance Effect.” Tezos (XTZ) and Doge (DOGE), for instance, exhibited lower correlations with other cryptoassets than the remainder of the set, mainly due to the listing on the exchange and the ensuing surge of price. A similar effect can be found in Bitcoin SV (BSV), which interestingly displayed decorrelation with other cryptoassets following the Binance and Kraken delisting.

The report also highlighted higher correlations values among privacy coins such as DASH (DASH) and MONERO (XMR). Similarly, cryptoassets that deliver similar functions to Ripple (XRP) and Stellar (XLM) also exhibit a higher correlation.

According to Binance, the correlation between cryptoassets is still significant and may demonstrate that today’s market behaves similarly to the early historical stages of bullish environments in traditional finance markets.