Bitcoin could rally to $40k then correct says analyst

According to Michael van de Poppe, BTC is trending down, but long-term strength remains.

The analyst believes that BTC could go to a high of $40,000 before facing harsh corrections. Michal van de Poppe, CEO and founder of trading business Eight, in line with the prediction, went on to assert that the recent slump will be brief.

“The current market correction is good news for those looking for entry positions. But, unfortunately, we may continue down for a while longer. So, a week of consolidation before carrying on.”

Michal van de Poppe, CEO and founder of Eight

According to van de Poppe’s study of the bitcoin price chart, the cryptocurrency’s recent price movement has been contained inside a contracting wedge formation, with $22,500 serving as a crucial support zone below.

His long-term prognosis claims new highs followed by a deeper downturn, which is still likely to bring bitcoin back to $20,000.

Poppe anticipates that BTC will continue to advance toward $35,000–40,000 before seeing a severe reversal, maybe down to $25,000–30,000.

“The higher we go, the more capital should be allocated to $USDT, and then, in the second half of 2023, investors should purchase on the downturn.”

Michal van de Poppe, CEO and founder of Eight

Thoughts on BTC price movements

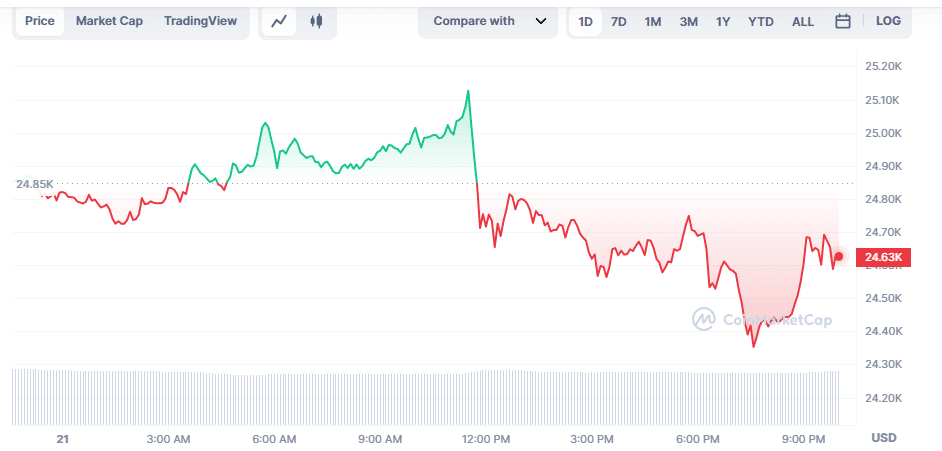

Monitoring resource Material Indicators found that bitcoin needs support at the 200-week moving average (MA) of around $25,100 to reverse its long-term trend amid concerns about whale movements on exchanges.

According to analysts’ opinions on Twitter, this is still distributed in a bear market rally until we get complete candles above the 200 WMA. With the bid well over $24,000, shorting from this level has about as much short-term risk as buying as per the analysis.

How is bitcoin doing today?

Today hasn’t been much of a pleasant day for bitcoin bulls. Although mild, the digital gold registered a 0.9% price decrease as of the time of writing, which saw a slight disruption of bitcoin’s on-chart upward trend.

Bitcoin, whose circulating supply stood at 19,298,012 BTC, saw a decrease of more than 2% in its trading volume as of the time of writing, according to the CoinMarketCap stats.