Celsius moves to unstake $470m in ETH for creditor repayments

Bankrupt cryptocurrency lender Celsius Network revealed plans today to unstake its existing Ethereum holdings in preparation for prompt distributions to its creditors.

On Jan. 5, the lending company Celsius that is currently embroiled in bankruptcy proceedings since its Chapter 11 filing in July 2022, declared the initiation of asset reallocation to secure sufficient liquidity ahead of potential distribution of funds back to creditors.

Celsius also announced plans to unstake its current holdings of Ether (ETH), which have been generating significant staking rewards income for the estate.

The released Ethereum aims to cover various costs incurred during the restructuring and expedite distributions to creditors.

The decision is seen as a positive development for Celsius customers, who have been awaiting the return of their funds for over a year and a half. According to Celsius’ recovery plan, creditors will receive Bitcoin (BTC) and/or Ethereum as part of the settlement.

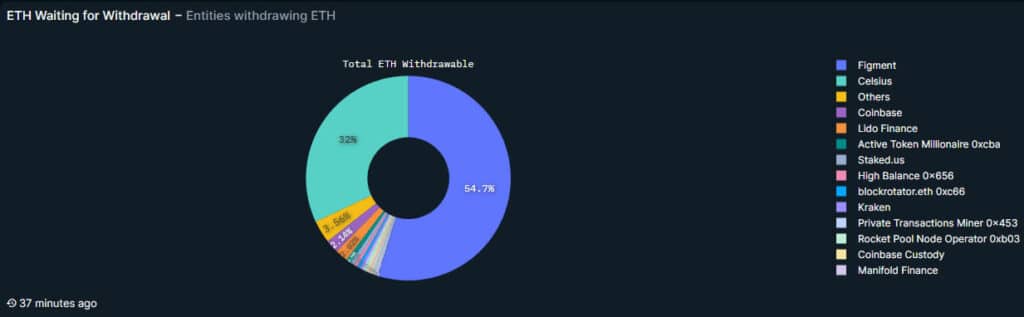

Nansen, a blockchain analytics firm, reported that Celsius currently holds about 32% of the Ether now pending in the withdrawal queue, amounting to 206,300 ETH, valued at around $468.5 million.

The firm also noted that Celsius has withdrawn 40,249 ETH to date and that 19,906 validators are awaiting complete withdrawal.

While some fear that this large-scale withdrawal of Ethereum could negatively impact its market value, others believe it will positively influence Ethereum’s long-term prospects as Celsius progresses through its restructuring.

Celsius’s journey into bankruptcy began in July 2022 following a liquidity crisis triggered by the downturn in the crypto market. This led to the freezing of withdrawals and the eventual filing for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Southern District of New York.

Celsius has since been working on a settlement plan that permits qualified users to withdraw 72.5% of their crypto holdings until Feb. 28. Court documents from September reveal that around 58,300 users held a total of $210 million in assets classified as “custody assets.”

Alex Mashinsky, Celsius Network’s founder and former CEO, currently released on bail after being arrested on fraud charges. His trial is set for Sep. 17.

Celsius pivots towards crypto mining operations

Last month, Judge Martin Glenn authorized Celsius Network to pursue an alternative plan previously ratified by its creditors involving forming a new public company with a sole focus on Bitcoin mining.

Creditors of Celsius will be compensated partly through shares in this new Bitcoin mining venture, aligning their interests with the success and expansion of the mining activities. The approach also releases $225 million worth of cryptocurrency assets, initially earmarked for other projects but turned down by the SEC.

The new company, dubbed MiningCo, is set to be managed by Hut 8 under a contract spanning four years, focusing on mining operations.

The deal includes managing five Texas-based mining facilities, collectively equipped with a computational power of roughly 12 EH/s, akin to 122,000 miners, and a total energy output exceeding 300 MW.

MiningCo is set to concentrate on staking and mining activities, with an anticipated balance sheet reaching $1.25 billion, including $450 million in readily available cryptocurrency assets.

According to court filings, the enterprise aims to generate annual profits between $10 and $20 million from staking cryptocurrencies on the Ethereum network.