Crypto industry furious as SEC goes after Uniswap

The SEC is being criticized for acting beyond its authority — with one lawyer telling crypto.news that the regulator’s case against Uniswap is weak.

Following the bombshell announcement that Uniswap has been slapped with a Wells notice by the U.S. Securities and Exchange Commission, the reaction in crypto circles has been harsh and uncompromising.

For the uninitiated, this means that the SEC is intending to take enforcement action against the decentralized exchange — and indicates an investigation has uncovered wrongdoing. But given Wells notices aren’t made public, only Uniswap knows of the securities violations it’s accused of.

Uniswap’s inventor Hayden Adams broke the news to his 280,000 followers on X — defiantly declaring that he was “annoyed, disappointed, and ready to fight.” He maintains the services offered by the DEX are legal and couldn’t help but take a swipe at SEC chair Gary Gensler for his heavy-handed approach to “good actors” in the crypto space, while failing to clamp down on FTX until it was too late.

SEC’s arguments ‘particularly weak’

Countless other industry heavyweights have also jumped to Uniswap’s defense — accusing the SEC of operating beyond its remit, pursuing regulation by enforcement while failing to offer clear rules of the road for firms to follow, and shoehorning cryptocurrencies into securities laws established almost 80 years ago. Industry groups have reiterated their calls for Washington to pass “smart legislation that provides a regulatory framework for the digital asset sector” — a prospect that seems unlikely any time soon as the presidential election approaches.

Laura Sanders, policy counsel at the Blockchain Association, told crypto.news:

“The SEC continues to push the limits of its congressional mandate. Its authority is explicitly confined to securities, which do not include tokens exchanged on secondary platforms such as Uniswap. The recent ruling in SEC v. Coinbase, Inc. dismissing the SEC’s claim that crypto wallets qualify as brokers, underscores the weakness of the SEC’s position here. We anticipate that its arguments in any future legal dispute with Uniswap will face similar skepticism in court.”

Laura Sanders, Blockchain Association policy counsel

Coinbase’s tangle with the SEC after it too was handed a Wells notice in March 2023 helpfully illustrates the exasperation that crypto businesses face. At the time, the exchange criticized the commission for failing to offer a clear path to registration — as well as for declining to state which digital assets listed on its platform were suspected securities. “The U.S. crypto regulatory environment needs more guidance, not more enforcement,” it said in a blog post.

With history now repeating itself, Uniswap Labs chief legal officer Marvin Ammori is making a similar complaint — arguing that the protocol, app, and wallet “don’t meet the legal definitions of securities exchanges or brokers” and the SEC’s overall arguments “are particularly weak.” He wrote on X:

“We welcome sensible regulations for crypto — and clear rule of law that we expect in the U.S. — not arbitrary enforcement and continued abuse of power. Uniswap Labs is prepared to fight against this abuse, and we’re confident we’ll win.”

Marvin Ammori, Uniswap Labs chief legal officer

Jake Chervinsky, the chief legal officer at Variant, went further — accusing the SEC of actively trying to “drive crypto founders out of the United States through fear and intimidation.”

Attempting to strike a positive note, he pointed out that Gensler’s term will expire in 2026, it is Congress that’s tasked with determining the law surrounding cryptocurrencies, and that means that the SEC can be proven wrong and defeated in court. The commission has suffered a number of defeats of late, notably when a judge concluded it was wrong to reject Grayscale’s application to establish an exchange-traded fund based on Bitcoin’s spot price.

“The SEC has had to twist the law beyond recognition in order to justify expanding its reach beyond financial instruments that are actually meant to be securities. Thankfully, federal judges aren’t easily fooled.”

Jake Chervinsky, Variant chief legal officer

Chervinsky praised the crypto sector’s innovation and efforts to fight back through litigation of its own — with a notable example seeing the defi Education Fund and Beba launching a lawsuit against the SEC designed to challenge its “unending enforcement actions.” However, he admitted that things may get worse before they get better.

“Unfortunately, it looks like a long road ahead before we get clarity on whether and how the securities laws apply to digital assets. Hopefully Congress will pass new legislation that actually makes sense for crypto some day. In lieu of that, we’re stuck fighting this out in the courts.”

Jake Chervinsky, Variant chief legal officer

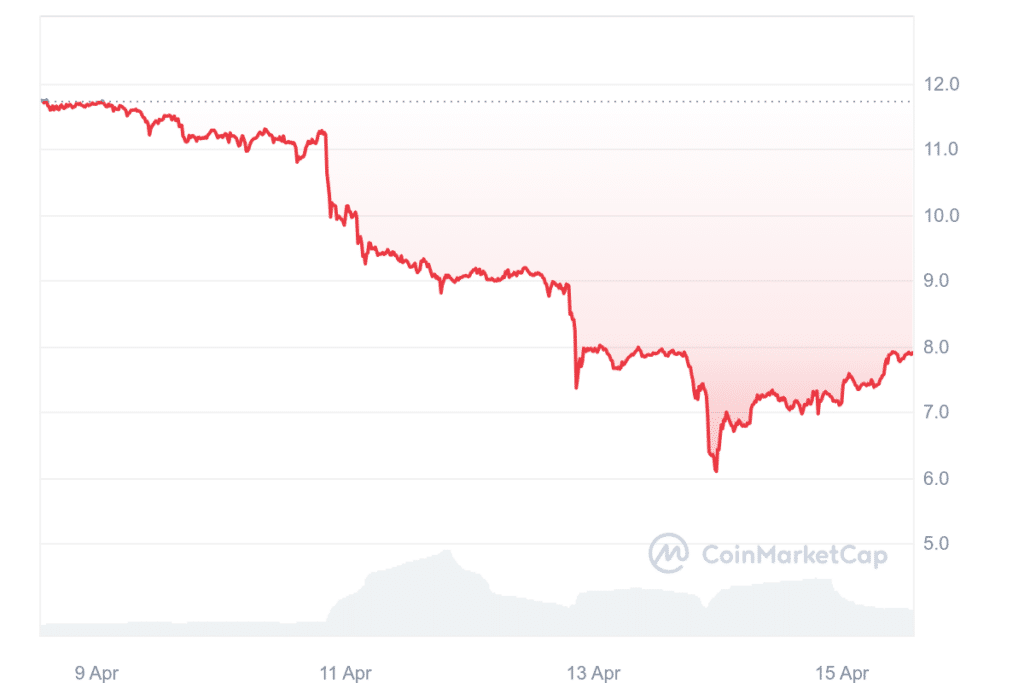

While it’s been a trying week for the crypto markets overall, Uniswap’s native UNI token has been particularly punished by news of the Wells notice — falling 32% in the week to April 15.

Wells notices can lead to a company being fined or forced to shut down services, with assets seized. But given Uniswap’s infrastructure is decentralized, meaning no single individual or entity is in charge, it’s difficult to see how the SEC would be able to shut it down.

Gary Gensler appears to be betting that the DEX isn’t as decentralized as it seems.