What awaits FTX after Sam Bankman-Fried’s 25-year sentence?

What does the future hold for the platform now that Bankman-Fried faces decades in prison, and is there any chance for a revival of the FTX exchange?

Once a leading name in the crypto world, FTX faced a dramatic downfall in November 2022, leading to its bankruptcy. Recently, Sam Bankman-Fried, FTX’s former CEO, received a 25-year prison sentence for various crimes, including fraud and stealing user funds. This raises a big question: What happens next for FTX? Crypto.news is exploring how this verdict will impact the future of the exchange.

Prosecutor requested 40-year sentence

According to the judge, FTX clients lost $8 billion and investors another $1.7 billion, with an additional $1.3 billion from the exchange’s creditors. This financial turmoil led to at least three FTX clients taking their own lives. In the courtroom, the possibility of a life sentence for Sam Bankman-Fried was on the table. Judge Lewis Kaplan said the former CEO of FTX committed false testimony on at least three occasions.

Bankman-Fried admitted to debts owed by Alameda Research, a fund tied to FTX that also went bankrupt. He claimed, however, that FTX could have avoided bankruptcy and sorted out its issues. Alameda had access to FTX clients’ funds and used them for risky investments and other spending, including donations to American politicians.

While prosecutors pushed for a 40-year sentence, Bankman-Fried’s lawyers argued for a much shorter sentence of six and a half years at most. The defense asked to consider his background, education, Wall Street experience, and role in founding trading firms, arguing that greed wasn’t his sole motivation.

Failed attempts to restart FTX

On June 28, 2023, FTX CEO John Ray said the company had launched a stakeholder engagement process to reboot the FTX.com exchange. As The Wall Street Journal’s sources noted, the exchange would most likely rebrand when it restarts.

In August 2023, FTX unveiled a relaunch plan that included, among other things, the creation of a new international marketplace for customers outside the United States. At the end of October 2023, FTX managers were negotiating the restoration of the platform with three investors. The exchange considered selling the company and customer base or bringing in a partner to help it reopen.

According to Kevin M. Cofsky, an investment banker at Perella Weinberg Partners, who oversaw the negotiation process, the exchange should decide whether to continue operations by mid-December 2023. FTX is considering two transaction options: selling the entire exchange and customer base or bringing in a partner to help it reopen.

“We are engaging with multiple parties every day.”

Kevin M. Cofsky, an investment banker at Perella Weinberg Partners

However, at the end of January, FTX abandoned attempts to resume operations, deciding to liquidate all assets and return funds to customers.

For over a year, FTX’s new management has been handling its bankruptcy and trying to recover what’s left of the company’s assets. FTX attorney Andy Dietderich shared that they’ve been in talks with potential buyers and investors for months. However, these parties need more time before they can commit the significant funds needed to revive the exchange.

“FTX was an irresponsible sham created by a shameful felon. The costs and risks of creating a viable exchange from what Mr. Bankman-Fried left in a dumpster were simply too high.”

Andy Dietderich, FTX attorney

He expressed his team’s disappointment with FTX 2.0, as the company still holds valuable customer data that could be used to generate revenue.

The attorney also pointed out that FTX’s previous acquisitions, worth hundreds of millions of dollars, turned out to be largely unsuccessful. Interest in buying these assets is limited. Even LedgerX—one of the few exchange divisions considered solvent when the parent organization filed for bankruptcy—was a terrible investment, Dietderich emphasized.

What is going on around FTX?

The interim administration of the bankrupt FTX Group is selling crypto assets and hoarding cash to pay off debts to clients whose accounts were frozen after the platform collapsed in the fall of 2022.

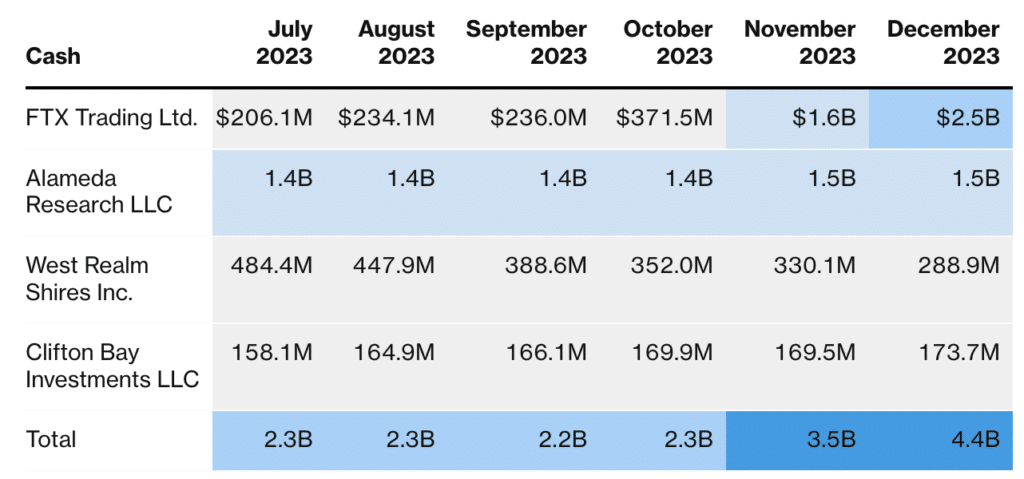

Bloomberg sources report that FTX Group’s four most significant subsidiaries, including FTX Trading and Alameda Research, doubled their cash assets to $4.4 billion in 2023. In comments sent by FTX bankruptcy consultants to U.S. regulators, it is said that in December last year alone, the interim administration of FTX gained more than $1.8 billion from the sale of digital assets.

FTX has recovered over $7 billion in assets to return money to customers and has agreed with various government regulators, Dietderich said. The regulators decided to wait until customers were fully compensated before attempting to recover about $9 billion in claims.

Now FTX expects to pay all clients in total but will calculate their payments based on cryptocurrency prices at the exchange rate in November 2022, when the collapse of the exchange led to the collapse of the entire crypto market. Dozens of FTX clients challenged this decision in court. Paying compensation at this rate (at a Bitcoin price of about $17,000) would mean that they completely missed out on the growth of the crypto market in 2023 because their assets were blocked when the exchange went bankrupt.

However, the court rejected their appeals and, at a hearing on Jan. 31, approved awards at 2022 prices, saying U.S. bankruptcy law is obvious that debts must be discharged based on their value on the date the company filed for bankruptcy.

Will SBF conviction be a turning point in FTX story?

FTX and Sam Bankman-Fried were once closely linked, but since the exchange declared bankruptcy, their paths have diverged. Bankman-Fried now faces prison time, while FTX is left as a shadow of its former self, focusing on paying back its clients.

This separation means Bankman-Fried’s fate probably won’t impact FTX’s current operations. Without finding anyone to revive the exchange, FTX’s future looks to be centered on settling its debts. As for Bankman-Fried, he’s likely to spend many years in prison, marked as the mastermind behind one of the biggest frauds in the crypto world.