Cryptocurrency and environment: How digital coins affect the planet

The growing popularity of cryptocurrencies has led to more people looking into how much energy they use and how they affect the environment. Let’s delve into the environmental impact of well-known coins, looking at the technology behind them and the consequences they have on our planet.

Ethereum’s evolution toward sustainability

Ethereum has cemented its status as a significant player in the blockchain landscape, facilitating the rise of smart contracts and decentralized applications (dApps). However, its influential position comes with an environmental cost. Ethereum recognized this issue and transitioned from the energy-hungry proof of work (PoW) to the greener proof of stake (PoS) system through the Ethereum Merge in September 2022.

According to Ethereum, its annualized electricity consumption plummeted from a staggering 2,565 MW to a mere 0.0026 TWh, making it virtually unrecognizable in energy consumption. The shift in consensus mechanism also led to a substantial reduction in carbon emissions, with the annual footprint dwindling to 870 tonnes of CO2e.

Putting Ethereum’s environmental impact into perspective

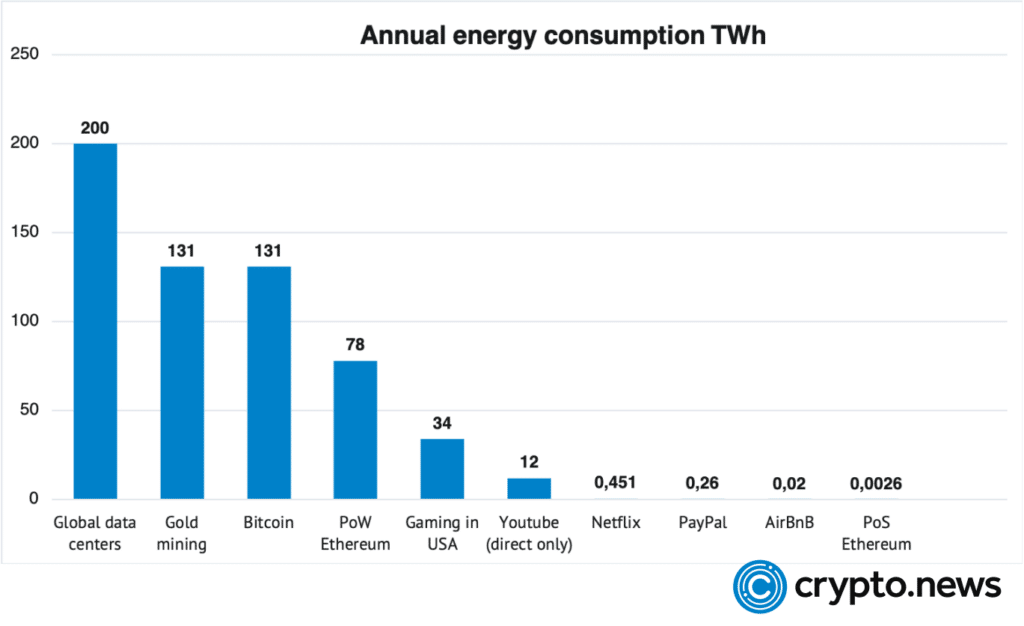

To contextualize Ethereum’s environmental footprint, it’s worth comparing its energy use to other high-consumption sectors. According to data on the Ethereum website, in 2023, Ethereum’s power use of 0.0026 TWh was dwarfed by energy-intensive industries such as data centers (200 TWh/yr) and gold mining (131 TWh/yr). Ethereum’s PoS system even consumed less energy than gaming in the US (34 TWh/yr) and popular services like Netflix (0.451 TWh/yr) and PayPal (0.26 TWh/yr).

Ethereum’s transition to PoS and the resulting decrease to a carbon footprint of 870 tonnes of CO2e annually demonstrate its commitment to sustainability. This pivotal move signals the potential for cryptocurrencies to adopt environmentally friendlier practices.

However, the transition to PoS isn’t without complications. Ethereum Classic and EthereumPoW, which use the PoW system, continue to utilize energy-demanding ASIC devices and GPUs. The blockchain’s replication and data redundancy also generate higher energy costs compared to centralized alternatives, signaling the need for additional improvements.

Bitcoin’s environmental challenge

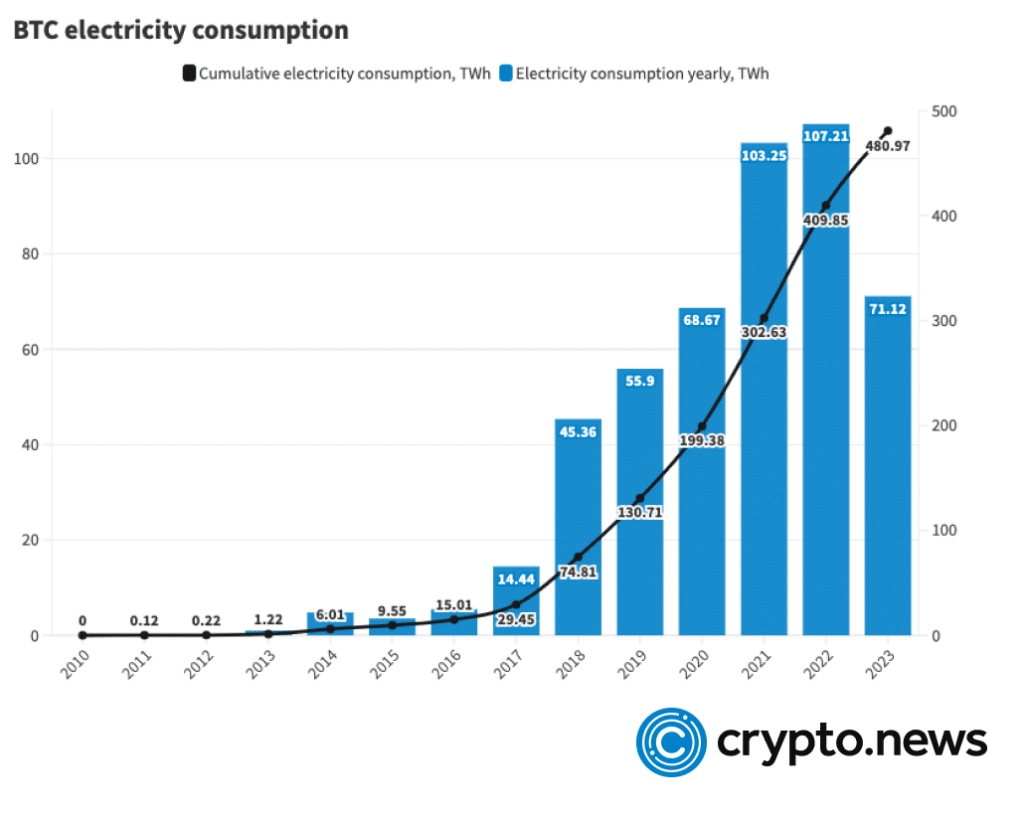

Bitcoin, the pioneering cryptocurrency, is grappling with significant environmental challenges due to its vast annual electricity consumption of around 139.39 TWh, comparable to the power demands of entire countries. Bitcoin’s PoW system, responsible for its high energy use, contributed to a carbon footprint exceeding 65 million tonnes of CO2 in 2021.

Bitcoin transactions are validated by users who mine bitcoins through the energy-consuming PoW process. The winning miner, who solves complex cryptographic puzzles, receives new Bitcoins as a reward. This process, primarily powered by fossil fuels, releases significant amounts of greenhouse gases, exacerbating global warming. As research published in 2022 revealed,

“Bitcoin mining may be responsible for 65.4 megatonnes of CO2 per year, which is comparable to country-level emissions in Greece (56.6 megatonnes in 2019).”

TRON’s energy footprint

Like other cryptocurrencies, TRON, which uses a PoS system, has its own environmental considerations. TRON’s energy use and carbon emissions are under-researched areas that warrant further study.

However, preliminary assessments from the Crypto Carbon Ratings Institute report provide some insights.

As per the institute’s report, the TRON PoS blockchain network hosts 367 nodes and processes approximately 22.317 billion transactions annually. It’s estimated that TRON’s total electricity consumption amounts to 162,867.85 kWh per year, contributing to total carbon emissions of approximately 69.47 tonnes of CO2e yearly. These calculations are based on data measured as of July 2022.

To put TRON’s energy consumption into perspective, the report provides some familiar comparisons. According to the U.S. Energy Information Administration, the average American household consumes about 10,600 kWh of electricity annually. In contrast, the TRON network consumes approximately 15.4 times this amount.

Compared to Bitcoin, which operates on the energy-demanding proof-of-work (PoW) consensus mechanism, TRON’s energy use is significantly lower, consuming less than 0.001% of Bitcoin’s annual electricity consumption of 83.87 TWh (as of July 1, 2022).

Dogecoin and its environmental impact

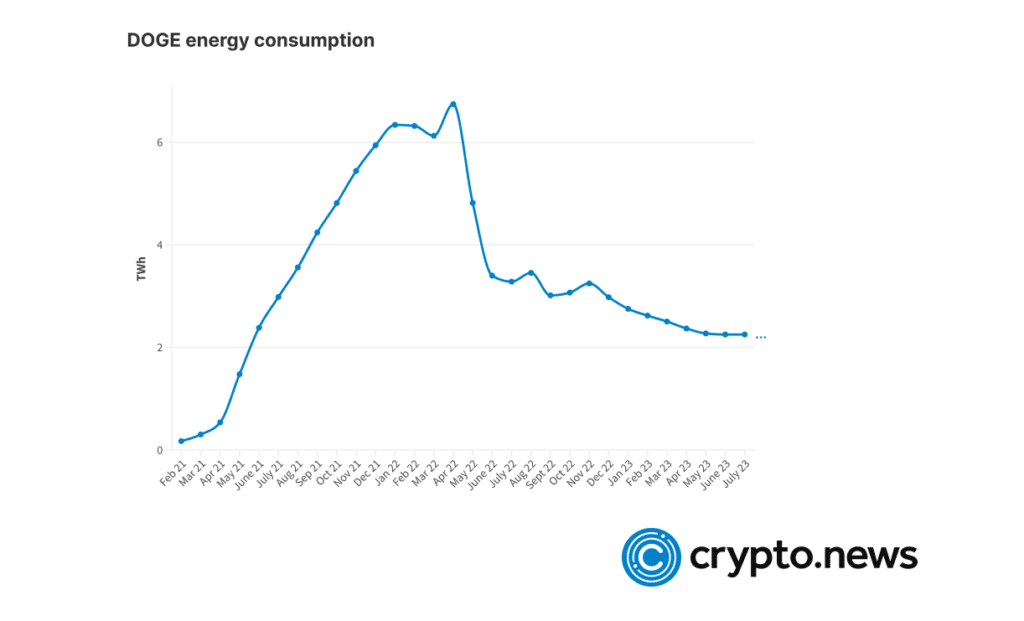

Dogecoin, similar to Bitcoin, operates on the energy-intensive PoW mechanism. As of July 2023, it consumes an estimated 2.25 TWh annually, comparable to the energy use of a country like Gabon, and its carbon footprint is on par with the emissions of the nation of Eswatini.

The challenge of electronic waste

In addition to carbon emissions, cryptocurrencies contribute significantly to electronic waste (e-waste), discarded electronic devices that pose environmental risks. Cryptocurrency mining necessitates powerful computing devices, which are frequently replaced as technology advances, leading to the disposal of older, ineffective models.

Cryptocurrency miners commonly upgrade their hardware to maintain profitability, leading to an ongoing cycle of electronic waste. Large-scale mining operations worsen the problem by disposing of outdated equipment en masse. This issue calls for responsible mining practices and effective recycling measures to combat the e-waste problem.

Solving the e-waste puzzle

Addressing the e-waste challenge requires a proactive approach from the cryptocurrency community and industry stakeholders. Embracing responsible mining practices involves several key steps:

The growing electronic waste (e-waste) issue linked to cryptocurrency mining calls for decisive actions from industry stakeholders. Here are a few steps that can help:

Efficiency and durability: Miners could focus on hardware that’s not only energy-efficient but also lasts longer. Fewer replacements mean less waste, promoting sustainability.

Recycle and repurpose: Instead of throwing away obsolete hardware, miners can recycle or repurpose them. This helps to extract valuable materials, reducing the demand for new raw materials and easing the environmental impact.

E-waste management: Cryptocurrency operations could adopt e-waste management programs, ensuring the right handling and recycling of old devices. This could be done through partnerships with reputable e-waste recycling organizations.

Supporting green projects: Backing cryptocurrencies associated with eco-friendly initiatives can steer the industry towards sustainability. It aligns financial interests with environmental responsibility.

Is green the way forward?

Despite challenges, some cryptocurrencies are trying to make a difference: the so-called “green” cryptocurrencies. These digital assets use energy-efficient methods, put computing power to good use, and promote sustainability, all while furthering blockchain technology. This different approach aims to flip the script on energy-intensive mining.

For instance, FoldingCoin (FLDC) rewards participants for contributing their computational power to Folding@home (FAH), a project that simulates protein folding to understand diseases like cancer, Alzheimer’s, and viral infections.

Primecoin, another green cryptocurrency, finds prime number chains during its mining process, contributing to scientific and mathematical efforts, while also serving as an energy-efficient alternative to traditional cryptocurrencies.

The legal roadmap

As the cryptocurrency industry evolves, sustainability is now a key concern. While the path to eco-friendliness isn’t straightforward, the transformation of Ethereum from a proof-of-work to a proof-of-stake system shows that change is achievable. Further, collaborations between the crypto community, regulators, and other stakeholders can harmonize technology with environmental responsibility.

The proposed Crypto-Asset Environmental Transparency Act of 2022 is one such initiative. It seeks to compel crypto-mining operations using over 5 megawatts of power to report their carbon dioxide emissions, increasing transparency and understanding of crypto-mining’s environmental impact.

The Act also proposes an interagency study to assess the environmental impacts of crypto mining in the US, including the number of mining operations, the effects of energy demand on emissions, local impacts on noise and water pollution from mining facilities, and the negotiation of demand response programs between mining centers and utilities.

The story of cryptocurrencies and their environmental effects is still being written. As it progresses, the pursuit of sustainability continues to shine as a guiding light, leading the way toward a more environmentally friendly and responsible future.