Defi trends of 2023: emerging developments in decentralized finance

Discover the latest 2023 defi trends. Explore breakthroughs and developments that shaped the landscape of decentralized finance this year.

Decentralized finance, more commonly called defi, has gained prominence in crypto in the last few years. It came from a need to change the way traditional financial systems worked, making them more open, unrestricted, and inclusive.

Throughout 2023, despite a few hiccups, defi made several strides, introducing decentralized fintech solutions across numerous financial services.

The demand surge is such that analysts project the worldwide defi market will hit $239.19 billion by 2030, a significant leap from $13.61 billion in 2022.

Let us take a closer look at the trends in defi that shaped the sector in 2023.

Major defi trends in 2023

Rise of layer-2 solutions

Among the many trends in defi in 2023, one of the biggest was the growth of layer-2 (L2) sidechains and rollups.

These protocols were developed to solve the high transaction fees and sluggish processing times experienced on the Ethereum (ETH) network.

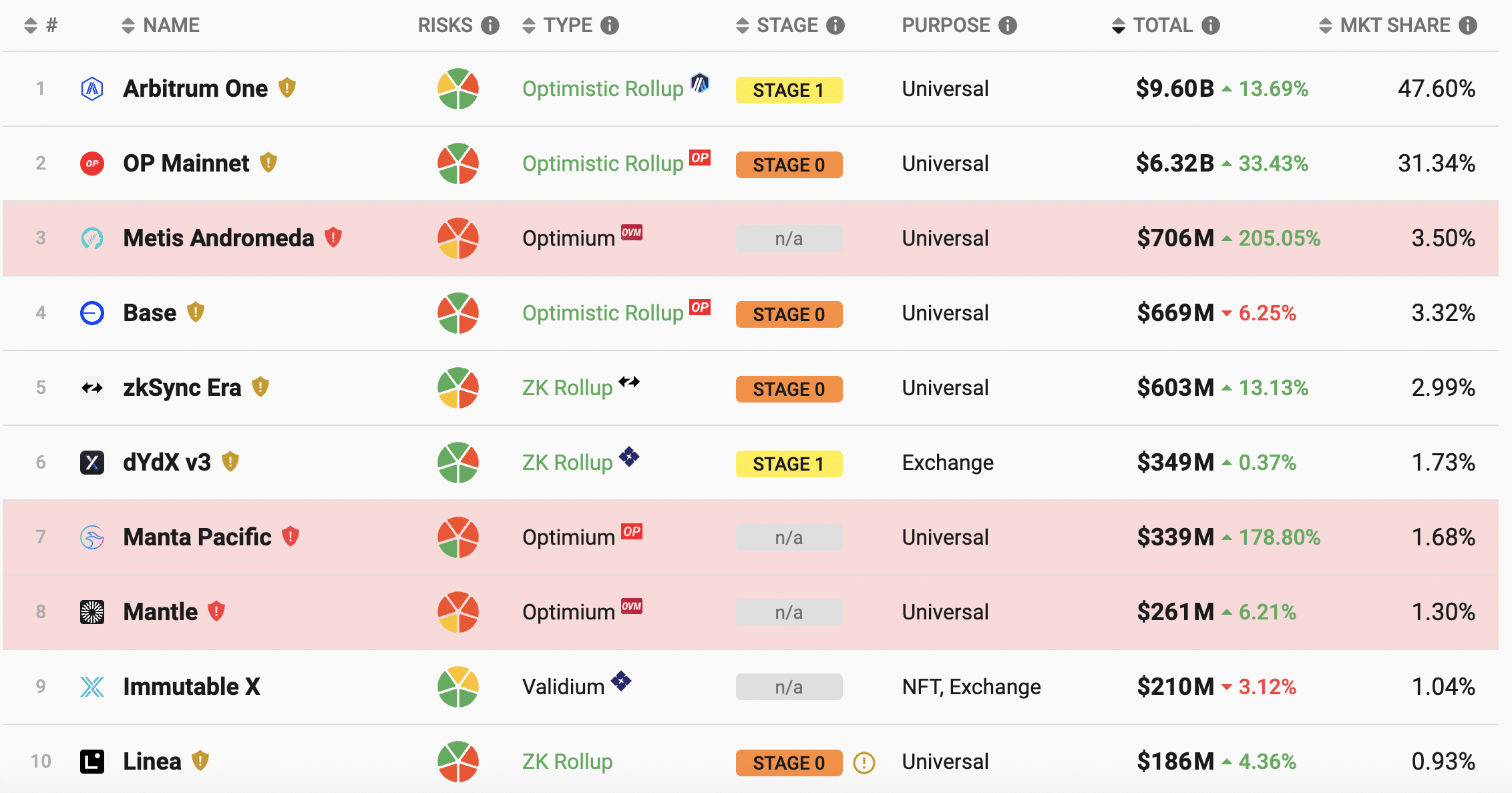

They work by undertaking transaction execution and sequencing while Ethereum ensures consensus and data availability, reaching a major milestone in November 2023, when the total value locked (TVL) within their contracts surpassed the $15 billion mark.

The sector includes networks such as Arbitrum One (ARB), Optimism (OP), Base, and Polygon zkEVM.

Before June 15, the combined L2 TVL was below $10 billion, per data from blockchain analytics platform L2BEAT. However, by the end of October, nearly 20 weeks later, these networks approached a new peak of around $12 billion, with growth continuing into November.

One of the triggers for the TVL surge was Optimism’s introduction of the OP token. Currently, though, Arbitrum tops the chart in terms of TVL.

Apart from their attractiveness to users trying to avoid the high gas fees and slow confirmation times experienced on Ethereum, especially during the recent bull run, L2 networks rose in popularity by executing successful marketing strategies.

However, their seeming success has not been without criticism. Some key players in the sector, including Shardeum’s Chief Growth Officer, Kelsey McGuire, have voiced concern in a conversation with Cointelegraph over the trade-off in decentralization.

According to McGuire, there could be potential issues with centralized sequencer nodes at the execution layer, which could make L2 networks susceptible to censorship or government interference, rendering moot the principle of decentralization and trustlessness fundamental to blockchain.

Even though ETH transaction costs have reduced somewhat, they still typically hover around a few dollars for most defi operations, a significant amount compared to the mere cents charged by L2s.

Going forward, analysts have suggested that due to Ethereum’s congestion and high gas fees, a trend could emerge where trading volume and TVL from ETH and other funds residing in EVM chains move to L2 networks in larger amounts, thus sustaining their growth into 2024 and beyond.

Integration of traditional finance (tradfi) with defi

Another defi trend that took root in 2023 was the drive to assimilate traditional finance more effectively with aspects of web3. It is now possible to transform tangible assets like corporate credit or mortgages into crypto tokens.

This migration of real-world assets (RWA) onto blockchain technology has allowed for unlocking vast liquidity and utility, which previously seemed impractical, if not downright impossible.

However, despite the progress made, tokenizing physical assets has not been entirely seamless. The primary reason is the robust legacy market for most RWAs, which, despite its complexity, is still regarded by users as reliable and well-established.

An exception could be carbon offsets, an emerging trend without a deeply rooted legacy system. Analysts believe that the real success story in the integration of tradfi and defi may lie in the development of decentralized infrastructure for bringing carbon offsets on-chain.

Further, defi lenders like Archblock, Credix, and MakerDAO are working separately, partnering with traditional financial institutions to provide loans secured with RWAs.

Such collaborations highlight one of the more practical applications of defi technologies, with industry watchers believing they hold immense potential from now on, especially since they combine defi’s speed, transparency, and low-cost advantages with tradfi’s compliance proficiency, superior risk management, and more established asset management.

Regulatory developments and their impact

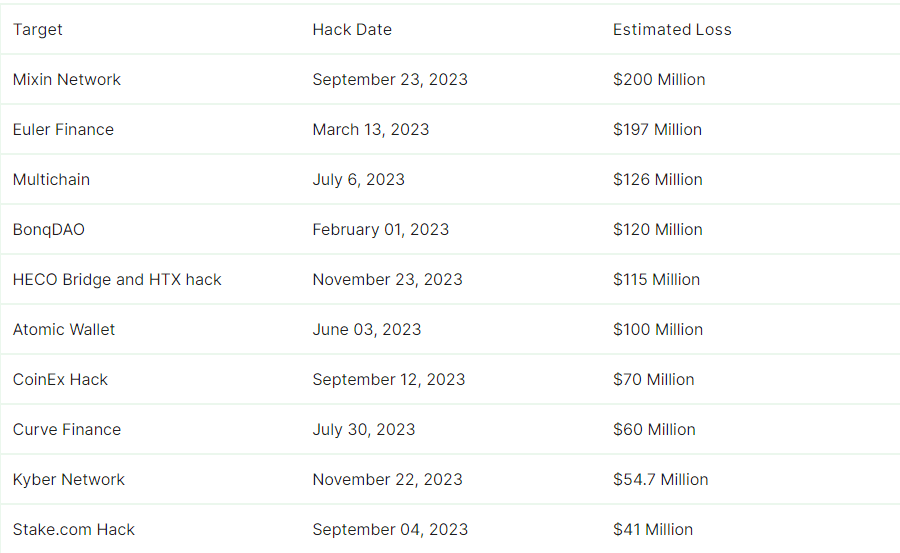

Despite its potential to revolutionize traditional finance, defi technology is not without risk. Recent data from cryptosec.info indicates that the sector lost an estimated $2.4 billion due to various exploits and hacks.

Naturally, such issues have sparked debate over defi and regulation. Some fear that regulatory intervention might compromise the core tenet of defi projects, their decentralization. However, others believe regulations are crucial for the industry to build trust with users.

2023 saw the motion for defi regulation get underway in earnest. For instance, the European Union (EU) introduced the European Markets in Crypto Assets Regulation (MiCA) in 2021, ratified and adopted in 2023.

The World Economic Forum has also created a policy-maker toolkit to guide lawmakers and regulators in various jurisdictions on the legal and regulatory aspects of crypto and defi projects.

As the industry expands, observers expect regulatory bodies worldwide to pay more attention and work towards balancing consumer protection and innovation promotion.

Going into 2024, we expect clearer guidelines from global regulators, including the Financial Stability Board (FSB), the G20, and national regulators. This clarity will likely encompass digital asset classification, taxation, anti-money laundering (AML), and know-your-customer (KYC) requirements.

In 2023, the regulation of specific token types, including security tokens and stablecoins, came to the fore, with regulators and the courts making pronouncements on the issue.

The International Organization of Securities Commissions (IOSCO) recently highlighted the lack of standardized data on ongoing and new defi projects and the obfuscation tactics used by market participants as hindering effective sector regulation.

IOSCO proposed a framework it hopes will be finalized by the end of the year that ensures the protection of investors, the management of risks, and the enforcement of laws related to defi and crypto across the 130 jurisdictions that are members.

Monetizing web3 gaming

This year also witnessed the growing integration of NFTs into in-game purchases. With the anticipation of the expected expansion of another web3 component, the metaverse, the focus has shifted towards creating transferable digital assets across games.

There are currently more than 1 billion users engaged in the buying, selling, and trading of in-game assets. With the advent of the metaverse, analysts project the number to reach 5 billion and the sector to have a value of approximately $13 trillion by 2030.

Observers have posited that traditional monetization methods such as pay-to-play, in-game purchases, and advertising have created an imbalance between gamers and developers, often leading to player dissatisfaction.

However, the emergence of web3 game monetization holds promise for addressing these issues in four critical ways:

- Play-to-earn games: Web3 introduced play-to-earn (P2E) games, a game-changing trend that incentivizes player participation by earning them crypto or NFTs, disrupting the typical developer-centric monetization.

- Player ownership of in-game assets: In P2E games, players can own in-game assets represented as NFTs on the blockchain. It allows players to trade their assets within a game or across titles, increasing the items’ value and uniqueness and enabling real-world earnings from game achievements.

- Revenue sharing: Blockchain technology has allowed more transparent revenue distribution between developers, gamers, and stakeholders.

- Decentralized autonomous organizations (DAOs): A defi trend slowly taking root is the introduction of DAOs within games to empower communities, enabling them to make collective decisions regarding game development, distribution of rewards, and general governance.

Despite the positive impact the monetization trend could have on the blockchain gaming sector, it still faces several challenges, including scalability and ease of use.

Decentralized exchanges (DEXs) make a comeback

Decentralized exchanges, or DExs, once hosted a fair amount of the trading in the defi sector. So high was their popularity that in 2021, such platforms collectively achieved a trading volume of over $60 billion. However, as they continued to expand, DEXs faced the dual challenges of cost and time.

It eventually led to their market share being largely gazumped by bigger centralized exchanges (CEXs) such as Binance and Coinbase.

The tail end of 2022 saw several CEXs, including Sam Bankman-Fried’s FTX, close down and file for bankruptcy as the sector reeled from the effects of a prolonged bear market and unscrupulous practices by certain firms.

The closures caused concern among many defi users regarding these platforms’ transparency and control, or lack thereof, leading to fears of potential losses.

It sparked a resurgence in the popularity of DEXs, which many saw as alternatives to CEXs, despite their reputation for being more complex and demanding greater responsibility from users.

Their comeback has been propelled by automated market makers, a tool reportedly used by more than 90% of all DEXs, according to a past Consensys report.

2023 also saw the continued growth of liquidity mechanisms introduced by several DExs in 2022, including GMX’s GLP token and Gains Network’s DAI vaults, which serve as counterparty liquidity.

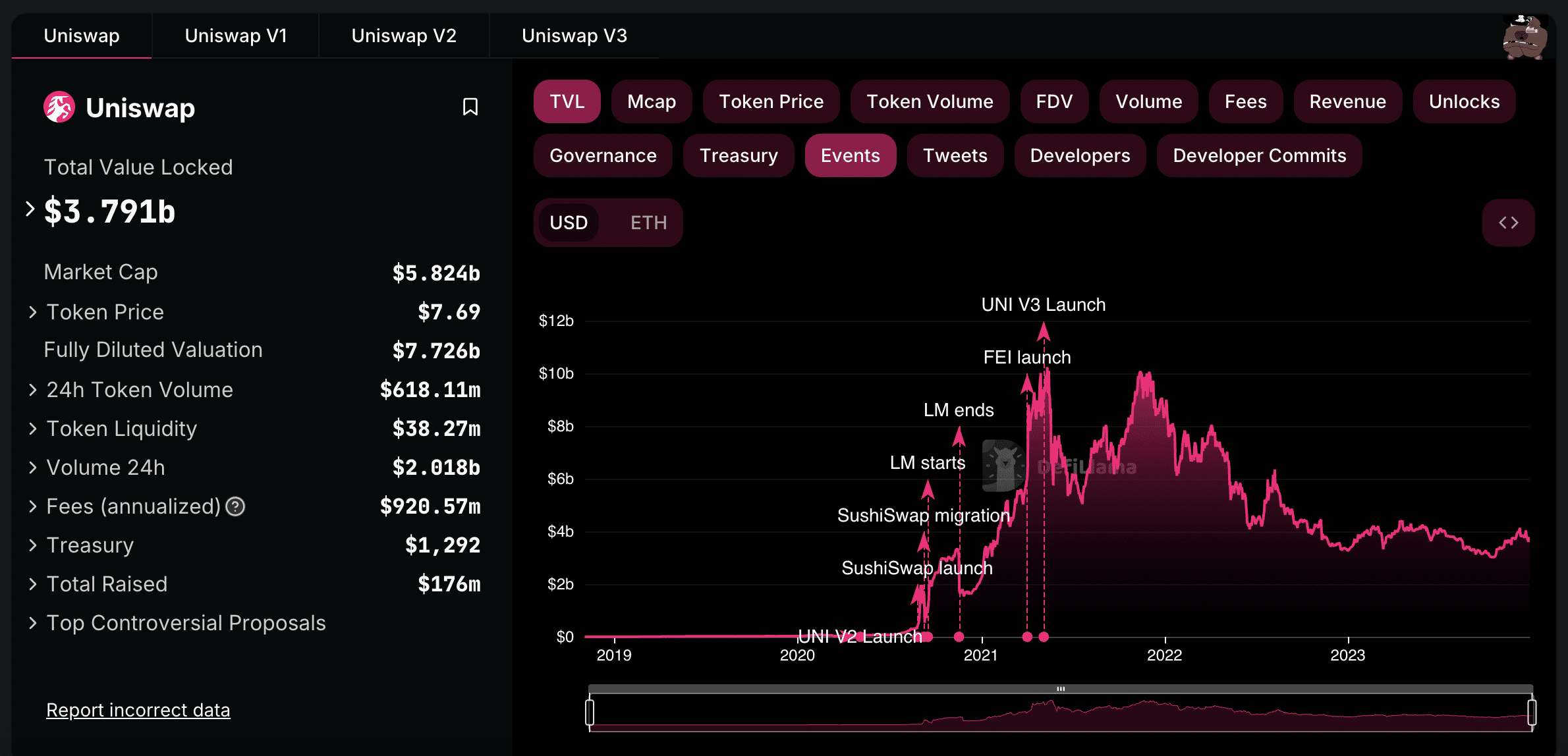

Among the DExs, Uniswap is currently boasting a TVL just north of $4 billion per data from DefiLlama.

Hacks and security breaches

Same as in previous years, 2023 was also marked by an alarming trend of cyber attacks on defi projects. Euler Finance, a pioneer in the defi sector, suffered a $197 million flash loan attack. Luckily for some of the victims of the attack, the hacker, who called himself “Jacob,” returned part of the stolen funds.

Other major attacks on defi platforms in the last 12 months include the following:

- Mixin Network: The platform got hit for $200 million in a cyber attack that specifically targeted its cloud service provider’s database. The attack caused Mixin to suspend deposits and withdrawals.

- Multichain: The cross-chain bridge protocol lost over $125 million, becoming a prime target for hackers due to its experimental nature and centralized asset repositories. The incident raised suspicion of an inside job, leading to substantial losses from bridges like Fantom (FTM), Dogecoin (DOGE), and Moon River, which affected several assets, including wETH, wBTC, USDC, Dogecoin, and Tether (USDT).

- BonqDAO: The decentralized autonomous organization lost $120 million due to a smart contract exploit triggered by an oracle vulnerability. The attacker manipulated AllianceBlock (ALBT) token prices by tampering with an oracle in a smart contract, leading to the creation of large amounts of Bonq Euro (BEUR). They then traded the stolen BEUR on Uniswap, causing a sharp price drop and initiating ALBT trove liquidations. The loss included $108 million from 98.65 million BEUR tokens and $11 million from 113.8 million wALBT tokens.

- HTX and HECO: The two crypto platforms associated with Justin Sun were the targets of separate hacks on Nov. 23, resulting in the loss of approximately $115 million. HTX, formerly Huobi, lost around $30 million, while HECO Chain lost an estimated $85.4 million, primarily in USDT and ETH. HTX’s native cryptocurrency, HBTC, was also significantly impacted. The company has pledged to compensate for the losses arising from the attack fully.

Defi and the broader crypto market

The resurgence in ETH prices, marked by a 13% gain in the last 30 days, has been accompanied by a significant shift in investor interest toward the defi market.

Data from CoinGecko indicates that the total market cap of defi tokens currently stands at around $72 billion, up from about $51 billion on Nov. 5, which suggests an additional $21 billion investment in various defi tokens within the Ethereum smart contract environment.

The commensurate rise in ETH’s value attracted investor attention and stimulated activity around multiple defi projects built on the network.

Several defi tokens registered double-figure spikes in tandem with ETH’s resurgence in the last few days. According to analysts making defi predictions, these surges typically indicate increased capital inflow towards defi assets traded on such platforms.

Historically, high ETH prices would lead to a rise in gas fees, discouraging transactions with ETH-based defi tokens due to network congestion. However, the emergence of L2 scaling solutions has helped alleviate congestion on the network.

Consequently, with lower risks of high fees and network congestion, the defi prediction market has such tokens pegged to continue their growth trajectory.

Looking at 2024

Like the rest of crypto, defi is still in flux. Industry watchers anticipate the trends observed in 2023 will be crucial in shaping defi events in 2024 and beyond.

Collectively, the trends are expected to prompt consistent growth and maturity. However, security and regulatory issues persist, and users hope that the new year will usher in regulatory clarity and improved protection for assets under decentralized finance protocols.