Ether (ETH) Sharks and Whales Follow “Buy the Dip” Strategy, Data Shows

While the panic selling in the crypto market persists, Ethereum’s sharks and whales (holding 100 – 100,000 ETH) continue to actively accumulate the major altcoin in the anticipation of the crypto market’s reversal in the following weeks.

ETH Sharks’ and Whales’ Strategy

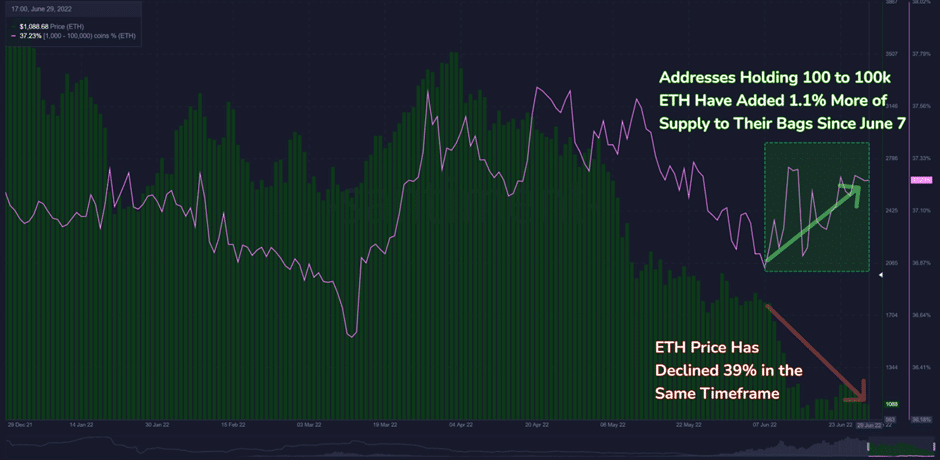

According to the blockchain analytics company Santiment, the ETH price declined by about 39% from June, 7th, thus, testing the major support levels. Most short-term and even some long-term holders demonstrate the signs of capitulations both due to financial losses suffered due to the crypto recession and panic expectations of a further market collapse.

In contrast, ETH sharks and whales demonstrate the string conviction in Ethereum’s strategic success and ability to appreciate further after the complete transition to the proof-of-stake consensus mechanism. Thus, these categories of ETH holders added about 1.1% to their previous holdings.

In this manner, they effectively reduce the average price of ETH accumulated, thus creating a basis for maximizing their future revenues in case Ethereum continues to appreciate in the long term. Such an investment strategy constitutes the optimal representation of the “buy the dip” approach. Based on the fundamental factors, such as the realized price, developmental activity, transition to Ethereum 2.0, and the phase of the crypto market; these investors can determine that the current market price of the major altcoin is seriously undervalued. By purchasing oversold assets, they maximize the likelihood of increasing their long-term returns.

Viability of Such a Strategy

According to the statistics provided by Santiment, sharks and whales appear to be highly successful in predicting the major price movements and opportunities for reducing the average price of their holdings. The reason is that they combine the application of technical and fundamental analysis, thus, objectively evaluating the major opportunities and risks. Moreover, they can rely on their earlier experience that may be applicable to various present-day challenges. The market mechanism also ensures that holders with a higher amount of ETH tokens are typically the most effective in managing their investments.

One of the potential practical implications of such a situation is the high likelihood of a negative trend reversal in the following weeks. The historical data illustrate that the crypto market tends to demonstrate the signs of restoration after the more aggressive accumulation by whales and sharks. On the one hand, they objectively assess the major factors that may lead to the change in the balance between the supply of and demand for ETH tokens. On the other hand, their market power may be sufficient for stimulating the price and providing it with the initial impulse. Then, it may be followed by other market participants, willing to follow the newly formed trend, thus resulting in Ethereum’s appreciation.

The transition to Ethereum 2.0 also makes the realization of such a scenario probable. At the same time, the identified trends do not necessarily mean that such changes will occur in the following days. Some market adjustments may require more time, and the presence of financial problems in DeFi lending platforms increases the risks of additional capitulations in the near future. Therefore, it appears that the reliance on “buying the dip” strategy may be applicable only to long-term investors who are not highly concerned with the risks of short-term price fluctuations and potential losses.

ETH Price Implications

In terms of the short-term price analysis, technical analysis may be helpful for identifying the major support and resistance levels that may affect the appreciation or depreciation of ETH in the following weeks. Despite high volatility, some price levels appear to be historically significant, and they may be used for determining the key areas of price dynamics in the following weeks.

ETH has successfully deviated from the downward price channel, and a strong support level of around $800 has been formed. However, the complete price reversal may become possible only after the following major resistance levels are overcome: at the price of $1,250 and $2,100 respectively. The former is the major level in the short term because it prevents Ethereum’s appreciation during the past few weeks. The latter is the major level in the medium term as it may prevent the restoration of Ethereum’s price in the following months. If whales and sharks are successful in exceeding both of these levels, their impact can be long-lasting.