Ethereum MEV bots make $1m profit amid sandwich attacks

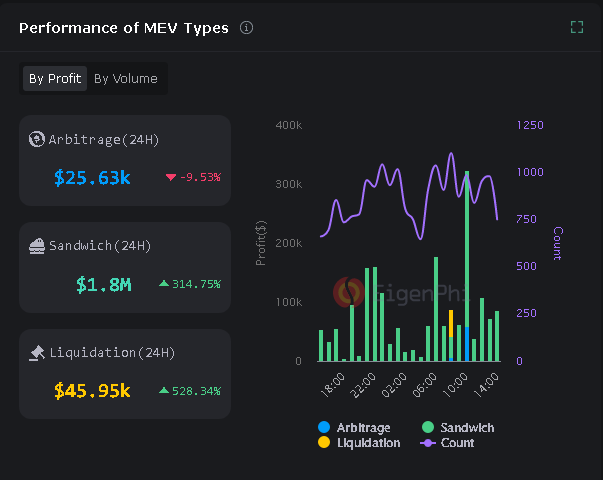

Ethereum MEV bots have captured more than $1 million in profits from 11,640 transactions executed in a single day, according to data from eigenphi.io.

MEV is the highest amount that can be recovered from block production above and beyond the usual block reward and gas fees by including, omitting, and rearranging transactions in a block.

MEV bots can use various strategies, such as front-running, back-running, arbitrage, and liquidation, to profit from the information and influence they have over the transaction ordering.

One of the most common and lucrative MEV strategies is the sandwich attack, which involves placing a transaction before and after a victim’s trade in the same block, manipulating the price of an asset in favor of the attacker.

Per data from the token flow-oriented data platform eigenphi.io, sandwich attacks accounted for $940,000 of the total MEV profits on April 19.

The most successful MEV bot on the day was controlled by jaredfromsubway.eth, a pseudonymous entity that has been dominating the MEV leaderboard for the last few days.

The bot captured a profit of over $710,000 on April 19 after capturing $950,000 the previous day to rack up a cumulative profit exceeding $2.3 million.

MEV bots skewering Ethereum network

The rise of MEV bots has raised concerns about the security and fairness of Ethereum, as they can potentially harm users by increasing gas fees, front-running transactions, and causing network congestion.

Several initiatives have been proposed to mitigate or redistribute MEV, such as Flashbots, MEV-Boost, and Fair Ordering Services.

Flashbots is a research and development organization that aims to democratize MEV extraction and reduce its negative externalities.

MEV-Boost implements proposer-builder separation (PBS) for PoS Ethereum, allowing validators to access blocks from a marketplace of builders who produce blocks containing transaction order flow and a fee for the block proposing validator.

On the other hand, fair ordering services are protocols that provide a fair and transparent way of ordering transactions on ethereum, such as the Eden Network and Archer DAO.

However, MEV is likely to remain a persistent phenomenon on Ethereum and other blockchains, as it is inherent to the nature of decentralized systems.

Many feel that as long as there are arbitrage opportunities and market inefficiencies, actors will seek to exploit them for profit.