FOMC, BRICS de-dollarization, and the future of crypto

With the BRICS nation exploring de-dollarization to minimize the impact of FOMC policies on the global market, does crypto have a role to play?

The Federal Open Market Committee (FOMC) has become synonymous with interest rate hikes and subsequent market upheavals. Its notoriety stems from a decision made in 2022 to curb runaway inflation by drastically increasing federal funds rates in quick succession.

The committee’s power to set interest rates was granted by the Banking Acts of 1933 and 1935 in the aftermath of the Great Depression.

Its role was further clarified by the Federal Reserve Reform Act of 1977, which directed the Federal Reserve to focus its policies on achieving maximum sustainable employment and overall price stability.

In 1994, following years of low inflation and modest fluctuations in economic activity, the FOMC began issuing statements at the end of each of its meetings. Then, in 2011, it became customary for the Fed chair to host a press conference following FOMC meetings to share insights into the discussions and resolutions from the meeting.

Impact of FOMC announcements on financial markets

Financial market participants, whether traditional or crypto, often take a keen interest in these FOMC press conferences, given the impact they tend to have on the U.S. dollar (USD) as well as commodities like gold, oil, and even major cryptocurrencies like Bitcoin (BTC).

When the committee announces an interest rate hike, it often results in a reduction of the money supply, a contraction of the Federal Reserve’s balance sheet, and an increased cost for individual and corporate borrowing.

A recent S&P Global report suggested that this decrease in the money supply and the surge in prices imposed on businesses and individuals usually lead to a drop in the valuations of public companies, subsequently causing their stocks to dwindle.

For that reason, people tend to have less discretionary income to invest, prompting them to stop buying or even offload assets such as stocks and cryptocurrencies in favor of fixed-income investments like bonds.

This shift occurs as rising interest rates enhance the anticipated return on government bonds, causing investors to gravitate towards these seemingly more secure assets.

Effects of federal funds rate changes on crypto

In the last few years, as crypto became more mainstream, market watchers have observed that when interest rates increase, it creates a ripple effect in the digital asset market, leading to a reduction in crypto prices.

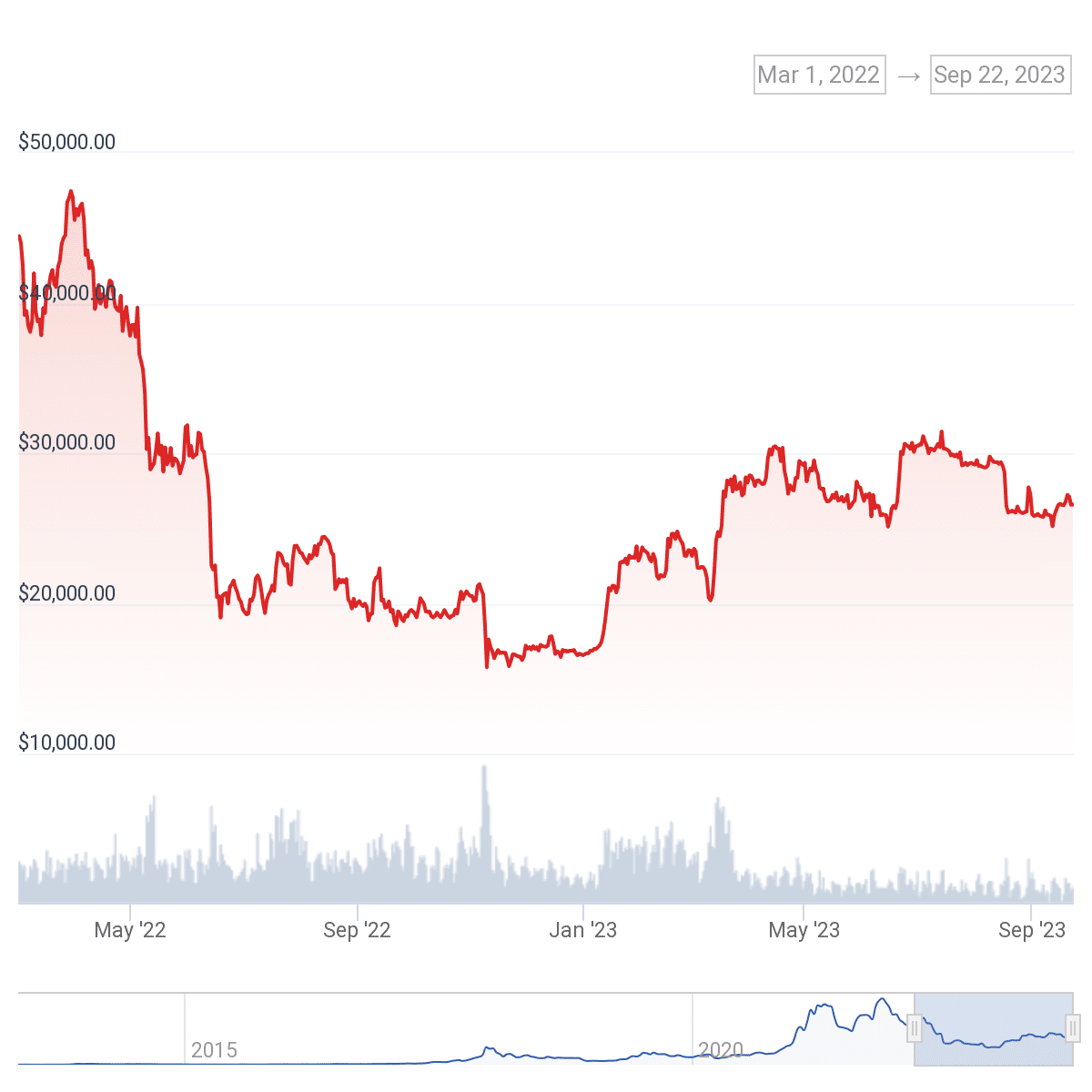

Since March 2022, the Federal Reserve has taken action on interest rates 12 times. Initially, the alterations were modest, with a hike of 25 basis points; however, persistently high inflation led the committee to become bolder, implementing four successive rate hikes of 75 basis points from June to November 2022.

The rapid adjustments had a crippling effect on both traditional stock and cryptocurrency markets since investors were forced to quickly pull their money from those markets as they were unprepared for such drastic changes. It resulted in considerable price falls for both crypto assets and regular stocks.

Crypto’s upward trend, off the back of a bullish 2021, was halted by the first 25 basis point hike and subsequently cooled off, but it didn’t completely crash.

It wasn’t until the FOMC hinted at substantial rate hikes in May, such as 50 or 75 basis points, that the crypto market experienced its first significant dip of the period, with Bitcoin dropping from the $30,000 band to the lower $20,000s.

However, between July and September 2022, investors were already accounting for consecutive 75 basis point hikes, thereby limiting any drastic negative price reactions. According to data from the crypto price tracking website CoinGecko, the price of Bitcoin is currently nearly 40% higher than it was around this time last year when the crypto market was in the throes of a third consecutive 75 basis point hike.

While the drops and rises in crypto prices were not solely down to FOMC pronouncements, there was a strong correlation between federal funds rate increases and crypto price decreases, especially in 2022.

However, it’s crucial to emphasize that a number of factors, such as the general economic situation, geopolitical events, and market sentiment, also affected how the Federal Reserve interest rate increases actually affected the cryptocurrency market.

Given how the committee’s decisions impact the mainstream and crypto markets and the USD, which represents almost 60% of worldwide foreign exchange reserves, it raises the question: can the BRICS nations, led by Russia, mitigate the influence of U.S. fiscal policies on global markets?

The quest for de-dollarization

Recently, Brazilian President Luiz Inacio Lula da Silva called for the creation of a currency for trade and investment between members of a grouping of developed and emerging economies that includes Brazil, Russia, India, China, and South Africa (BRICS).

The desire for BRICS alliance members to rely on their own currencies instead of the U.S. dollar was made more urgent in the wake of its significant surge in 2022, propelled by the Fed’s interest hikes and the conflict in Ukraine.

Going into the group’s latest summit in South Africa, where President Da Silva spoke, observers had expected the subject of a USD alternative to dominate proceedings. Some even anticipated a concrete decision regarding the dollar-changing currency would be made, especially given that the alliance was set to welcome several new members for the first time in 13 years.

However, most of the leaders seemed to sing from different hymn books. While the Brazilian president was all for a common BRICS currency, Russia’s Vladimir Putin emphasized the need for countries to trade in local currencies to de-dollarize the world economy.

On its part, India, through its oil and gas minister Hardeep Singh Puri, admitted that overturning long-standing dollar-based payment systems would be difficult.

And while touting the international financial system reform, China, which holds the world’s largest foreign exchange reserve, valued at over $3.3 trillion, made no comment regarding the BRICS common currency.

The summit host, South Africa, dismissed the notion out of hand, insisting that no member had tabled the issue of a common currency.

“Setting up a common currency presupposes setting up a central bank, and that presupposes losing independence on monetary policies, and I don’t think any country is ready for that.”

Enoch Godongwana, South African Finance Minister

BRICS and alternative currencies

For BRICS, moving away from the dollar would require a multitude of exporters, importers, borrowers, lenders, and currency traders worldwide to choose to use alternative currencies.

However, data from the Bank for International Settlements (BIS) shows that the USD continues to rule global trade, with nearly 90% involvement in international forex transactions. Given such a deep-rooted hold, getting so many components of the global economy to move away from the dollar will not be easy.

Policy analysts have proposed several ideas regarding the monetary strategies BRICS might explore. These ideas ranged from adopting a collective currency pool comprising the currencies of the alliance nations to considering gold as a standard for a new currency or even venturing into the realm of cryptocurrencies.

Though distinct and complex, each option appears to be more long-term strategies than immediate solutions. Importantly, many have been met with skepticism by experts.

Speaking to Aljazeera on the sidelines of the BRICS meeting in Johannesburg, Professor Danny Bradlow of the University of Pretoria’s Centre for Advancement of Scholarship expressed doubt that returning to the gold standard would appeal to many. Additionally, he regarded cryptocurrencies as risky while expressing apprehension about the practicality of a separate BRICS currency.

Investment analyst Chris Weafer echoed Prof. Bradlow’s skepticism, labeling the notion of a BRICS currency as a “non-starter”.

According to these experts, the idea of a unified currency also opens up risks and constraints due to the varying dynamics of each member nation’s economy. For instance, China’s economic dominance would likely overshadow the other smaller economies within the group.

Furthermore, they suggested that instead of a new currency, the BRICS nations might encourage more trade in local currencies, a trend already observed in trade between Russia, China, and India.

However, trading in local currencies brings its own set of challenges, notably the issue of convertibility, with countries needing greater reserves of each other’s currencies for enhanced trade. India’s capital controls, for example, present a hurdle for the easy conversion of the rupee into another country’s currency.

It is here that some experts feel less volatile versions of cryptocurrency, like stablecoins and central bank digital currencies (CBDCs), may come in.

Can crypto be an alternative to the dollar?

An increasing number of individuals in countries experiencing high inflation are turning to cryptocurrencies and dollar-pegged stablecoins as an alternative form of savings.

Numerous fledgling companies also provide stablecoin savings and payment platforms in Latin America and Africa, often in nations with a clear shift away from the USD.

Stablecoins, backed by the dollar, have achieved market capitalizations in the hundreds of billions and support transaction volumes even larger than this. They appeal to ordinary people in these countries because they eliminate the need for a local bank account and only require internet access.

Many stablecoins also offer interest, have no minimum balance fees, and have low or even no transaction fees. Crucially, they enable individuals to escape oppressive monetary policies in developing countries and preserve their hard-earned wealth in a relatively stable dollar form.

A 2022 Federal Reserve discussion paper co-authored by Gordon Y. Liao and John Caramichael pointed out several advantages of stablecoins, including cheaper, safer, real-time, and more competitive payments compared to current consumer and business experiences.

The paper also suggested stablecoins could quickly reduce the cost for businesses to accept payments and facilitate governments in administering conditional cash transfer programs such as stimulus money distribution. It also claimed that such cryptocurrencies could help to include the unbanked or underbanked population segments financially.

Similarly, the advent of digital currencies is challenging the dominance of traditional currencies like the USD. In 2021, China introduced a CBDC, the digital yuan (e-CNY), sparking a conversation about the potential downfall of the dollar’s supremacy.

Economic analysts consider the digital yuan a fundamental piece of Beijing’s endeavor to devise an alternative to the dollar-centric world we live in.

Beyond the geopolitical implications, they suggest that the digital yuan could simplify and reduce the cost of cross-border payments, facilitating its global adoption.

Notably, Zimbabwe also introduced its own gold-backed digital currency on May 8, 2023.

On the other hand, emerging nations like El Salvador and the Central African Republic (at least for a while) have accepted Bitcoin as an official currency, with El Salvador even incorporating the cryptocurrency into its national reserves.

Some observers have suggested that if this trend continues, it could shift the power dynamics among global states.

Crypto market resilience in light of de-dollarization

The fate of the BRICS formation’s quest to muzzle the dollar and the Fed’s inadvertent impact on the global economy is still unknown. Additionally, whether crypto in the form of stablecoins or CBDCs plays a role in the alliance’s de-dollarization effort is mere conjecture at this point in time.

However, were de-dollarization actually to happen, would it affect crypto’s market resilience?

According to some experts, while the USD still has significant dominance as the world’s primary currency, de-dollarization could lead to less circulation of the dollar.

Were that to happen, it could potentially trigger a downturn in the traditional stock market, which, as previously shown, typically affects the crypto market.

Furthermore, Bitcoin’s correlation with gold seems to be getting stronger with time. In April 2023, the correlation hit a two-year high level of 57% per data from Kaiko, reinforcing Bitcoin’s potential as a store of value.

Some feel that while Bitcoin may not become the next global reserve currency, it could challenge gold as an alternative reserve asset. And if the situation persists, there are those who posit it could eventually push BTC to become the world’s dominant currency.

If Bitcoin, the most substantial and influential cryptocurrency, were to replace the USD’s global status, the cryptocurrency market would theoretically be less susceptible to fluctuations caused by the Federal Open Market Committee’s interest rate announcements.

However, the reality on the ground is vastly different. U.S. regulators, led by Gary Gensler’s Securities and Exchange Commission (SEC), have severely clamped down on crypto.

While there are currently several key crypto legislations set to be debated by U.S. lawmakers this fall that the industry feels could offer clear and correct guidelines, it still remains to be seen whether they will be passed and what potential impact they could have on the growth and development of crypto.

Nonetheless, if, by definition, de-dollarization involves replacing the dollar with other currencies, redirecting even a small portion of that liquidity towards cryptocurrencies, while not guaranteed, could inflate crypto prices in the long run.

The future of crypto investing

The increased prominence of cryptocurrencies on the global stage indicates a diversification in economic influences, particularly as traditional economic powerhouses grapple with economic volatility.

Russia and China are at different stages of developing digital versions of their national currencies. However, while their stated intention is to improve cross-border payments, challenge the dollar’s dominance, and, on Russia’s part, circumvent sanctions with the CBDCs, critics have pointed to the authoritarian states’ overarching need to control and monitor their citizens as a more plausible reason for their embrace of state-approved digital currencies.

In China, residents can establish e-CNY accounts using their mobile numbers, and they have the option to grow their balances and daily transaction limits by providing additional personal information, including their identification and banking details.

The country’s regulations may forbid telecom operators and internet service providers from collecting and using the personal details of e-CNY users, but authorities could access the data with “necessary legal documentation.” It has led some critics to express concern that the Chinese government could use the system to control and suppress individuals or groups.

Despite their motives, these nations, endowed with substantial economic and political clout, adopting cryptocurrencies on a broader scale could significantly alter the dynamics of the global crypto market.

Post-de-dollarization could herald both opportunities and challenges for the crypto industry. On one hand, the industry would be poised to benefit from the diversification of economic power and influence. As countries seek alternatives to the USD, cryptocurrencies could gain increased acceptance as a medium of exchange, store of value, or unit of account.

Their potential to fill this role could result in heightened demand, increased adoption rates, and, in the long run, price appreciation.

This shift could also result in a more resilient global crypto market that isn’t as heavily swayed by U.S. economic policies or the health of the U.S. economy.

Nevertheless, the potential shift won’t be without its challenges. De-dollarization could increase regulatory scrutiny as governments seek to control and regulate this burgeoning sector. It could create a more uncertain and challenging operating environment for crypto businesses, potentially stifling innovation and growth.

Furthermore, whether cryptocurrencies can effectively function as a mainstream medium of exchange remains untested on a large scale.