Gold vs bitcoin. Which is better and how are they related?

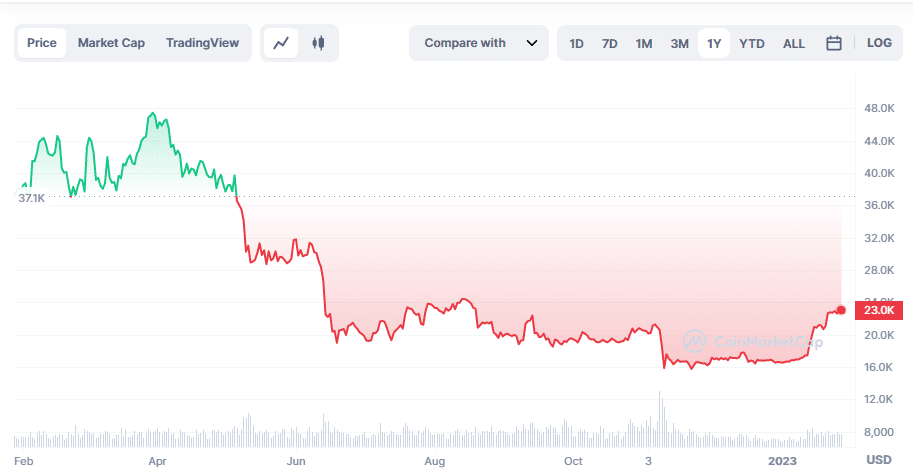

The heated argument on which gold and bitcoin is the better investment has been going on for a while. Since bitcoin has lost nearly 64% of its value in 2022, some investors might have lost support for cryptocurrencies.

Many bitcoin (BTC) skeptics say there is too much uncertainty and volatility surrounding the major cryptocurrency. Additionally, bitcoin needs to catch up to a number of the significant commitments meant to support its value proposition. For instance, the claim that it would protect against inflation or highly volatile markets.

Even if some of bitcoin’s flaws have undoubtedly been revealed this year, the following query is still pertinent: does gold represent a superior long-term investment to bitcoin?

Why invest in gold

Bitcoin is trading essentially like the shares of a high-risk, high-growth IT business. Based on the market-beating profits that firms may provide, they can make excellent investments during bull markets.

Investors, however, often go for less risky assets during bad calls, such as blue-chip stocks and gold. Based on this argument, gold is a safer investment option as long as concerns about inflation and the possibility of a recession continue to hang over the economy.

In addition, some may say that there are just no “non-speculative use cases” for bitcoin. In contrast, gold has valid applications that consistently increase demand for metal.

Why invest in bitcoin

The primary justification for bitcoin is that, historically, it has offered yearly returns much higher than any other asset. With annualized gains of 230.6% over the ten years from 2011 to 2021, bitcoin was the world’s best-performing asset. This was ten times better than the results of even the best high-growth tech stocks. And over its existence, bitcoin has given investors a return of more than 17,000%.

In contrast, traditionally, gold has produced meager annualized returns over more extended periods. The annualized return on gold from 2011 through 2021 was barely 1.5%.

Investors believed they were getting the best of both worlds with bitcoin until 2022 because it offered a secure place to keep assets and the possibility of fantastic yearly returns. However, bitcoin didn’t provide either last year. On the other hand, gold fulfilled its promise. In contrast to bitcoin’s fall in 2022, gold is essentially flat for the year (down roughly 1%).

Although bitcoin had never developed into the payments network that many anticipated when it first appeared in 2009, there are indications that it is increasingly a viable choice for online transactions, especially now that the asset is recovering from the previous bear market turbulence. This is partly because of creative work to add speedier payment layers (like the Lightning Network) on top of its blockchain’s foundation layer. The recent slight comeback seems to be good news for various bitcoin enthusiasts.

Cryptocurrencies like bitcoin will become more critical as the digital economy expands as a means of making payments. According to this viewpoint, physical gold could lose significance in the digital age.

However, both assets had a tough year based on different aspects. Below is how they performed in 2022.

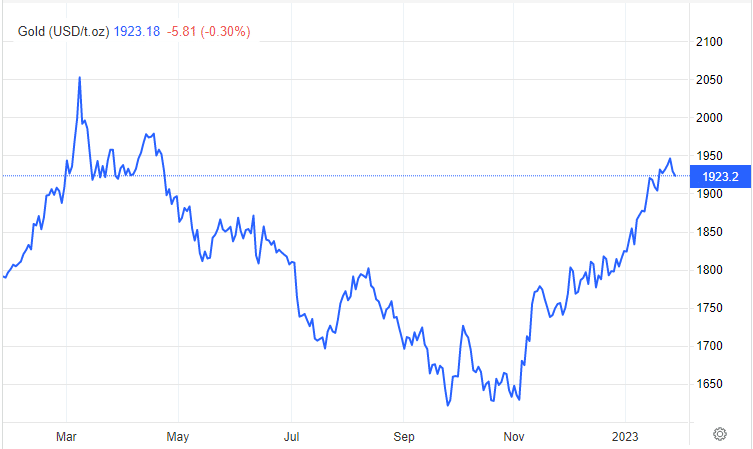

Gold price analysis

In 2022, as the yellow metal faced challenges from a strong US currency and the US Federal Reserve’s war on inflation, support came from its role as a haven and an inflation hedge.

Gold, which had declined by almost 1.6% by December 2022, could not hold onto gains gained in the first quarter when a price surge in response to Russia’s invasion of Ukraine brought the precious metal to a 19-month high of US$2,053 an ounce. The price jump in March represented a 13% increase from the beginning value in January, but it was short-lived as gold fell back to the US$1,939 level after Q1.

Gold fell to US$1,811 during the year’s second quarter, and market volatility caused the Dow Jones Industrial Average and the very tech-heavy NASDAQ Composite to enter the bear market territory.

Seasonal weakness and a rising US dollar in Q3 drove gold to a 30-month low of US$1,691 per ounce. Early in 2022, when economies worldwide were still recovering from the epidemic, Russia’s war on Ukraine sparked uncertainty, which helped gold throughout the first quarter of the year.

War in Ukraine significantly affected gold prices

There were two leading causes for the performance of gold in 2022. Of course, the first one is the war, during which several precious metals experienced substantial price increases — flight to safe havens, which predominated everything before dissipating.

After the initial shock, the gold price steadied, and long-term influences started to show. The macro background and diving down more profound, the actions and expectations of the Fed could be what came to the fore and are still the most crucial.

Contrary to popular belief, the war had a more significant influence on output than on the price of gold. Russia’s invasion of Ukraine and the ensuing sanctions have made it difficult for miners working in Russia to secure funding and equipment from western sources.

As gold fell below $1,800 in the year’s second half, US inflation hit a four-decade high of 9.1% in June. Some market players questioned the efficacy of gold as a hedge due to its weakness in the face of inflation. However, some specialists say the yellow metal is performing its job.

While rising opportunity costs influence gold, its value has been substantially maintained despite widespread inflation. The year-to-date peak in output coincided with a more than two-year low in gold’s price in Q3, a phenomenon Webb connected to seasonality.

Mine output increased to about 950 metric tons for the three months, up 2% from the previous year. Even though miners have profited from these favorable circumstances, inflation’s repercussions have been unavoidable.

Despite a sharp fall in investment demand, demand improved by 28% year over year in the September quarter. Even while purchases of bars and coins increased by 36%, exchange-traded funds (ETFs) struggled with larger withdrawals.

Bitcoin price analysis

The second major crypto winter began in 2022, with high-profile businesses crumbling everywhere and the value of cryptocurrencies decreasing significantly. The year’s events shocked many investors and made it more challenging to forecast the price of bitcoin.

The cryptocurrency market was flooded with analysts speculating fervently about where bitcoin might go next. They were frequently optimistic, although a handful predicted that bitcoin would go below $20,000 per coin.

But many market observers were surprised in what has been a turbulent year for cryptocurrencies, with high-profile firm and project failures sending shockwaves across the sector.

The red flag appeared back in May with the collapse of terra, also known as UST, an algorithmic stablecoin meant to be tied 1:1 to the US dollar. Due to its downfall, firms exposed to both cryptocurrencies were hurt, and luna, the sister coin of terraUSD.

Due to links to terraUSD, Three Arrows Capital, a hedge firm with solid views on cryptocurrencies, entered liquidation and filed for bankruptcy. Then, in November, one of the biggest cryptocurrency exchanges in the world, FTX, which Sam Bankman-Fried, a prominent businessman, headed, collapsed. The cryptocurrency sector is still feeling the effects of FTX.

Bitcoin forecast for 2023

In the early days of the upheaval after the failure of the exchange FTX, co-founder of Mobius Capital Partners Mark Mobius anticipates bitcoin will drop below $10,000 per coin. The fact that bitcoin is “extremely hazardous” prevented him from investing any of his clients’ or his funds in it, he said, even though “crypto is here to stay.”

Later, in an interview with CNBC, Mobius expanded on his prediction, attributing the predicted losses to rising interest rates and growing investor apprehensions about the cryptocurrency sector. He said that while he anticipates bitcoin’s price to remain around $17,000, it may drop below $10,000 in the next year.

Matthew Sigel, the director of research for digital assets at the brokerage VanEck, anticipates a similar price objective. In the first quarter of 2023, he believes that the price of bitcoin will drop to between $10,000 and $12,000 per coin. However, he thinks that by Q3 2023, BTC could reach $30,000.

Sigel attributes the fall on struggling cryptocurrency miners, writing last month that bitcoin mining is generally unprofitable given recent rising power bills and lower bitcoin prices. He believes that many miners will reorganize or combine.

Over the next year, some experts anticipate that the price of bitcoin might fall as low as $5,000, while others forecast a rise to $250,000. The experts at Ark Investment Management, led by renowned entrepreneur and investor Cathie Wood, stick by their forecast that the value of one bitcoin would surpass $1 million by 2030.

Gold’s 2023 forecast

Several factors point to a potential decline in the price of gold in 2023, including increased interest rates and geopolitical upheaval. This is the outcome of the Federal Reserve continuing to raise interest rates and low investment demand. The most recent commodity price projection published by the World Bank states that “since interest rate rises are anticipated to continue far into next year, gold prices are predicted to decline by 4% in 2023.”

Which is better, gold or bitcoin?

All depends on your investment strategy. The conservative investors would opt for gold, generally considered as a safe haven. The percentage of risky assets, such as bitcoin, in traditional portfolios does not surpass 10%. However, if you’re trading actively, BTC volatility might look attractive.

What affects bitcoin and gold price?

Both bitcoin and gold react to general market and political conditions, such as US interest rates, major fiat rates, local conflicts, pandemics, etc.