Huobi’s HT token saw 93% flash crash

The Huobi exchange’s native HT token flash crashed a few hours ago, losing more than 93% of its value. It quickly recovered from the incident, but its price is still 20% below pre-crash levels.

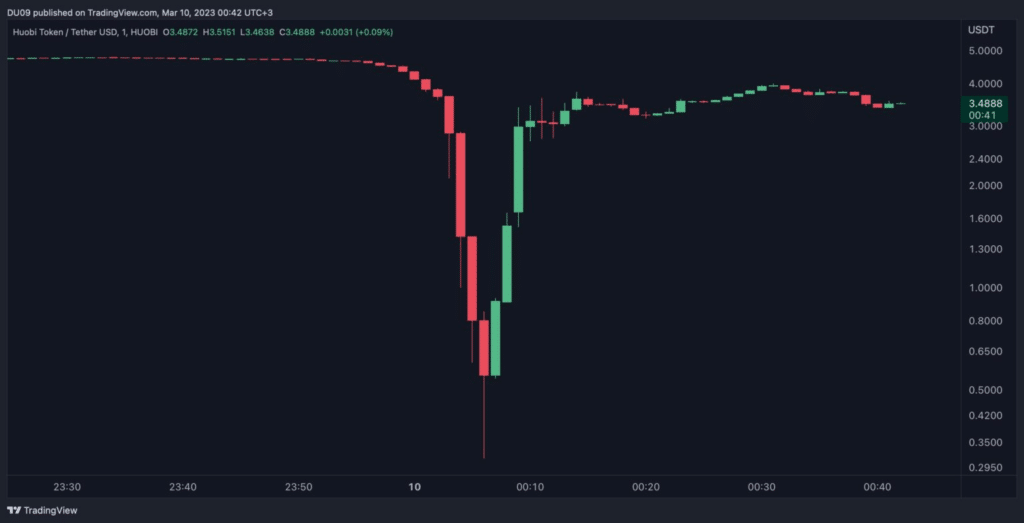

Data from the crypto price charting platform TradingView shows HT fell from a 24-hour high of $4.81 to a low of $0.31 in the early hours of March 10 on Huobi’s exchange.

Just before the crash, Riyad Carey, a researcher at financial data provider Kaiko, tweeted that there had been about $2 million in sales in the five minutes leading up to it.

This is significantly more than the typical $600,000 buy on the HT-USDT pair.

Despite a 21% drop in the last 24 hours, the token has recovered from a flash crash and is now trading at $3.81, per CoinMarketCap. However, its current price is still 20% below where it originally stood before the flash crash happened.

HT is used on the Huobi Global exchange to reduce trading commissions, purchase VIP status plans, vote on exchange decisions, and receive cryptocurrency rewards.

The sudden price volatility was noteworthy because the token is one of the more prominent cryptocurrencies, with a market capitalization currently of approximately $617 million.

Justin Sun blames flash crash on ‘few users‘

HT has also drawn investors’ interest because Justin Sun, the founder of the Tron blockchain, is a large holder and Huobi’s chief strategy advisor. Sun dismissed the flash crash right away.

In response to the outpouring of concern on crypto Twitter, he reassured users that the exchange and all funds were secure.

He further explained that the crash may have resulted from leveraged liquidations caused by a “few users”, triggering a chain reaction of forced liquidations in the spot and contract HT markets.

Sun added that Huobi would bear the full cost of user losses caused by HT’s market fluctuations. He also announced the establishment of a $100 million fund to improve multi-currency liquidity and promised to keep the crypto community updated on the flash crash incident.

Interestingly, blockchain data and research platform Nansen claims to have discovered some recent stablecoin movements attributed to Justin Sun.

According to Nansen, Sun withdrew $60 million in stablecoins from Huobi on March 9.

However, the platform quickly clarified that the movement was not necessarily suspicious. It could have been part of Sun’s fund deployment practices, especially since he deposited $100 million USDC to Huobi afterward.