Italian Bank Meltdown Strengthens Bitcoin’s Safe Haven Appeal

The Italian government has presented a crisis intervention or “bank rescue” for the world’s oldest surviving bank, Monte Paschi, which continues to scramble for cash to recapitalize. A proposed solution is to increase the public debt by as much as 20 billion euros, but this proposed amount does not even generate enough to keep the affected banks afloat.

The deficiency that remains is approximately how much lenders would need to increase “loan-loss provisions” to make room for the sale of bad debt; the gap is substantial according to Bloomberg data. To recapitalize, the Italian banks need around 52 billion euros and the rescue package needs to be more like 30 billion euros to relieve the debt crisis, according to Paola Sabbione, an analyst from Milan, from Deutsche Bank AG.

Additionally, this relies on the assumption that UniCredit and other lenders are actually able to raise 20 billion euros through asset sales and profit retention, which is still uncertain, leaving taxpayers to fill the void. Sabbione stated:

“Some of the publicly traded banks can probably raise some of the funds needed for a cleanup, including Monte Paschi… The government would have to plug in the rest. But still, at this level, it won’t do the full job.”

There are bound to be negative consequences for Italian taxpayers in the midst of this financial crisis and a heavier tax burden for future generations via higher public debt.

In stark contrast to the uncertainty offered by Italy and her banking sector, Bitcoin users enjoy the transparency of distributed ledgers, which require no third parties to receive or make payments. More importantly, no banks can be bailed out, as Bitcoin is a full reserve system, as opposed to fragile fractional reserve systems.

The government cannot impose debt on future generations with Bitcoin, only with fiat, so at times like this, with the world’s oldest surviving bank collapsing before our eyes, bitcoin’s appeal rapidly grows.

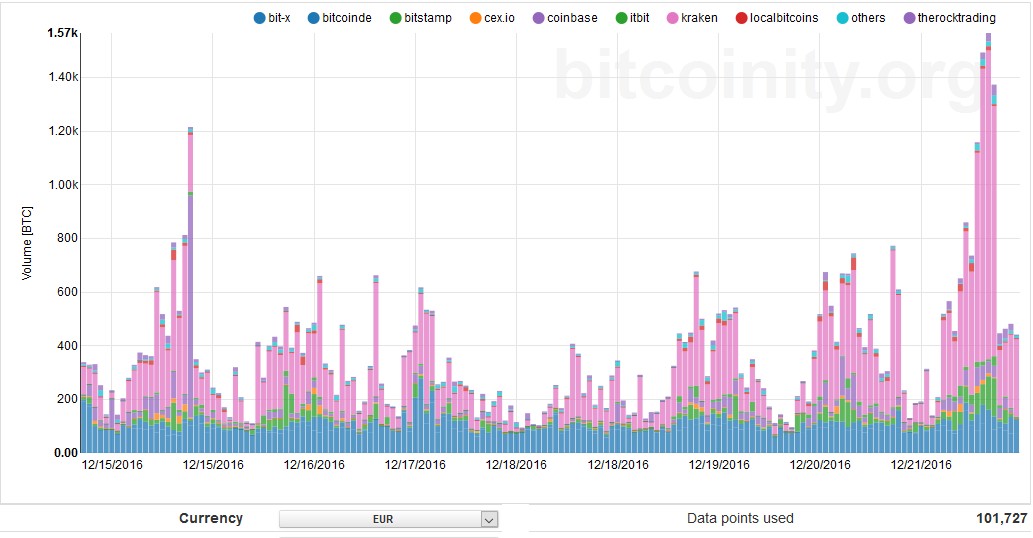

As the chart below shows, as the Bloomberg story on Italy’s Public Debt ceiling being lifted to rescue banks broke on December 19, European bitcoin exchanges witnessed a buying frenzy in the following days. There are also fears of further unsettling elections in Europe that could potentially threaten the euro and an intensification of the Eurozone crisis that has engulfed Greece.

Similar to how following an earthquake we experience aftershocks, the market for bitcoin has felt tremors from the news out of Italy, displayed above by the increasingly higher spikes in the data from December 19 onward.

Moreover, according to MarketWatch, on December 21 “U.S. and European buyers are accounting for the bulk of the trading volume,” so perhaps the break of the $800 level was helped by a run to bitcoin in response to Italy’s banking crisis.

The price of XBT-EUR on the Kraken exchange is 795.00 at the time of writing, up 2.51 percent on today’s open.

Contributions by Jamie Holmes