K33 Research finds institutional Bitcoin investment surge amid pending ETF decisions

A recent K33 Research report indicates a significant uptick in institutional investment in Bitcoin through exchange-traded products, coinciding with key deadlines for the SEC’s decision on Bitcoin spot ETFs, presenting a complex landscape of market optimism and caution.

In a recent analysis, K33 Research highlights a significant surge in institutional interest in Bitcoin (BTC), particularly through exchange-traded products (ETPs). This trend, marked by an increase of 27,095 BTC, surpasses the growth seen in the months following BlackRock’s filing for a Bitcoin spot ETF.

The report by K33 Research, led by Senior Analyst Vetle Lunde and Vice President Anders Helseth, points to a robust institutional demand for Bitcoin, evidenced by sustained high exposure on the CME (Chicago Mercantile Exchange). This trend coincides with impending deadlines for the approval of bitcoin spot ETFs by the U.S. Securities and Exchange Commission (SEC).

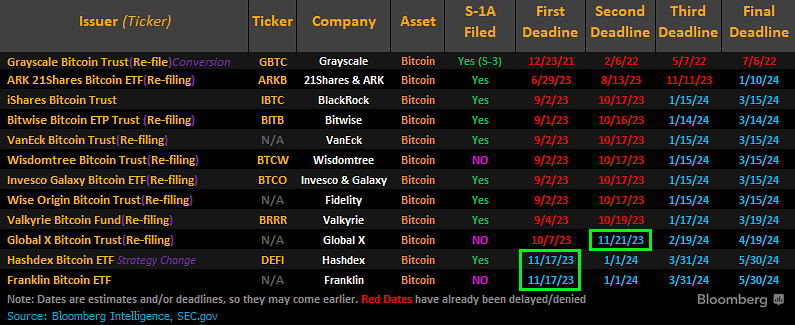

The spotlight is on two specific applications from Hashdex and Franklin, with a decision deadline set for Nov. 17. The analysts note that this window offers an opportunity for the SEC to approve all current applications concurrently, which would be a significant moment for the market. However, a failure to do so would shift focus to the next significant deadline on Jan. 10, potentially slowing market momentum.

While CME traders exhibit a bullish outlook, with Bitcoin futures premiums consistently high and open interest reaching new heights, making CME the world’s largest Bitcoin derivatives exchange, this sentiment is not universally shared. Crypto-native traders display a more cautious stance.

The report notes that the recent Bitcoin rally seems to be driven more by caution from short sellers than outright optimism. This cautious approach, alongside rising open interest, often precedes long liquidations.

Indeed, this caution was underscored by a significant liquidation event, the largest since August, where $89.5 million in long Bitcoin positions were liquidated across various exchanges. The event serves as a reminder of the volatility and risk inherent in cryptocurrency markets.