Can Merkle Mining Be the Next Step in Decentralized Token Distribution?

One of the critical characteristics that trump P2P networks like Bitcoin and Ethereum over traditional mechanisms of finance is their degree of decentralization. Having the authority to make decisions distributed equally among all the participating entities ensures an efficient and transparent mode of transactions, unlike centralized mechanisms where the power can be abused to wrong people en masse.

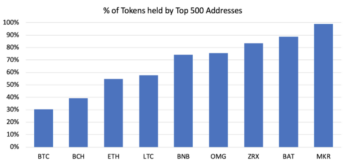

This property becomes all the more vital when studying a crypto ecosystem in isolation, and depends mainly on the distribution of tokens among the invested parties. Gini coefficient is one of the most used and accepted measures of calculating the concentration of wealth in a given scenario. It has a direct relationship with the concentration of wealth – higher the Gini coefficient, the higher the concentration of wealth with the select few, and vice versa.

Given the nascent state of the cryptocurrency ecosystem, the number of asset holders is also relatively small. As with every emerging industry, the few early movers capitalize on the lack of players and tend to hoard the offered commodity, which, in turn, results in a higher Gini coefficient. The crypto industry follows a similar behavior, as the Gini coefficients of the majority of the crypto assets lie to the north of the Gini coefficients of most fiat.

(Source: Etherscan.io)

(Source: Etherscan.io)

PoW vs PoS

Being the first cryptocurrency to exist has enabled bitcoin to be one of the major digital tokens with the lowest Gini coefficient. On further analysis, some reasons can be attributed to this.

Christened shortly after the 2008 global financial crisis, early entrants grabbed a huge amount of bitcoin at throwaway prices, and have been selling it slowly ever since.

However, a more prominent factor responsible for the diluted concentration of wealth in the bitcoin ecosystem is that it is mined using proof-of-work. One of the attributes of the PoW mining protocol is that it entails miners incurring fiat-denominated costs, subsequently forcing them to sell a portion of their earnings through mining to keep the business going. This keeps a balanced power among all the entities working on the blockchain.

Conversely, Ethereum, which follows proof-of-stake, doesn’t require miners to incur explicit fiat-denominated costs for their activities. This becomes all the more troublesome as it might prove to be unhealthy for the industry shortly by allowing for a higher Gini coefficient compared to the PoW protocol.

Today, the majority of the projects launched and tokens created are layer-2 assets, which operate on smart contract platforms. Further, the lock-in period for early entrants investing in token pre-launches is long as they don’t want to sell their holding shortly after the network launch. This results directly in an increased concentration of wealth in the ecosystem, thus nullifying the “giving the power back to the people” narrative which led to the rise of decentralized currencies.

Considering the arguments as mentioned above, it becomes imperative to discuss how the industry can work towards a mechanism that would ensure diluted token ownership. But before that, let’s quickly go through some of the tactics tried by firms in the recent past.

ICO Frenzy and Airdrops, do they Work?

2017 saw a colossal increase in the number of Initial Coin Offerings, which, in turn, spearheaded the bull run later in the year. However, an increasing number of ICO exit scams and thousands of investors losing their hard earned money have marred the reputation of ICO as the preferred method of raising funds.

Another method which aims towards widespread adoption of the firm’s tokens is airdrop. By dropping free coins into one’s wallet, companies try to pique the interest of wallet holders into their offering.

Recently, Stellar Lumens announced a massive $125 million airdrop of its native XLM token for Blockchain.com wallet holders. This roughly amounts to 0.5% of the total token supply.

However, skeptics opine that the method has numerous fallacies. Most notable of them is the “free tokens” notion among consumers, who sell the digital currencies for fiat. This takes us back to the initial question; is there an existing approach that has been successful in being completely decentralized in the true sense of the term?

According to a blog post titled “A New Model For Token Distribution” by Multicoin Capital co-founder Kyle Samani, the solution is on the horizon.

Enter Livepeer Merkle Mining

Founded in 2017, Livepeer (LPT) is an open-source protocol that enables decentralized video transcoding. After its network went live in May 2018, its co-founders, Eric and Doug, did away with the then prevalent methods of token distribution and envisioned a new way to create an interactive community of customers and transcoders.

Through constant revisions, the team came up with a clever protocol called “Merkle mining” which is, in essence, an amalgamation of PoW mining on top of the Ethereum blockchain. For a detailed overview of the mechanism of Merkle mining, readers can refer here.

In a nutshell, Merkle mining has a lot of similarities with traditional mining, with the only notable difference being that Merkle miners are required to generate Merkle proofs which confirm that a specific Ethereum address was in a group of accounts that had a minimum of X amount of ether at some block height.

To simplify things for the participants, the Livepeer team offered an exhaustive open-source depository to help people understand the dynamics of producing a Merkle mining proof. Some of the characteristics that set Merkle proof apart from PoW include their ability to be computed ahead of time, and them being less intensive computationally.

This practice of mining forces Merkle miners to incur ether-denominated costs to pay for data storage on the Ethereum network to store Merkle proofs.

Upsides to Merkle Mining

Some of the areas where Merkle mining trumps traditional ICOs is the absence of regulatory risk, ease of execution on any computer, global appeal, and being inherently permissionless.

These benefits put the process of Merkle mining and Livepeer’s LPT token perfectly in-sync with Satoshi’s vision of a truly decentralized, peer-to-peer system of transactions which can be run anonymously without any permission from a centralized authority.

As stated by Samani in his post, LPT is a work token. Being a work token, LPT cannot be spent by the users to pay for services in the Livepeer network. Users stake their LPT tokens to execute transcoding services for the Livepeer network, and in return, they are paid in the ether.

The fact that the target audience of LPT tokens is the select few, who are only interested in transcoding videos, the Merkle mining mechanism increases the efficiency of the ecosystem by filtering out short-term financial speculators.

Final Thoughts

As the cryptosphere continually undergoes new iterations to bring itself one step closer to perfection, developments like these only bolster its endeavors.

Merkle mining stands out because of its ease of use and implementation. In true Satoshi ethos, it’s not only permissionless in theory, but also in practice. It fills the gaps which PoW and PoS could not.