More than 13% of Polygon’s Total Supply Allocated to the Team and Foundation

According to an official Polygon announcement on Telegram, more than 13 percent of MATIC total supply will be allocated to the following three uses: the team (6.40%), Foundation (5.46%), and staking rewards (2.0%).

Polygon’s Supply Allocation Initiatives

Polygon’s team has implemented the large-scale token supply reallocation, according to its strategic vision and the set priorities. In particular, about 1.4 billion MATIC tokens were unlocked and transferred from the vesting contract. Polygon’s official representatives confirmed the maximum transparency in allocating such tokens. This reallocation should be consistent with the project’s strategic objectives. Moreover, the team and the Foundation will receive additional incentives to introduce innovations and contribute to the project’s sustainability in the long term.

Some members of the crypto community suggest that such large tokens’ supply redistribution may be detrimental to the overall stability of Polygon’s ecosystem. However, the management tries to maintain the maximum transparency by outlining all nine transactions and specifying the key directions of the funds’ allocation. In this manner, the proper awareness of all stakeholders can be maintained, thus, eliminating the risks of serious market disturbances or the conflict of interests in the future. Moreover, similar initiatives are also implemented by other projects that aim to achieve the maximum scalability.

Polygon’s founder Sandeep Nailwal also provided additional details regarding the process. According to him, the process of unlocking funds was not spontaneous but rather thoroughly planned and integrated with other activities. Thus, the tokens were unlocked about a year ago but moved only recently. The tokens were proportionally allocated between the Treasury, team, and staking rewards, thus, contributing to the most rational and efficient allocation of available crypto resources among all members involved. The objective investigation of independent auditors and experts also confirms the efficient completion of this stage of Polygon’s reforms.

Polygon’s Rapid Growth in Past Month

Despite the prolonged “cryptowinter” and the high level of uncertainty in the crypto market, Polygon continues to demonstrate the sustainable growth over the past month. In particular, it successfully reduced its fees up to 50%, thus making it the most appealing alternative for many DeFi investors and users. Polygon also effectively utilizes its interoperability functionality, especially in relation to Ethereum-based chains. Some investors concerned with the risks of Ethereum’s “Merge” may also consider Polygon as the optimal alternative for them.

Polygon also actively invests in establishing new partnerships that may be helpful for supporting the ecosystem and promoting the sustainable development in the following months. USDC is the second largest stablecoin that operates on Polygon, making it the mutually beneficial arrangement. Polygon also collaborates with Reddit regarding its new NFT marketplace. By expanding in the NFT segment, Polygon can effectively strengthen its competitive positions, especially during the next bull run. Overall, the strategic development of Polygon’s project in the recent months confirms the reasonability of addressing the traditional tokens’ redistribution question effectively.

Polygon’s Market Perspectives

Polygon continues to be one of the most dynamic cryptocurrencies among the TOP-20 projects available in the market. The following key factors explain its strategic advantages: the growing demand for scalable solutions; low fees; interoperability; and the positive perception by the majority of community members. In addition, MATIC’s recent price surge also stimulates the higher interest in the project among short-term investors. However, the competition in the segment may remain high in the following months, especially due to the fact that Ethereum will try to radically increase its market share after the Merge.

Technical analysis may also be helpful for determining the major opportunities for entering the market and controlling the marginal level of risks that may be incurred by investors.

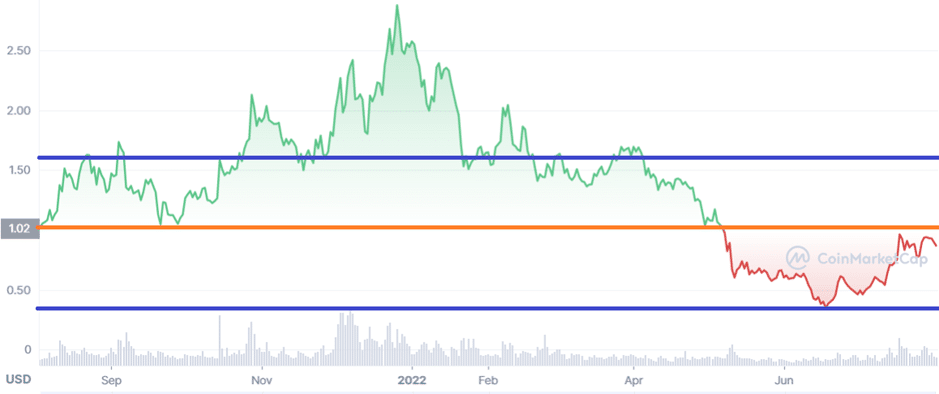

Figure 1. MATIC/USD Price Dynamics (3-Months); Data Source — CoinMarketCap

MATIC’s major support level is observed at the price level of $0.40 that serves as a local minimum and the key trend reversal point. At the same time, there are still the following two key resistance levels that should be overcome in order to test historical maximums in the long term: $1.02 and $1.60. MATIC has a potential of successfully overcoming the first level of $1.02 in the following weeks, enabling investors to open long positions and expecting it to strengthen its status among Top-10 largest cryptocurrencies in the short term.