PEPE flips XRP, ADA to be the third most traded token on Binance

Pepe coin (PEPE), the viral meme coin with zero utility, is now the third most actively traded token on the Binance’s futures market flipping ripple (XRP), cardano (ADA), and others, statistics on May 7 show.

PEPE’s trading volumes rise

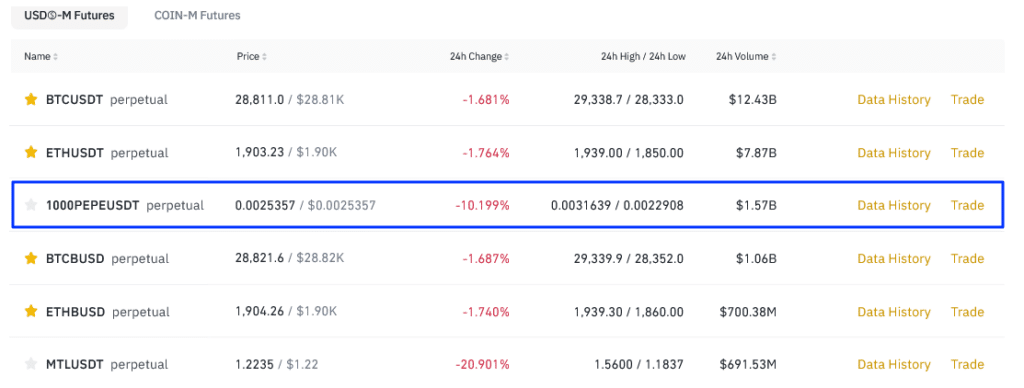

When writing, bitcoin (BTC) and ethereum (ETH), paired with USDT, the world’s most liquid stablecoin, only topped PEPE. Associated BTC and ETH trading volumes in the past 24 hours stood at $12.4b and $7.8b, respectively, despite a notable price contraction.

Meanwhile, the 1000PEPEUSDT perpetual was the third most traded instrument, posting 24-hour trading volumes of $1.5b. Even so, considering the general bearish sentiment across the cryptocurrency market, PEPE prices are down over 10% on the last trading day.

The spike in trading volumes of the PEPE’s perpetual instrument has seen it pushed to the top-3 in the top-trading volumes, only trailing bitcoin and ethereum.

This is a significant development for PEPE, further highlighting the state of affairs in crypto and retail keenness to ride on trending tokens.

The fear of missing out (FOMO) from mid-April, when PEPE began to rise, has pushed the token’s valuation, placing it in the top 50, according to CoinMarketCap data.

In the last week alone, PEPE rallied by over 12x, spurred mainly by the recognition by Binance, the world’s largest cryptocurrency exchange by trading volumes.

Will the PEPE bull run continue?

As of May 7, PEPE had a market capitalization of over $1b. At this valuation, PEPE is perched at 45th in the market cap leaderboard, flipping projects such as Tezos, a self-amending smart contracting platform; Flow, a non-fungible token (NFT)-centric blockchain; and even Curve, a leading protocol enabling the trustless trading of stablecoins.

Whether PEPE will retain this impressive trend only remains to be seen. With trading activity shifting to Binance from Uniswap, a DEX, it is easier for traders to use leverage and exit the market, cashing out with USDT. This could slow down the upside momentum, forcing prices lower.

PEPE is down 10% on the last day, underperforming BTC and ETH by almost similar margins during this period. At the same time, the number of PEPE holders has plateaued, a hint that organic demand for the token might be coming to an end.