Ripple CTO discusses keeping XRP in AMM

David Schwartz, chief technology officer of Ripple, has cautioned investors against holding XRP in an automated market maker (AMM).

Schwartz has explained three main reasons why owners of XRP should not keep their coins in AMM.

Ripple CTO cautions against XRP AMM

As the launch of the XRPL AMM launch approaches, Schwartz disclosed that he intends to hold between a third and a fourth of his XRP in the future XRPL AMM.

According to the Ripple CTO, there are three risks to storing XRP in an AMM. He lists exposure to digital assets other than XRP as the first reason.

Since the AMM is created to provide liquidity for various assets, any significant price change in one asset might impact the value of all the other assets in the pool, including XRP. This can be especially troublesome for investors holding XRP long-term because they might not want to avoid exposure to price changes in other assets.

Another reason he cited is the possibility of implementation flaws. AMMs are constructed using complex smart contracts. Therefore, there is always a chance that the code will have errors or weaknesses. This is problematic as the presence of a bug could cause investors to lose revenue.

Lastly, Schwartz believes that keeping XRP in AMM, which he views as a risk, has little possibility of making significant returns. AMMs can offer liquidity for XRP and other coins, but they might only sometimes result in XRP seeing big price increases.

This is due to AMM’s limited role as a channel for XRP buys and sells in response to price fluctuations thus, whether or not the price of XRP increases has no bearing on the value AMM retains.

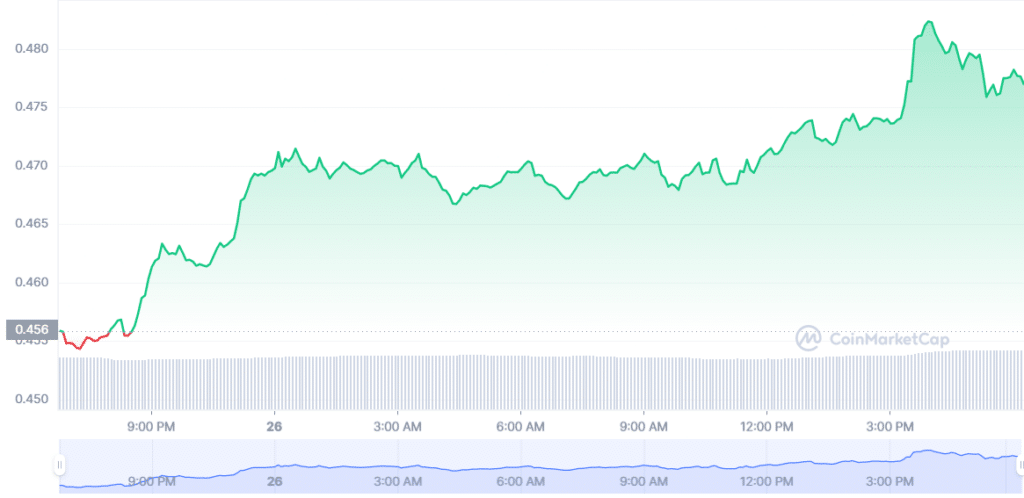

XRP’s price soars

XRP is currently experiencing slight gains. The price of the altcoin has increased by 5.59% during the past 24 hours to $0.482.

Before selecting to hold XRP in an AMM, investors should research extensively and understand the potential dangers. Even though AMMs can be helpful for trading tokens, Schwartz’s caution is a reminder that they are not risk-free.