Ripple launches new stablecoin. What is behind the move?

What does the launch of the new digital currency mean for the future of XRP and the crypto market?

Ripple (XRP) announced on Apr. 4 that it is diving into the stablecoin market, launching a digital currency tied to the U.S. dollar. The company aims to bring more stability and ease of use to its XRP Ledger.

Ripple plans to back its new stablecoin with U.S. dollar deposits, short-term U.S. government treasuries, and similar assets along with third-party audits and monthly reports on its reserve assets.

This move puts Ripple in competition with giants like Tether’s USDT and Circle’s USDC in the stablecoin arena, but Ripple’s CEO, Brad Garlinghouse, sees this as a natural step, bridging traditional finance with crypto.

Ripple’s stablecoin will initially be available in the U.S., leveraging not only its own XRP Ledger but also the Ethereum (ETH) blockchain. There also are plans for further integration into decentralized finance (defi) platforms and other global markets.

How did the community react?

The community’s response to Ripple’s entry into the stablecoin market reflects various opinions and speculations.

One user expressed excitement, suggesting a potential connection between Ripple’s stablecoin and the Palau Stablecoin (PSC), citing the success of a previous pilot project.

Another user sees the introduction of Ripple’s stablecoin as a bullish move for the XRP and Ripple’s ecosystem.

They anticipate benefits such as increased use cases for XRP, the attraction of builders to the ecosystem, and improved recognition with the U.S. government due to backing by dollars and U.S. treasuries.

Contrary to the optimism, skepticism exists within the community. One user cautions against premature claims that Ripple’s stablecoin will rival established players like USDC and USDT, suggesting that its market cap may not surpass $1 billion.

Why a stablecoin now?

Ripple’s decision to launch its own stablecoin stems from several key factors.

Firstly, Ripple finds itself embroiled in a legal battle with the SEC over the classification of XRP as a security, prompting the company to explore alternative avenues for growth and stability.

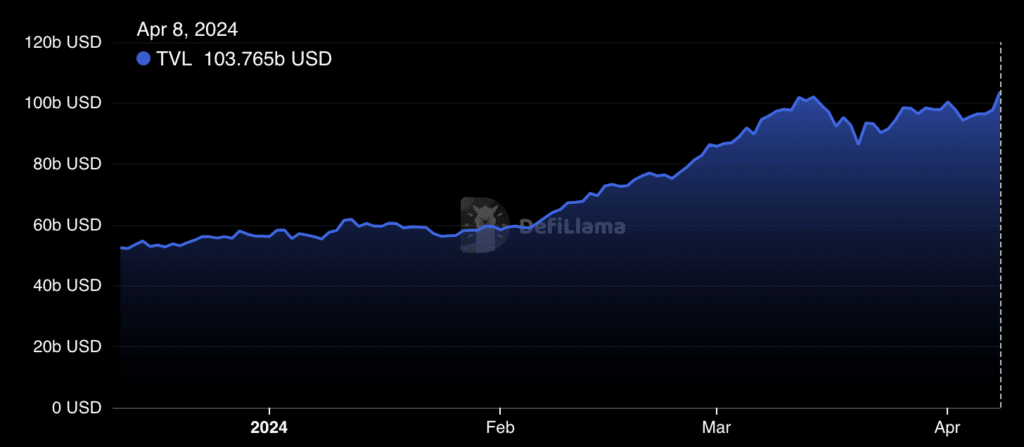

One possible driver behind Ripple’s stablecoin initiative is the dominance of stablecoins in the rebounding defi sector.

Since the start of 2024, the total value locked (TVL) on all defi platforms has increased from around $56 billion to $103 billion.

With defi platforms heavily reliant on stablecoins for liquidity and trading pairs, Ripple, as a major holder of XRP, might be seeing an opportunity to increase financial activity on the XRP Ledger.

Monica Long, Ripple’s President, highlighted the native capabilities of the XRP Ledger, such as decentralized exchange and automated market maker functions, which were designed to utilize XRP as the bridge asset. Long mentioned that by introducing a trusted stablecoin, Ripple aims to drive adoption and development.

Moreover, Ripple’s decision is influenced by the challenges faced by leading stablecoin issuers like Tether and Circle, including instances where their stablecoins temporarily depegged from the $1 peg.

Moreover, Tether has faced numerous allegations and concerns regarding its role in facilitating illicit activities.

According to a report, USDT remains the top choice for criminal activities, with over $19 billion in illicit funds attributed to its use, surpassing other stablecoins like USD Coin (USDC).

Concerns regarding USDT’s involvement in illicit activities have been further heightened by its association with incidents in Southeast Asia.

A January 2024 United Nations report highlighted instances of USDT being misused in money laundering schemes and scams, particularly through online gambling platforms operating in the region.

Such incidents have raised concerns about the stability and transparency of existing stablecoin offerings, prompting Ripple to introduce its own solution.

What to expect next?

With USDT dominating the stablecoin market, accounting for nearly 70% of all stablecoin market share, Ripple faces an uphill battle to achieve such dominance.

The stablecoin space is already crowded, with competitors like USDC and BUSD vying for attention. Hence, Ripple will require a sound strategy and widespread adoption.

Moreover, trust is paramount in the stablecoin market, and any misstep could lead to catastrophic consequences, as seen with Terra UST’s collapse.

Drawing parallels, Cardano’s (ADA) attempt to enter the stablecoin market with Djed in January 2023 serves as a stark reminder. Despite initial excitement, Djed failed to make a mark in the market. Today, its market cap sits at just a little over $3 million.

However, despite the challenges, there’s still ample room for innovation and growth. As the demand for stablecoins continues to rise, there’s an opportunity for new entrants to carve out their niche.

Only time will tell if Ripple can rise to the challenge and make a lasting impact in this competitive environment.