SEC Defers Judgement on Wilshire Phoenix ETF, Again

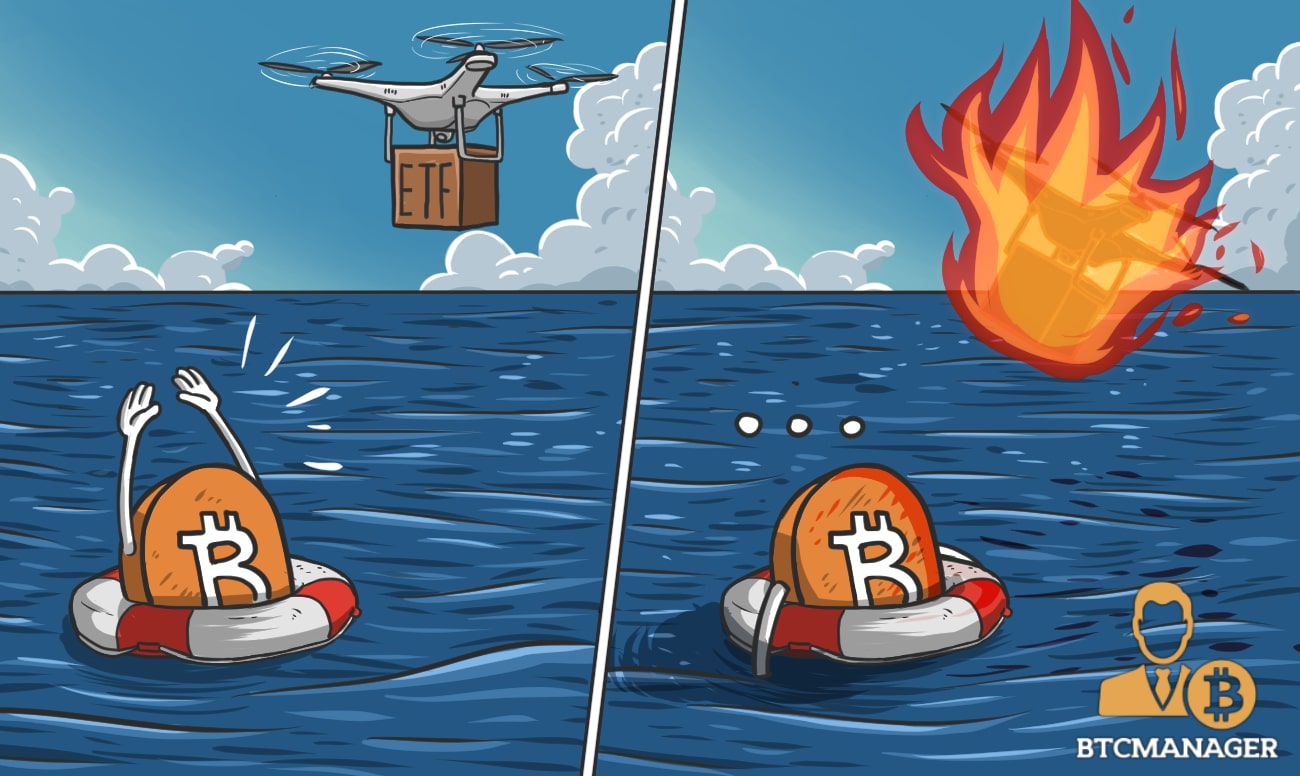

An expected turn of events has once again occurred as the SEC released a public filing stating their intent to gather more public commentary on Wilshire Phoenix’s Bitcoin ETF proposal before coming to a conclusion, September 24, 2019. It is worth noting Bitwise’s ETF proposal was not addressed, and this judgment now separates the fate between the two schemes.

SEC Solicits Public for Opinion

A bulk of the public filing content are questions the SEC is posing toward prospective commentators who could help them gauge on-ground sentiment regarding a Bitcoin ETF.

Those who have been in investments for a while would probably side with Wilshire Phoenix’s ETF over Bitwise.

This is because the Wilshire Phoenix proposal is not a pure-play on Bitcoin; it is a mix between Bitcoin and U.S. treasury bonds. The idea, in itself, is incredibly potent, as bitcoin is the best representative of value capture in the decentralized economy, and treasury bonds are a gauge of strength in the traditional economy.

Correlation in this ETF would be significantly lower to any other single asset class as the two inclusions in the portfolio are incredibly diverse.

So far, only six people from the public have offered their comments to the SEC with regards to the ETF. One of them humorously pleaded with the SEC to just accept the proposal as this debacle has dragged on for too long.

Just last week, VanEck announced they are residing their offer to launch a Bitcoin ETF scheme for non-institutional investors.

Chances of an Approved ETF

As BTCManager reported earlier this year, the likelihood of a Bitcoin ETF obtaining the green light from regulators was a detriment caused by sudden onsets of volatility.

Chairman of the SEC, Jay Clayton, also recently confirmed that there was a ton of work to be done before such a financial product could be offered to the public.

With Bitcoin dropping to $8,500 today, the SEC’s disdain for hyper volatility may influence their decisions in the near future. At this point, it can be argued whether public commentary would even matter if Bitcoin continues to fluctuate between wide price ranges.

Moreover, since the volatility occurred towards the downside, there will be retail investors who impatiently bought the top and expected a glamorous return on their investment in the span of months.

The real problem in Bitcoin investing in retail mindset; their inability to see this as a long term asset may be a fundamental reason for rejecting a Bitcoin ETF.