Summary on Tether and Where We’re At

In light of the most recent $300 million in currency. This is something that the entire Bitcoin community needs to worry about because all signs are showing that there’s a high likelihood that Tether will be forced to cease all of their operations in the United States at some point in the future.

Some may be tempted to respond by saying, “There’s no proof that Tether isn’t backed by real reserves!”

For those thinking this, please understand that this article has nothing to do with whether Tether is actually backed with a legitimate 1:1 reserve ratio to all of the tokens that they have issued over the last year. The main problem here is that Tether is essentially issuing a security.

But Everyone is Issuing One!

The difference here, however, is that Tether has been issuing a security for the last year instead of over the course of a few weeks like most ICOs have. The specific security that Tether has issued is based on the U.S. dollar, which puts them squarely in the crosshairs of the Department of Justice (potentially) for other potential violations of federal law.

Also, Tether has also printed approximately $2.5 billion worth of Tether tokens since they first began issuing them and they are already on record for receiving a subpoena from the CFTC. This information was released on January 30, 2018, and Tether has yet to issue a refutation of the report at the time of writing.

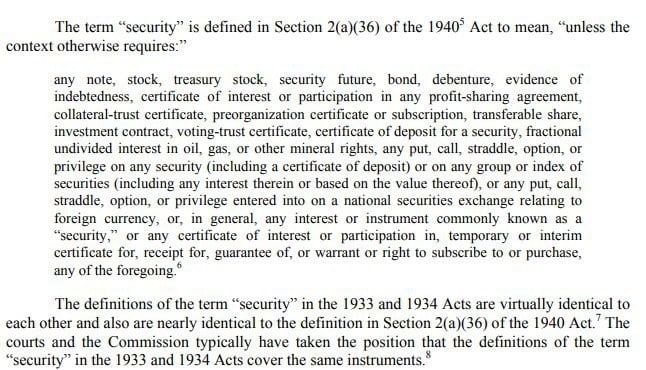

How is it a Security?

Below, is the formal definition of the term, ‘security,’ as defined in Section 2(a)(36) of the 1940 Securities Act passed in the United States.

Source: https://t.co/6cfLvVUPDz

As a rebuttal, several apologists for the Tether company have stated that they shouldn’t have to worry about the United States’ regulatory and federal bodies because Tether is not located in the United States.

However, information on their website appears to point to the contrary.

If you go to the ‘About Us’ section at the time of writing, here’s what you’ll see:

However, the author remembers looking at this page several weeks ago and seeing a U.S. location listed there. So, in order to perform due diligence, the author consulted the way back machine, which archives content posted on the internet with a webpage scraper dated all the way back to 1996.

This machine revealed that Tether did, in fact, have a U.S. location listed on their website as recently as November 2017.

Source: https://t.co/TG63e3ZFtJ

So What is the Subpoena For?

The subpoena, which sources allege was sent on December 6, 2017, during to the Tether Limited company, was sent by the CFTC, which stands for the U.S. Commodity Future Trading Commission.

Typically, they only send subpoenas in instances where they have a suspicion of wrongdoing. And even when there is a suspicion of wrongdoing, the CFTC will typically reach out directly to contact the alleged offenders and request that they volunteer information to them. It is only when this request gets ignored that they move forward with actually sending an official subpoena.

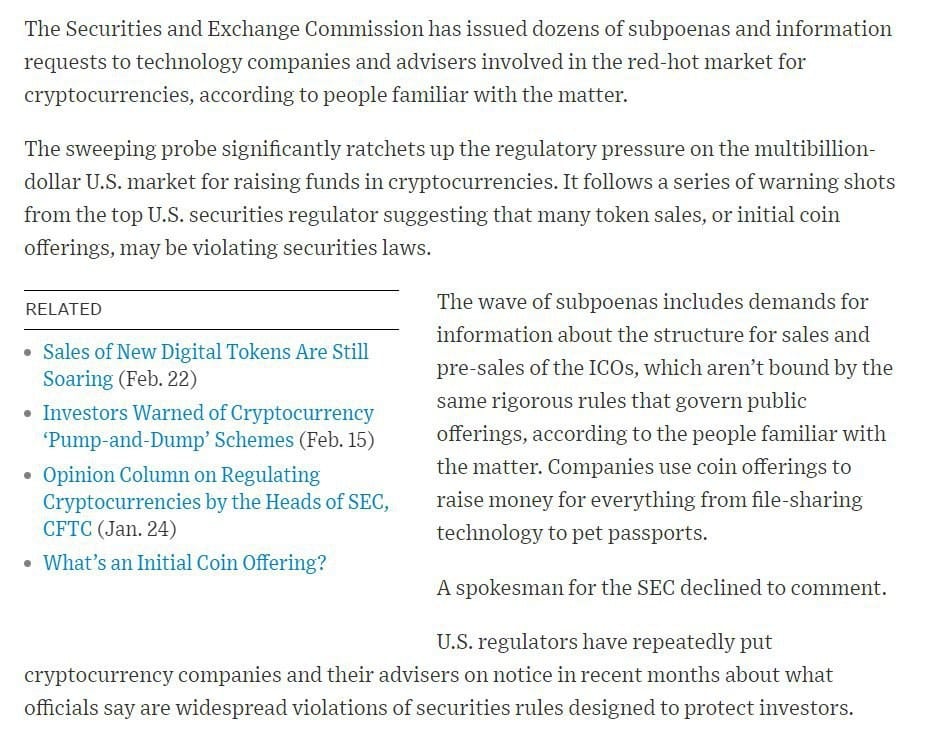

This issuance falls in line with the recent crackdown on ICOs by the Securities and Exchange Commission (SEC), which is a federal agency in the United States responsible for defining what qualifies as a security and subsequently regulating those things.

Source: https://www.wsj.com/articles/sec-launches-cryptocurrency-probe-1519856266

Another Kicker for Tether

As mentioned above, Tether scrubbed any and all mention of a United States-based office from their website entirely.

However, this is unlikely to have any great impact on the United States’ investigation because they have some level of regulatory power in many of the jurisdictions that Tether claims to operate in. At the very least, if the United States really wanted to get them, then neither Hong Kong nor the Caribbean (where they claim to be established and originated, respectively) would be a suitable haven for the company.

What makes things worse for Tether is that their transition from the Bitcoin blockchain using Omni Layer to creating ERC20 tokens on the Ethereum chain without a formal announcement before announcing the reason for suddenly switch to another chain spontaneously shows an apparent and flagrant attempt to obfuscate their printing habits.

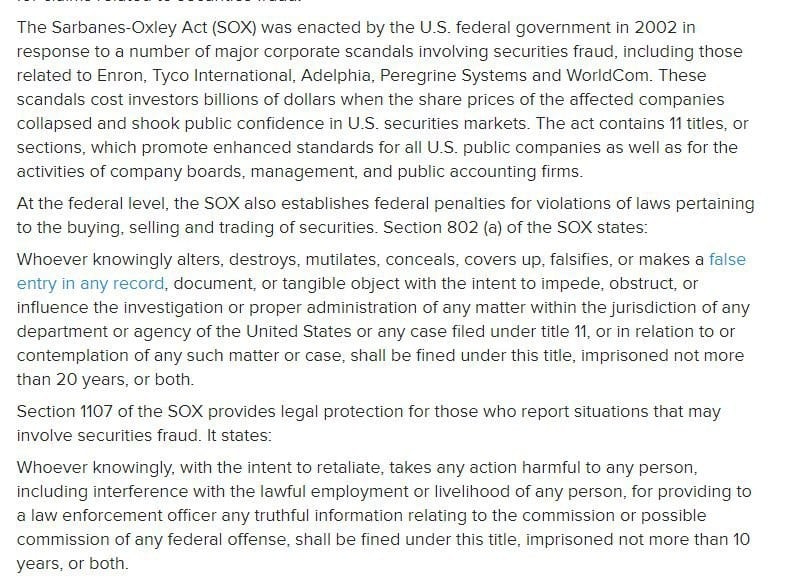

Thus, the image below applies to their situation perfectly:

Source: https://t.co/LkB9X0xAfE

Even BitMex came to the same conclusion in their study of Tether because they more than likely see the same issues that the author sees.

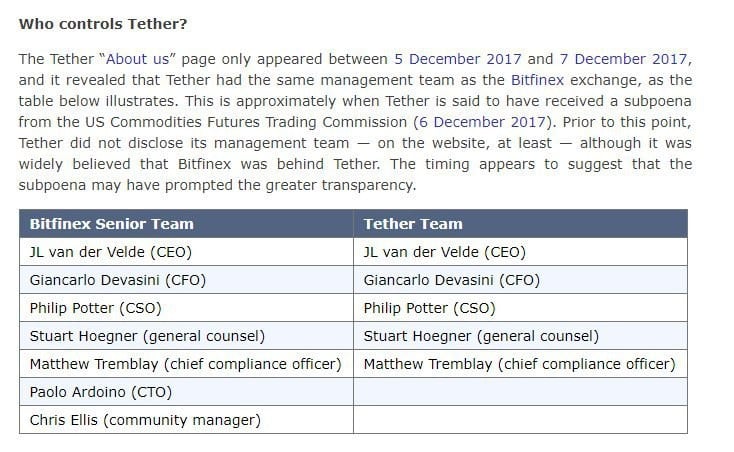

Who is Behind Tether?

What Could the U.S. Do Against Tether?

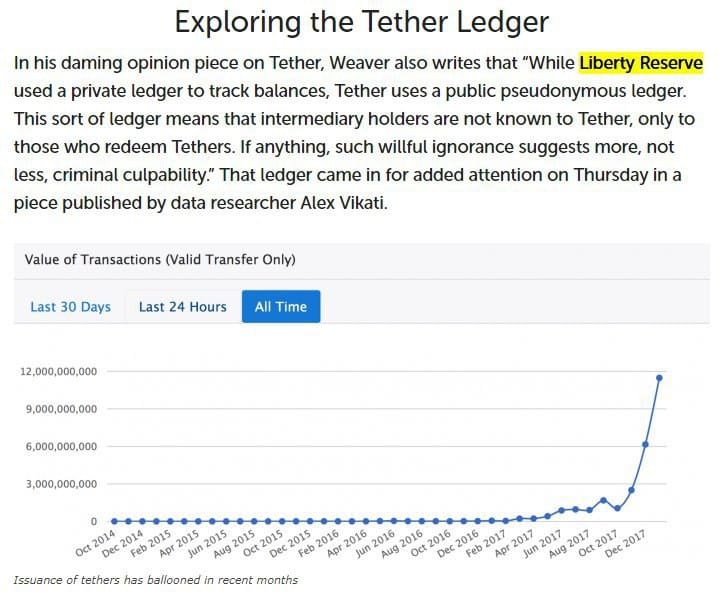

In order to get a better idea of how/what the United States would do in the event that they do decide to apprehend Tether Limited for their printing of unauthorized securities in the form of tokens that are tethered to the United States’ currency, one must examine the case study of a ‘Liberty Reserve.’

Liberty Reserve

“Liberty Reserve was a Costa Rica-based centralized digital currency service that billed itself as the ‘oldest, safest and most popular payment processor, serving millions all around the world.’”

It also asserted that “the site had over one million users when it was shut down by the United States government. Prosecutors argued that due to lax security, the alleged criminal activity largely went undetected, which ultimately led to them seizing the service.”

Source: https://en.wikipedia.org/wiki/Liberty_Reserve

Below is an excerpt of how Liberty Reserve eventually met their doom at the hands of the United States’ government:

Tether Company

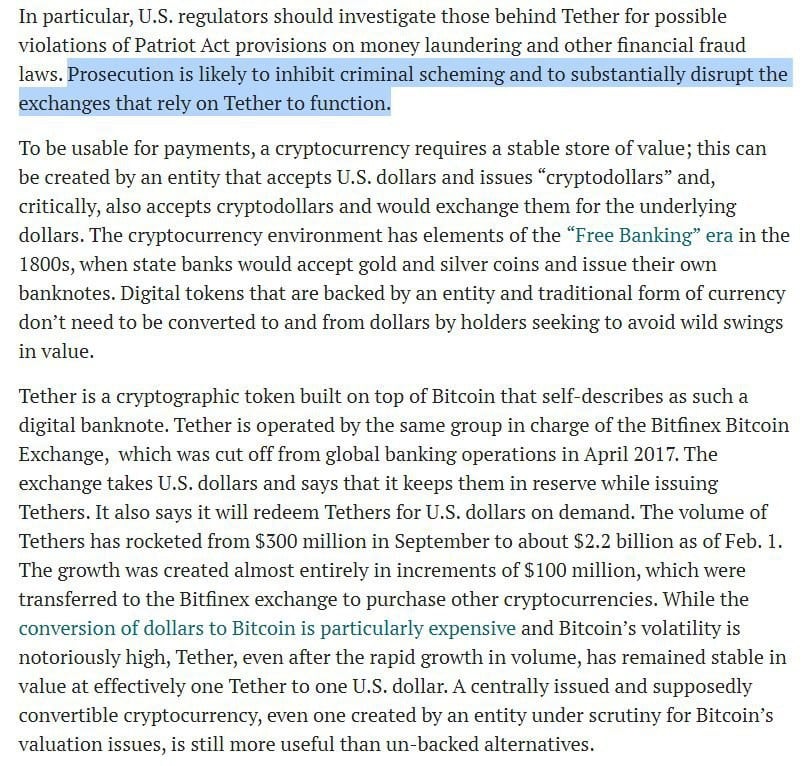

Here’s more good reading on Tether by a computer security researcher that specializes in investigating financial crimes from Berkeley. Some interesting notes from the piece:

Source: https://t.co/VTjqGz6xra

What are the Implications for Cryptocurrency?

If Tether is apprehended by the United States’ federal government, then it is more than likely that other exchanges that are trading/offering Tether would promptly be sent a cease and desist letter.

Based on what you can see above, the panic and insolvency that would ensue will (not could, will) cripple the whole cryptocurrency market.

Important Conclusions

What people should take away from this article is that Tether being backed legitimately one-to-one is neither here nor there at this point. Even if they were 100 percent correct in their claim that they’re backed by the United States’ dollar completely, there is still a significant possibility that they, at the very least, are forced to pay very hefty fines for their failure to abide by the SEC’s regulation and federal guidelines.

When the shoe drops on this case, there could be a substantial shake-up in the cryptocurrency sphere.