The Long and Winding Road: AEON Follows Monero’s Lead to Nullify ASICs

After an extended period of uncertainty, AEON has forked following the lead of Monero to nullify ASIC miners from the network on June 3.

A Long Road

The smaller, and more agile, project, however, did face some nerve-wracking moments, with some miners expressing concern about the profitability. AEON aims to be a lighter version of Monero and implement mining on mobile devices in the future, providing a fungible coin that even those in the developing world can mine and use.

Some miners and community members were concerned about the increased likelihood of attacks and slowing momentum of the project to update on two fronts; the rebase to Monero’s code as well as tweaking the Proof of Work (PoW) algorithm – CryptoNight-lite – to ensure that mining is ‘fair’ and ASICs have no real advantage over CPU and GPU miners.

The rebase ensures AEON is up to date with Monero’s latest upgrades, while still retaining its own unique features; one of the main differences the rebase brings is the addition of storing the blockchain via LMDB, reducing the memory requirement for the blockchain and opening AEON up to new people and exchanges.

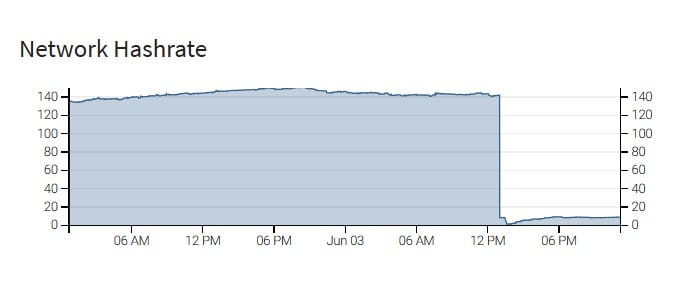

AEON Network Hashrate June 3. Source: aeonminingpool

But the fork looks to be successful for now, with blocks still being mined and no chain re-organizations as of yet. The chart above shows how the network hashrate has declined massively from around 140MH/s to a low near 1MH/s and recovered slightly to 10 MH/s at the time of writing as more miners come back online and take advantage of the more favorable profitability. By June 5, the difficulty should have stopped fluctuating so much and blocks should be mined on a more even basis.

Perhaps the coins that are not widely used on exchanges, like AEON, are relatively safe from these 51 percent attacks we have seen like on ZenCash. On the other hand, Electroneum is mining empty blocks after forking, and at one point, there were concerns that if AEON forked after Electroneum, the former would be more vulnerable to ASICs and malicious attacks as both use a similar algorithm (CryptoNight).

‘Sophia’ Release: Just in Time

In early May, Katiecharm, one of the figures instrumental behind the rebase of AEON and reviving momentum in the coin, stated that the altcoin is a possible target for a 51 percent attack:

“Yes, Aeon is under high threat of 51 percent in general. If there is enough of a financial incentive out there, then it will happen. We can’t just hope it doesn’t.”

The state of affairs was depressing for many AEON holders with no definite deadline initially. The negative sentiment was made clear by one miner during the wait for the upgrade to nullify ASICs, “Blindly waiting for the developers to drop some info on us is tiring and frustrating, especially when mining has lost its incentive. I’ll keep mining, hoping the rebase happens and we get rid of those asics but if nothing changes I’ll probably find something else to mine.”

Nevertheless, the concerns about ASICs did not fall on deaf ears, and on May 24, a new client was released named ‘Sophia,’ which implemented the rebase and set the stage for the June 3 fork to nullify ASICs.

The June 3 fork of AEON, which included a difficulty reset to mitigate the large reduction in hashrate expected, has galvanized the community and improved sentiment. The time needed for careful and meticulous testing of the new software had a handful of miners and community members worried, but the developers pulled through in the end, with help from Monero developers stoffu and moneromoo.

On June 4, it is clear that miners are beginning to return, as evidenced by a positive Reddit post celebrating the fork and the increasing hashrate following June 3, as displayed previously.

Despite the difficulties faced, namely project management and communication with the community, the developers delivered. Despite the success, the events that transpired go to show how coordination problems can cause problems for decentralized projects.

During the past couple months, the community was tense, and some members even questioned smooth’s and developer’s intentions, but it seems the trust in them has been well placed; but trusting or relying on someone is something that the AEON community does not want to engage in again.

What Doesn’t Kill a Project Makes it Stronger?

The series of events did reveal at least one flaw in the decentralized project; being too reliant on one, two or a handful of actors. While the developers delivered, some in the AEON community raised concerns as to what would be the path forward if smooth were to disappear suddenly, or something bad happened to the developer.

For instance, aeonminingpool raised their concern in a meeting on May 15, “Smooth – it’s best more individuals have access [to the GitHub repo] just for good governance. Nothing more and nothing personal said or implied. You can nominate people whom you deem reliable as well. No one would object I’m sure.” Katiecharm replied that the community should discuss this topic and smooth approved of the request, that is opening up access to the GitHub repo, so it is not accessible to just one person.

Furthermore, one Reddit user stated in response to the announcement of ‘Sophia’ – the software client that would be compatible with the tweaked CryptoNight-lite ASIC resistant algorithm – that his vocal, long-running concerns about long block times, as experienced by Monero in April, were ignored initially. The user went onto state how AEON can improve:

“If we can have a more open and expansive view of the crypto marketplace I am sure similar problems will be seen and addressed in a more timely and effective manner.”

More frequent communication and better organization is needed for the project to remain relevant and reach its true potential, where developer meetings held on a regular basis were highlighted as one positive step forward. With one major update behind AEON and miners in a better position to mine the altcoin profitably, things are looking up, and the path forward now must be forged to inspire confidence in the project.

With more exchange listings, an aeon pool league, initiatives to incentivize solo mining on the agenda since December 2017, as well as improving exposure and merchant adoption, the AEON project is now set to make some solid progress toward these objectives.

Disclaimer: The author has a small holding of AEON, as well as other altcoins. Please do your own research when investing in cryptocurrencies, as they can be risky investments. The author is comfortable with his losses if AEON ever becomes worthless.