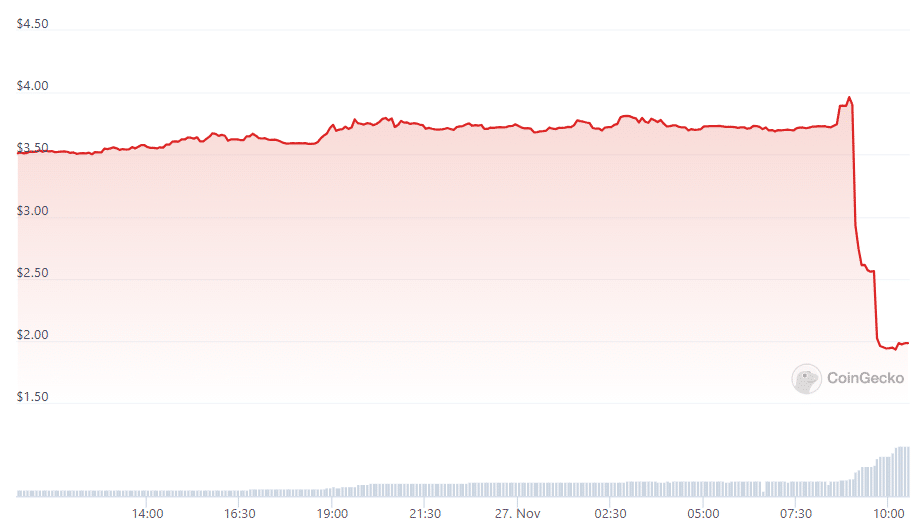

Tornado Cash’s token TORN plunges 45% following Binance delisting

Binance will delist Tornado Cash’s native token TORN on Dec. 7, 2023, as part of its review process.

Crypto exchange Binance will cease support for deposits and withdrawals of TORN, a native token for crypto mixing service Tornado Cash, which was sanctioned in August 2022.

In a blog announcement on Monday, Nov. 27, 2023, the exchange said it will delist TORN as well as BitShares (BTS), PERL.eco (PERL) and Waltonchain (WTC) on Dec. 7, 2023 at 03:00 (UTC).

After the deadline, Binance will stop accepting deposits with the tokens. Withdrawals of TORN, BTS, PERL and WTC from Binance are expected to be suspended on Mar. 7, 2024 at 03:00 (UTC).

While the reason for the move is not clear, Binance said the tokens no longer meet its standard. After the news broke, TORN price plunged by over 44% below the $2 mark, according to data from CoinGecko.

In Sept. 2023, Tornado cash co-founder Roman Storm pleaded not guilty to charges he helped launder over $1 billion of illicit funds generated by North Korean hackers.

Tornado Cash is a decentralized Ethereum-based protocol that enhances transaction privacy by obscuring the link between sender and receiver addresses. Crypto mixing, a service offered by platforms like Tornado Cash, involves pooling and scrambling cryptocurrencies from various users to anonymize transactions and obscure their origin.

The delisting announcement comes shortly after Binance founder Changpeng Zhao pleaded guilty to violating U.S. anti-money-laundering requirements and agreed to step down as the exchange’s head.

As per the U.S. Treasury Department, Binance “willfully failed” to report to regulators more than 100,000 transactions on its platform tied to illicit activity such as darknet, scams, fraud and other malicious activity. As part of the $4.3 billion settlement agreement, Binance agreed to a look back to identify and report to FinCEN the “suspicious transactions that it processed and willfully failed to report,” the regulator said.