Total Value Locked In DeFi Protocols Declined by 40% in May

DeFi protocols experienced their worst month as the panic caused by Terra’s and its stablecoin UST collapse resulted in the rapid decline in the total value locked by more than 40%.

Causes of DeFi Crisis

The large-scale DeFi crisis was mostly the result of Terra-caused market shock because its failure evaporated about $28 billion in May only in direct losses. In addition, Ethereum’s network experienced a series of declines equal to $111.4 billion as reported by DeFi Llama. Even alternative Layer 1 networks were also affected by investors’ threatened confidence in the segment. The total declines in the total value locked in Layer 1 networks reached 30-55%. Avalanche’s ecosystem lost about $5 billion, and Binance Smart Chain suffered losses of about $3 billion.

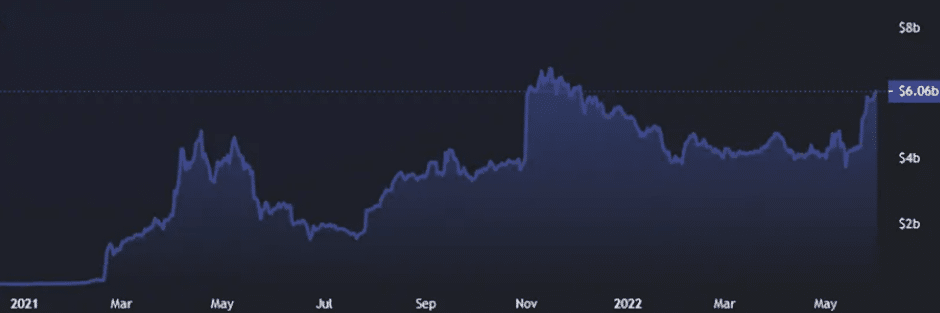

The total value locked in all DeFi protocols declined to $111.4 billion, the lowest level in many months. Moreover, protocols that specialized in the operations with stablecoins suffered the maximum losses. For example, the previous leader Curve lost its positions with its total value locked declining to $8.9 billion which was much below the record level of $24 billion reached in January.

Convex Finance provided additional liquidity to Curve users lost about half of its market capitalization in May, and its total value locked is just above $5 billion with its relative positions declining to the sixth rank in the market.

Major Exceptions

Despite the overall collapse of the DeFi segment, there were several exceptions that indicated a considerable potential for its long-term development. The major example is Tron able to demonstrate the high growth rates even in the stagnating crypto market. Tron has been able to increase its total value locked by 43%, thus reaching the third-largest position in the smart contract network. The key source of growth is its leading protocol JustLend which generated growth of about 65% in May. Currently, Tron is the third-largest network specialized in smart contract services.

MakerDAO is another example of a successful project able to become the largest protocol. The reason is that it mostly works with the DAI stablecoin proven to be more stable during the recent panic. However, MakerDAO still lost about 30% of its total value locked but improved its relative positions due to higher losses incurred by its key competitors.

The protocol Lido used for staking (including LUNA) also lost about half of its market value, although its relative positions remained comparatively stable.

DeFi Segment’s Potential

The recent shocks indicate the high likelihood of the radical transformation of the DeFi segment in the near future. Investors have become better aware of the implicit risks associated with stablecoins and related lending operations. However, the current decline in DeFi activities is not likely to be long-lasting because the DeFi segment offers unique opportunities for generating passive income and addressing the major liquidity and other related challenges. The major direction of change refers to the gradual shift toward more sustainable and reliable projects. This logic applies to both stablecoins and DeFi applications.

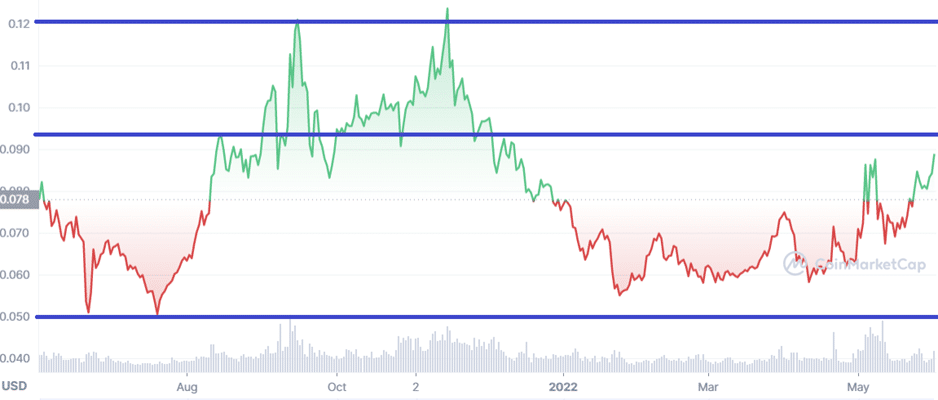

Technical analysis confirms that Tron has considerable potential for growth in the following weeks. The major support level corresponds to $0.050 which reflects the local minimum reached during the past few months. The first major resistance is at the price of $0.095, and Tron has the potential to overcome it in the following days, considering its current market trends. In this case, TRX can approach a significant resistance level at $0.12, thus approaching its 2022 maximum. The strengthened positions in the DeFi segment may be the main catalyst of this growth.

The situation with Convex Finance appears to be more problematic. If CVX is unable to maintain the current critical support at about $9, its price may collapse beyond $3, implying that it will not be able to restore its strong positions in the DeFi segment. In contrast, the trend reversal may allow gradually approaching the fits significant resistance level at $30 in the following months. This scenario may also be beneficial for other DeFi projects, contributing to market stabilization.